Stock Idea - Yoong Onn Corporation

AmInvest

Publish date: Mon, 22 Apr 2024, 10:51 AM

Company Background. Yoong Onn Corporation (YOCB) is an integrated manufacturer, designer, distributor and retailer of home linen, homewares and bedding accessories in Malaysia. The group operates under 3 main business segments: (i) distribution & trading, (ii) retailing, and (iii) design & manufacturing. YOCB owns over 13 different home linen brands - including Jean Perry, Ann Taylor, Louis Casa, Novelle and Genova - catering to various market segments. The group operates a state-of-the-art manufacturing and warehouse facility with a built-up area of 303,500 sq ft in Nilai, Negeri Sembilan. Its product range includes bedsheets, blankets, pillows, bath towels, tablecloths, curtains, rugs, floor mats and lifestyle furniture such as tables and sofas.

Prospects. (i) Focus on expanding new retail outlets for growth, primarily targeting the Klang Valley, Johor and Penang areas. Currently, YOCB has more than 30 retail outlets (i.e. Home’s Harmony, Home’s Outlet and Niki Cains Home) and 260 consignment counters nationwide, serving the premium, mid-range and mass markets, (ii) The recent acquisition of T.C. Homeplus (a Singaporebased home linen retailer) will allow the group to expand its range of products & services, creating potential synergies by tapping into the existing customer bases of both parties in Singapore, and (iii) Strategically expands alongside reputable township developers, targeting areas with growing communities due to development projects to meet rising demand for home linen products.

Financial Performance. In 2QFY24, YOCB reported higher revenue of RM66.4mil (+14.6% QoQ) with a PAT of RM9mil (+51% QoQ). This was mainly due to higher sales during the year-end festive season, promotional events, improved retail market sentiments, a better product mix and enhanced cost efficiency.

Valuation. YOCB is currently trading at an attractive 10.4x trailing P/E, which is lower than Bursa Consumer Index’s 5-year forward average of 17.8x. As a comparison, MR D.I.Y. Group (M), which is involved in home improvement retail and mass merchandise in Malaysia, trades at a much higher FY24F P/E of 21x.

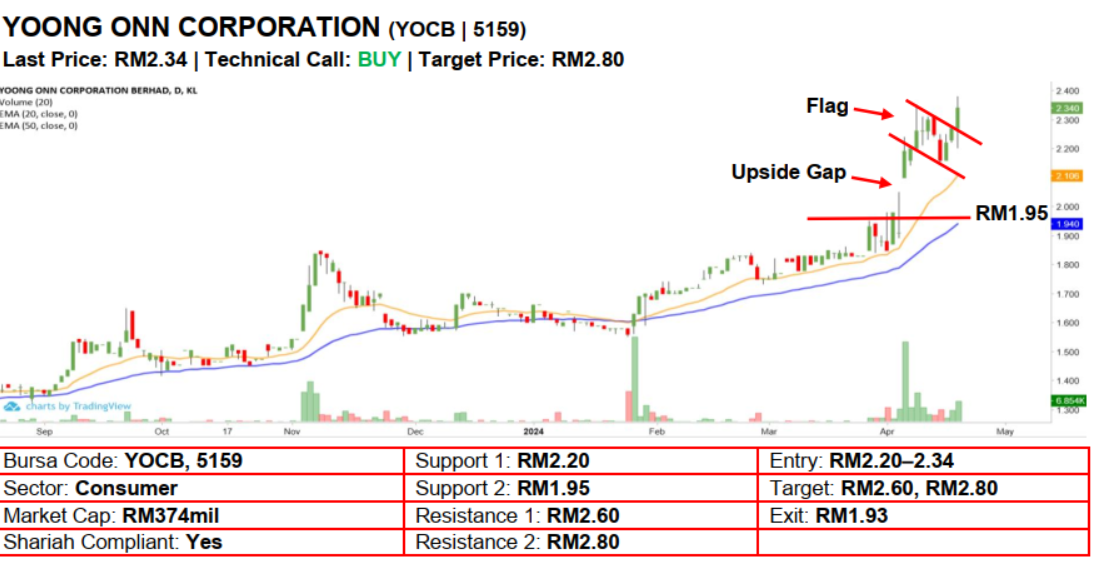

Technical Analysis. We expect further upside for YOCB after it broke out from the 2-week bullish flag pattern with a white candle on Friday. Given that the bullishness of the upside gap that formed on 4 April has not yet been negated coupled with rising EMAs, the stock still looks positive in the near term. A bullish bias may emerge above the RM2.20 level with stop-loss set at RM1.93, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM2.60, followed by RM2.80.

Source: AmInvest Research - 22 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Jan 24, 2025