Stock Idea - Skyworld Development

AmInvest

Publish date: Thu, 04 Apr 2024, 10:52 AM

Company Background. Skyworld Development (Skyworld) is an urban property developer focusing on the development of high-rise residential and commercial as well as affordable properties in Federal Territory of Kuala Lumpur (KL), Malaysia. The group operates under 4 segments: (i) property development, (ii) property management & management services, (iii) construction, and (iv) e-commerce platform. Since commencing its property development operations in 2014, Skyworld has completed 7 developments with a total gross development value (GDV) of RM3.1bil.

Prospects. (i) Revenue growth will be driven by ongoing project progress and completed inventory sales as Skyworld launched 2 new projects in KL in 9MFY24 with a total estimated GDV exceeding RM1bil. As at 31 Dec 2023, its unbilled sales totaled RM725mil (0.9x FY23 revenue of RM841mil), indicating a promising revenue stream ahead, (ii) Plan to replenish its land bank to seek potential land for acquisition in the Klang Valley. In FY23, the group has a total landbank of 55.7 acres in KL for its planned developments and future developments, (iii) Develop build-to-rent properties including commercial square footage and co-living spaces in KL, and (iv) Expand its urban property development business model into Ho Chi Minh City, Vietnam.

Financial Performance. In 3QFY24, Skyworld posted a higher revenue of RM171mil (+15.4% QoQ) with a PAT of RM25mil (+31.5% QoQ). This was mainly derived from progressive revenue recognition from on-going property development projects, sales of completed inventories and lower administrative expenses.

Valuation. Skyworld is currently trading at an attractive FY25F P/E of 5.6x, which is lower than Bursa Property Index’s 16.7x. As a comparison, UEM Sunrise, involved in property development such as industrial, commercial, residential, healthcare and mixed used properties, trades at a much higher FY25F P/E of 57x.

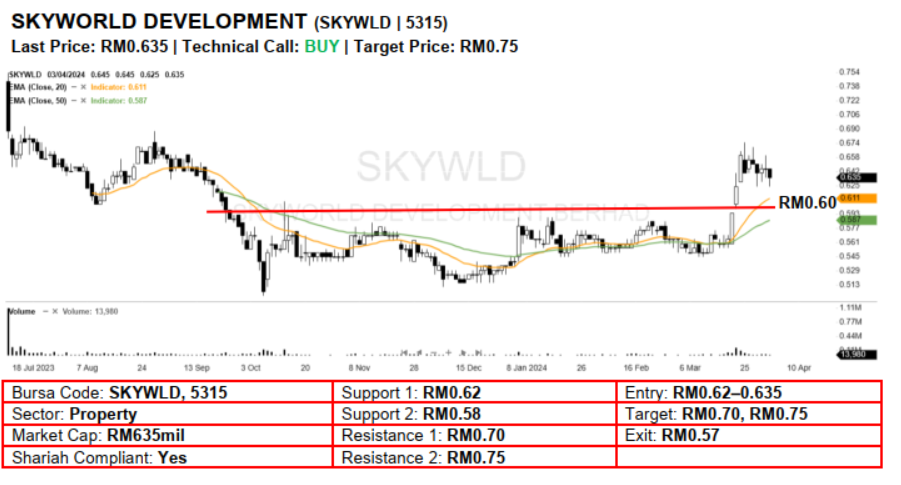

Technical Analysis. Skyworld may trend higher after it surged to a 6-month high and closed above the RM0.60 resistance a few sessions ago. As the 20-day and 50-day EMAs have established a bullish crossover on 20 Mar, the current upward momentum may persist in the near term. A bullish bias may emerge above the RM0.62 level with stop-loss set at RM0.57, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM0.70, followed by RM0.75.

Source: AmInvest Research - 4 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Jan 24, 2025