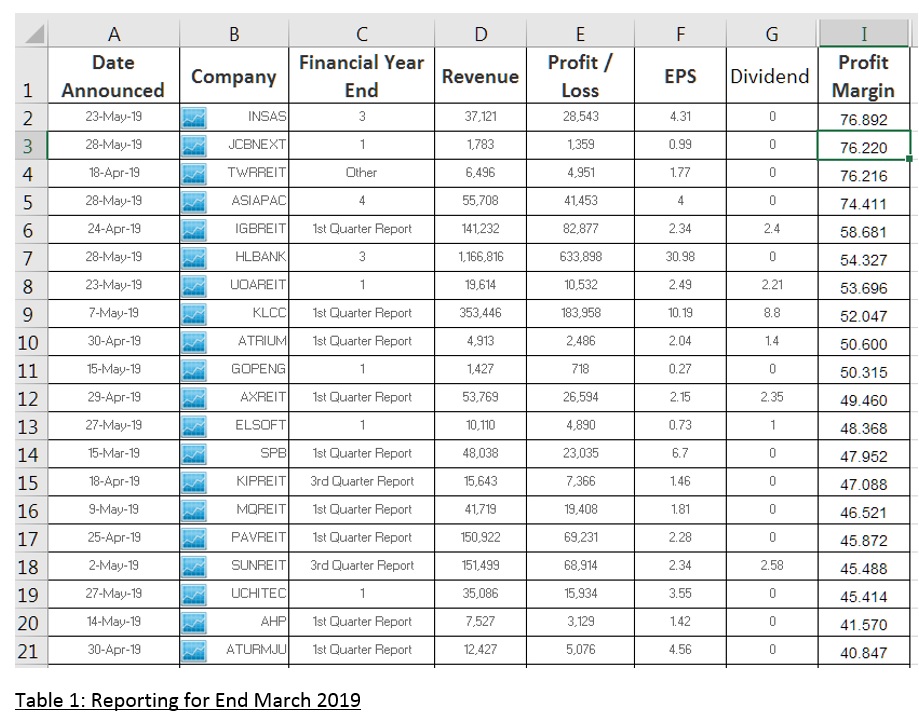

Top 20 Profit Margin % for BSKL as at Reporting 28052019

BLee

Publish date: Wed, 29 May 2019, 05:12 PM

A lot has being written about the good and bad of Insas Berhad businesses.

Below is my quick analysis of Insas Berhad latest QR showing Insas Berhad topping “profit margin” comparing with the rest of counters listed in BSKL as at reporting 28 May, 2019; shown in Table 1.

Good? Any Opinion please.

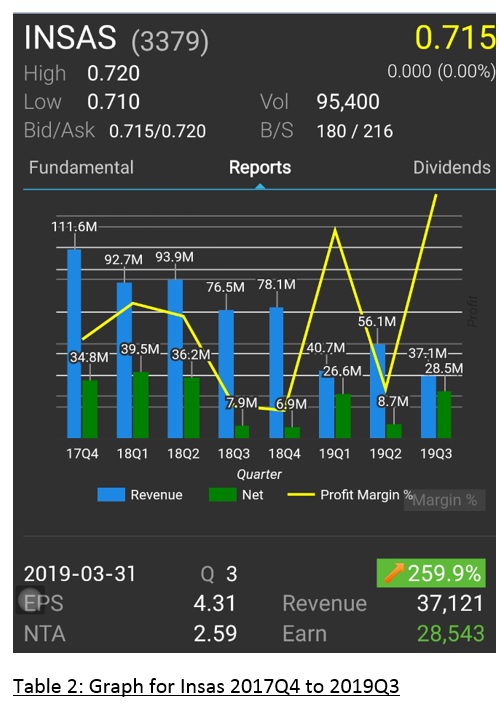

What does it mean by topping “Profit Margin”? IMHO, Insas Berhad business is very low risk, as it is standing side by side with all the REITs. But if refer to table 2, this performance is very cyclical as shown in 18Q4 and 19Q2 result.

Bad? Any Opinion please.

The revenue in term of RM also on the downturn as shown in 17Q4 of RM111.6M to 19Q3 of RM37.1M, table 2. Bad? Opinion please.

What does it mean by revenue downturn? IMHO, Insas Berhad business is not growing, but declining.

Quite a big amount of liquid assets (cash and shares investment) is earning interest and dividends, therefore low risk. The only risk is shares investment of paper gain become paper loss.

Good or Bad? Any Opinion please.

Source: https://www.malaysiastock.biz/Latest-Announcement.aspx

Source: KLSE Screener

Note: I have had gain some very valuable information from I3 forum, therefore I feel that I shall do my part to contribute. I am holding very little Insas Berhad shares for long term and having neutral outlook; this is not a buy or sell call for Insas Berhad. Any critics and opinions are welcome. Happy trading and TQ.