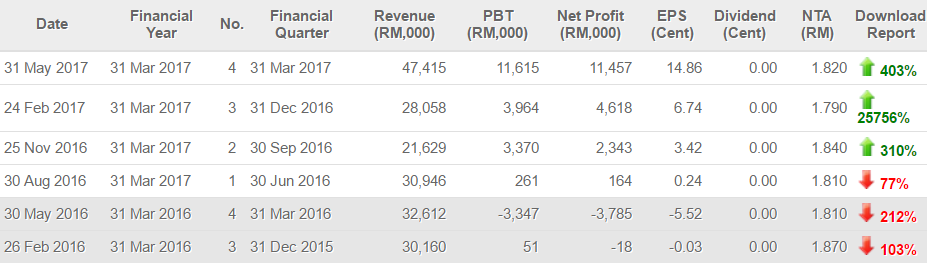

ATTA: Excellent Quarter, Forgotten Steel Stock, PE 5.63

AllWin

Publish date: Wed, 31 May 2017, 10:15 PM

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

They benefit from raising steel price. As long as the price is good, they should be doing well.

2017-05-31 22:38

@probability is right. It is from other operating income. I believe it is ICULS. Next quarter will be back to low figure.

2017-05-31 23:07

@gohkimhock refer to A4 Segmental Reporting in quarter report, other operating income is around 20% of total net profit, the rest is from real manufacturing income. I give discount of 50% from latest EPS still get valuation of 2.40.

2017-05-31 23:50

but latest EPS is dominated by other income, without other income net profit is very much lower, even lower than your 50% discount.

2017-06-01 00:30

There's a big contribution from 'other income' lah. Until management clarifies what is this, whether they are recurring or not is anybody's guess.

2017-06-01 05:58

The increased in profit mainly contributed by other operating income already happened 3 quarters continuosly. Don't believe you can see these yourself.

4th 2017

The Group made profit before tax of RM11,615 Million for current quarter compared to profit before tax of RM3,963 million for the preceding quarter. The significant increase in profit mainly contributed by higher profit margin in manufacturing segment and other operating income.

3rd 2017

The Group made profit before tax of RM3,964 million for the 3rd quarter ended 31 December 2016 compare to profit of RM0,051 million for the preceding year corresponding quarter The increased in profit mainly contributed by metal recycling division and other operating income.

2nd 2017

The group made profit before tax of RM3.370 Million for current quarter compared to profit before tax of RM0.261 million for the preceding quarter. The increased in profit mainly contributed by other operating income.

So conclusion, sustainable lah.

2017-06-01 07:33

full year wise, other income contributed a huge huge portion of its pbt. should we be worry about that?

2017-06-01 08:19

Earning dilution by the LA, WB, WC and EOS is HUGE.

Atta only 94 million shares, but outstanding LA alone is already 184 million (conversion at 1.00) !

2017-06-01 10:02

1LA+90Sen cash can convert to 1 mother share...The nominal face value of the LA is 10sen ..

2017-06-02 14:16

Hi allwin, thanks for the great write up. Would wb or La be a better buy? Altho La has greater volume today, wb seems to be less volatile.

2017-06-02 21:12

Hi AnnH, La would be better buy now. Both very much depends on mother price. Both volumes high and can be volatile. I won't rule out got shark so apply tight stop/cut loss if you are in.

2017-06-03 07:54

.png)

probability

Current Net Profit margin seems unrealistic...may not be sustainable

2017-05-31 22:25