Stock Idea - Synergy House

AmInvest

Publish date: Mon, 16 Oct 2023, 09:10 AM

Company Background. Synergy House (Synergy) is principally engaged in the design, development and sale of ready-to-assemble (RTA) home furniture. The group sells RTA home furniture through both business-to-business (B2B) and business-to-consumer (B2C) sales channels, including online retailers/chain stores/wholesalers and individual consumers through online store & third-party e-commerce platforms. Synergy’s top 3 markets collectively contributed 95% of the group’s 2QFY23 total sales: USA (47%), United Kingdom (33%) and United Arab Emirates (15%).

Prospects. (i) Expansion of customer reach through listing and selling products on more third party e-commerce platforms with a focus on new markets, (ii) Enhancement of revenue through advertisement and promotions, (iii) Establish new warehouses in Muar, Johor and Port Klang, Selangor as e-commerce fulfilment centres, (iv) Purchase of inventories for third party e-commerce fulfilment centres in overseas countries, and (v) Expand the group’s range of home furniture through continuous design and development efforts.

Financial Performance. In 2QFY23, Synergy reported higher revenue of RM58.6mil (+13.5% QoQ) with a PAT of RM6.2mil (+2.3x QoQ). This was mainly due to higher sales contributions from both B2B and B2C segments in USA, United Arab Emirates and Asia as well as foreign currency exchange gains.

Valuation. Based on Synergy’s 1HFY23 annualised net profit, the stock is trading at an attractive 2023F P/E of 13.6x, versus Bursa Consumer Index’s 5-year forward average of 29.2x. As a comparison, Ecomate Holdings and Spring Art Holdings, both also involved in the furniture sector, trade at much higher trailing P/Es of 49x and 95x, respectively.

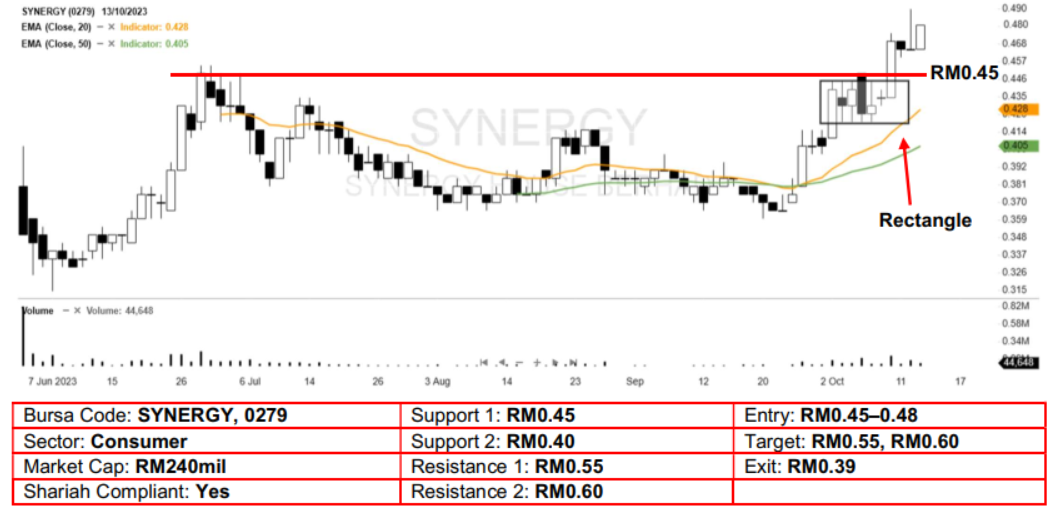

Technical Analysis. Synergy may trend higher after it surged to a new all-time high and closed above the RM0.45 resistance a few sessions ago. As the stock also broke out of the 1-week bullish rectangle pattern, it may see additional strength in the near term. A bullish bias may emerge above the RM0.45 level, with stop-loss set at RM0.39, below the 50-day EMA. Towards the upside, nearterm resistance level is seen at RM0.55, followed by RM0.60.

Source: AmInvest Research - 16 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024