Stock Idea - Wellcall Holdings

AmInvest

Publish date: Mon, 28 Aug 2023, 09:10 AM

Company Background. Wellcall Holdings (Wellcall) principally manufactures industrial rubber hose for customers in the business of distributing rubber hose to equipment manufacturers. Its business segment mainly comprises the manufacture and sale of rubber hose and related products. The group's product ranges to various application markets such as water, oil & gas, welding, automotive, abrasion, marine, food grade and chemical applications. Wellcall generates the majority of its revenue from export sales.

Prospects. (i) Optimistic to remain resilient and sustain market share & positioning in industrial rubber hose sector. This is supported by a rising orderbook due to higher demand for low- and medium-pressure hoses, (ii) The group maintains efficient cost management and global market expansion efforts. This involves leveraging on a wide customer network, boosting productivity/quality and diversifying product range for stronger competitive position, and (iii) Consistently, Wellcall has distributed dividends in prior financial years, in line with its policy to maintain a dividend payout ratio of at least 50% of annual net profit.

Financial Performance. In 9MFY23, Wellcall posted a higher revenue of RM158.9mil (+22.4% YoY) with a PAT of RM38.6mil (+50.6% YoY). This was mainly due to increasing orders from both local and export markets, underpinned by growing market demand for industrial rubber hoses.

Valuation. Wellcall is currently trading at 14.1x trailing P/E, versus Bursa Industrial Products & Services Index’s 20.1x. As a comparison, China-based Shanghai Hongda New Material Co., which produces insulating rubber, high temperature resistance rubber and silicon rubber, trades at a much higher trailing P/E of 34.6x.

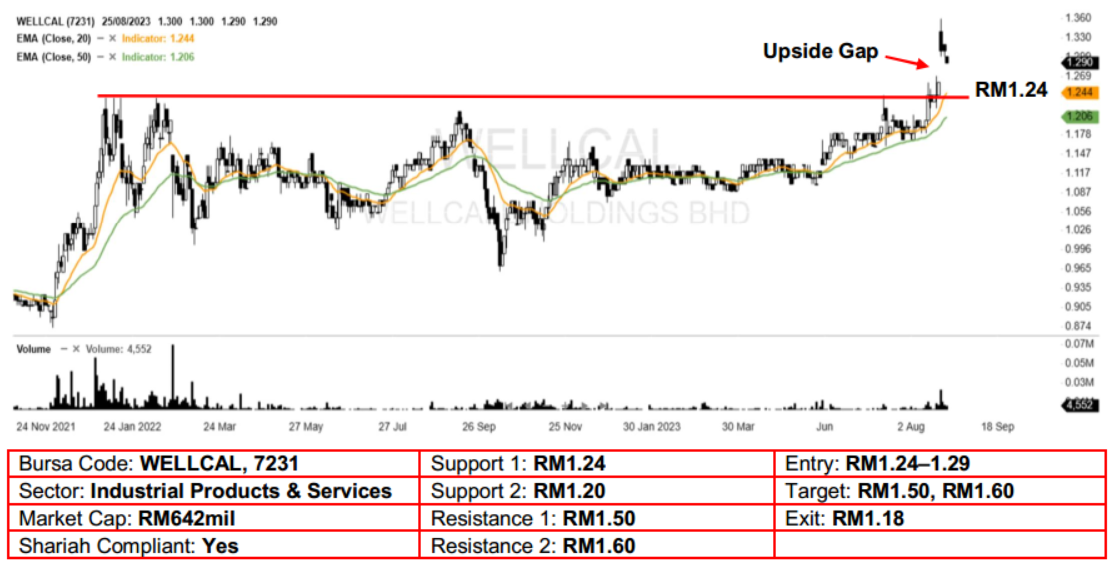

Technical Analysis. Wellcall may rise higher after it gapped up and hit a new 52-week high a few sessions ago. In view that the 20- day and 50-day EMAs are starting to turn upwards, a positive outlook can be expected here. A bullish bias may emerge above the RM1.24 level, with stop-loss set at RM1.18, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM1.50, followed by RM1.60.

Source: AmInvest Research - 28 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Jan 24, 2025