Focus Dynamics: Recovery play?

BLee

Publish date: Wed, 13 Oct 2021, 02:14 PM

Below is my discussion of ideas with one i3 forumer:-

"@Forumer: Unless the stock limit up if not better don’t buy first if not u will stuck for a long time. U have to prepare to wait

13/10/2021 9:28 AM

BLee: Bro @Forumer, If stock limit up already, better don't buy, will be stuck for a long time. When is the right time to buy? No one know. Now will be a recovery play since we are free to travel further and businesses opening up. All the warning of PP, ESOS, SIS, etc might not be relevant for recovery play. My 2sen, hope we can huat (prosper) together. Happy trading and TradeAtYourOwnRisk.

13/10/2021 9:46 AM"

Focus Dynamics main business is food. We 'eat to live' and 'live to eat', that is no 'or'. Although we can't dine in during MCO, the food delivery and businesses dealing with raw food will never stop. In my humble opinion, food businesses are very much relevant in recovery play when all businesses open up.

In my very first class of commercial study (only for 3 years, then went into science stream and Engineering studies), the teacher started the class with one simple question, what are human basic needs? Various answers are air, water, food, shelter, clothing, etc..The answer from the teacher etched into mind clearly for my daily recall; You need to do well in commercial studies to understand the power of money. Of course, with money, we can buy food for our survival, houses for shelter and rental investment, and clothing for our wearing. Moral of the story, food businesses will survive under whatever environment and usually on cash (money) terms.

I have published 2 articles on Fintec cash/capitalisation and cash+shares/capitalisation, very much like to present the same on Focus Dynamics.

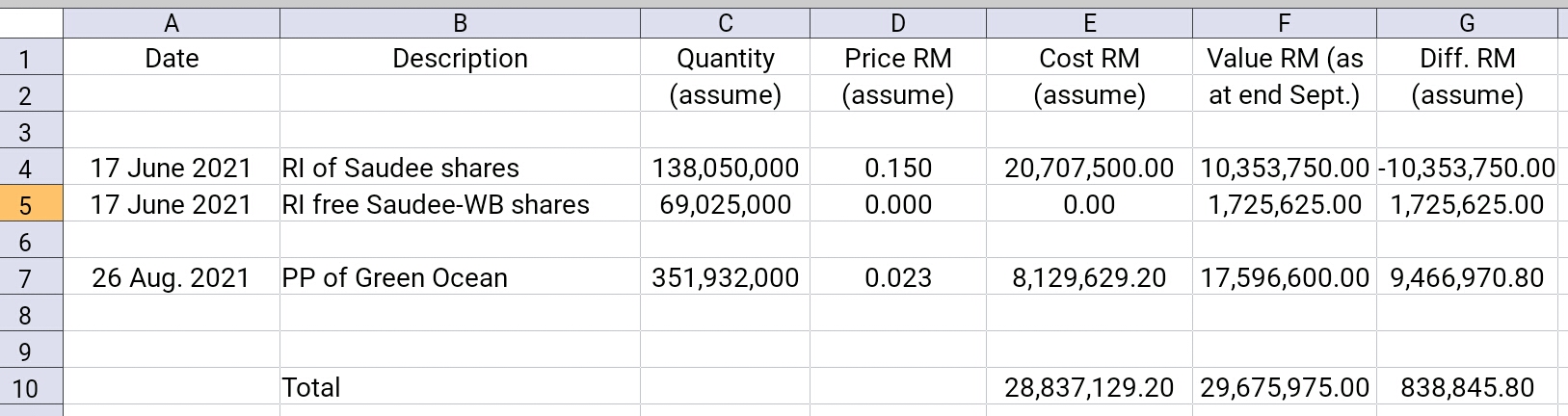

Details No. 1: Focus Dynamics QoQ investment in Saudee and Green Ocean.

- with only 2 counters calculated, the recovery is barely in the positive region over 1QoQ.

- As Saudee RI before the end of June, cash already accounted in the June QR. Cost assumed as book value.

How undervalue is Focus D? I have calculated based on available data for cash position w.r.t. QR30.06.2021 vs Focus market Capitalisation value of RM350mil in one of my articles.

Since I have new data as shown in Details No. 1, let me calculate the new value.

New calculated Cash and cash equivalent position: RM128.352mil - RM8.123mil = RM120.229mil

The new calculated Shares holding value based on Saudee and Green Ocean only as at end Sept.2021: RM 29.676mil

Focus D Share and cash details:-

(For info: Number Of SHares (NOSH): 6,372mil

Quantity by funds exercises: 6,372,185,736 as at 30 June 2021- 2,044,266,157 as at 30 June 2020 = 4,327,919,579

Percentage by exercises: 68%)

Capital: RM350mil as at 1st Oct. 2021

Cash and cash equiv. position: RM128.352mil as reported at Q30.06.2021 report.

Cash/Capital: 0.37

Cash+calculated shares holding/Capital: (120.229+29.676)/350= 0.4283

Sources: i3investor, klsescreener and other internet surfing.

Happy trading and TradeAtYourOwnRisk.

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|