Stock on Radar - Northeast Group (NE)

AmInvest

Publish date: Mon, 21 Oct 2024, 10:09 AM

Northeast Group (NE | 0325)

Last Price: RM0.53 | Technical Call: BUY

| Support 1: RM0.50 | Resistance 1: RM0.60 |

| Support 2: RM0.47 | Resistance 2: RM0.70 |

| Shariah Compliant: Yes | Sector: Industrial |

Company Background. Northeast Group (Northeast) specializes in manufacturing precision engineering components for the photonics, electrical and electronics (E&E), semiconductor, telecommunications, and optoelectronics industries. These components are precisely machined to exact specifications for further processing or assembly into end products by clients. The group also offers value-added services, including surface finishing, sheet metal fabrication, and mechanical sub-assembly. Northeast operates 3 factories in Penang, Malaysia, serving clients both locally and internationally, including in the USA, UK, Thailand, and Singapore.

Prospects. (i) Northeast's business model is export-oriented, generating over 70% of revenue from international markets. To enhance its presence, the group aims to capitalize on its high-quality precision engineering products and enhance its market position by forming strategic partnerships and acquiring new clients, (ii) The ongoing expansion of production capacity involves constructing a new factory with 79,020 sq ft of space, capable of accommodating 200 units of CNC machines. This initiative aims to boost production, support growth, and meet the rising demand for continued success, and (iii) Procurement of new CNC machines to support production capacity expansion, including 36 units of CNC milling, turning, turn-mill, automatic lathe, and indexer machines.

Financial Performance. In 3QFY24, Northeast reported revenue of RM21.6mil with a PAT of RM3.2mil. Comparative quarter-on- quarter (QoQ) and year-on-year (YoY) figures are not available, as Northeast Group was newly listed on 15 October 2024. As of 30

June 2024, the group held a robust net cash balance of RM59mil.

Valuation. Northeast is currently trading at an attractive FY26F P/E of 12.3x, which is lower than the Bursa Industrial Production

Index's 22x. In comparison, SFP Tech Holdings, which is involved in customized sheet metal fabrication, CNC machining, equipment automation assembly processes, and automated equipment solutions, trades at a much higher FY26F P/E of 23x.

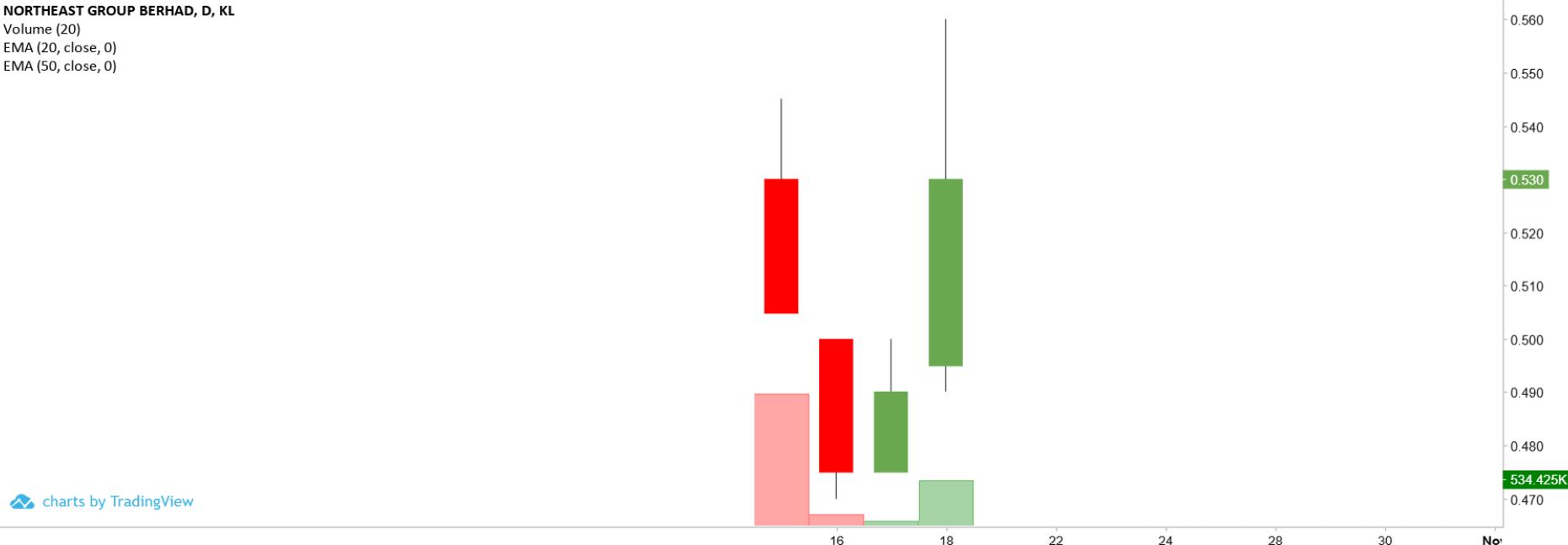

Technical Analysis. Northeast formed a bullish tower bottom pattern on Friday, implying that a bullish reversal sign may have occurred. The stock also posted two positive candles in a row and negated the bearish 16 October's downside gap, likely suggesting that upward momentum is picking up. A bullish bias may emerge above the RM0.50 level, with stop-loss set at RM0.46, below the recent pivot low. Towards the upside, near-term resistance level is seen at RM0.60, followed by RM0.70.

Entry: RM0.50-0.53

Target: RM0.60, RM0.70

Exit: RM0.46

Source: AmInvest Research - 21 Oct 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Jan 24, 2025