WATCHLIST : 16 – 20 Nov 2015 – CAUTIOUS BUT SELECTIVE

This week should be a very trying week with most parameters and indicators trending negatively both locally and globally. Bursa Malaysia is expected to trend sideways within a 1,660-1,680 trading band on the heels of sliding commodity prices and anticipation that the US Federal Reserve would hike interest rates next month.

However, small cap rotational play is expected to create some excitement to a lackluster scenario. Export-led lower liners and penny stocks should still capture the limelight . So selective counters for the week which we can look at are as follows:-

|

ESCERAM (0100)

|

|

|

ESCERAM has demonstrated positive resilience to the lackluster market last week with a slightly softer underdone. It has been able to make a resistance breakout of price and volume at 0.475 and was able to maintain above this level conclusively. It is now apt for it to sail through the next resistance level at 0.55. If this level is broken conclusively, we should be able to see 0.60 in the immediate term.

However, strong support should be seen at 0.475 and a cut loss is peg at 0.445 upon a breach, to exit.

Salient features :-

- Export related

- Glove sector

Reference : http://klse.i3investor.com/blogs/the_edge_insider_asia_stock/85119.jsp

|

PWROOT (7237)

|

|

|

|

PWROOT has shown a impressive rally recently closing Friday at 2.86, a notch from its all-time intraday high of 2.90, registered on 5-Nov-2015. The recent upward movement has pushed the price to be quite far from the support level of 2.61. Last week it added RM0.12 to its price and for 52-week period, it has more than double its price by gaining a phenomena RM1.50.

- Expect a stellar quarter result to be released in the 3rd week of November 2015

Reference : http://klse.i3investor.com/blogs/the_edge_insider_asia_stock/86082.jsp

|

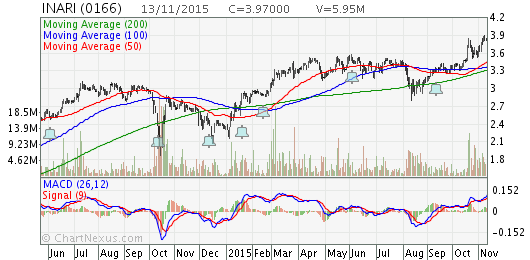

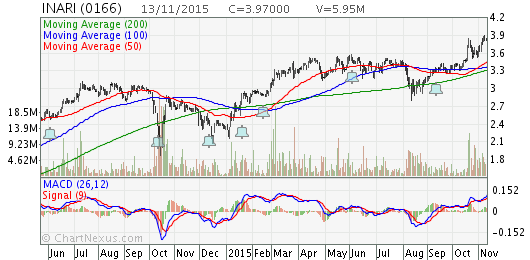

INARI (0166)

|

|

|

|

INARI has seen a phenomena and stellar performance recently. For last week it added RM0.22 to close Friday at 3.97 after touching a high of 4.00. For a 52-week period, it has registered a huge gain of RM1.72 In addition, the price just broke the resistance of 3.85 reinforcing the bullishness in the recent price movement. This breakout was accompanied by a higher than average traded volume which shows the enthusiasm of the traders to push the price higher and past this resistance hence giving a higher probability of a successful breakout.

Immediate TP : 4.50

- 1QFY16 sales of RM274.9m was translated into a core net profit of RM42.2m which came in within expectation, accounting for 24.4% of HLIB’s full year forecast but shy of street’s estimate by 11.2% when annualized.

- 1QFY16 sales of RM274.9m was translated into a core net profit of RM42.2m which came in within expectation, accounting for 24.4% of HLIB’s full year forecast but shy of street’s estimate by 11.2% when annualized.

- More positive newsflows expected VERY soon

Highlights

-

Attributed the expansionary results solely to the favorable movement of USD against RM. For 1QFY16, the exchange rate averaged at RM4.04/USD, representing +10.6% qoq and +26.6% yoy.

-

Although CY15 global semiconductor market growth has been cut by Gartner to 0.8% yoy decline due to weakening demand in several electronic equipment sectors including PC, smartphone market continues to show growth of circa 10%. Gartner believes that the industry will return to positive growth in CY16 with 1.9% yoy expansion.

-

Inari will continue to integrate and improve the profitability of Optoelectronics business and continue to ride the growth of the mobile smart device market. The capacity expansion in P13 is on track and will drive growth in FY16.

-

While the strong USD is a boon, it is seeing risks of customer price-down, wage inflation, loss of highly qualified technical staffs seeking better opportunity elsewhere and difficulty of attracting good foreign workers to Malaysia.

Reference : http://klse.i3investor.com/blogs/amresearch/86097.jsp

|

TAS (5149)

|

|

|

|

TAS has been trading above its upward sloping 20-Day Moving Average which is a good sign. However the upward movement has encountered resistance at the level of 0.83. Traders should pay special attention to the price and volume behavior in order to determine whether this resistance level can be broken decisively for TAS to resume its upward movement. Once 0.83 broken conclusively; we can expect 0.97 to be tested.

Qtr Result shows :

- profit increased by 1.6 times

- EPS increase 1.6times

- Nett asset increase 1.07 times. from last year

- cash 29.8 cents/share from Annual Report 2015

- Debt/ equity : 0.46

- Reserves/Equity; 1.14

|

NIHSIN (7215)

|

|

|

|

NIHSIN has demonstrated an impressive record by lifting its price from a low of 0.22 in Aug 2015 to 0.34 closing Friday; an impressive 55% increase over a 3-month period.

In addition, there is a technical level at 0.34 which may support any short-term retracement. RSI is also showing an overbought condition which may indicate some retracement may take place especially if the support level of 0.34 is broken. Thus it is most important that the resistance of 0.355 broken conclusively for it to tread high to its TP of 0.385 N 0.45

- Expect it to release a good qtr result this week

- Heard there are some positive corporate development under-way

Reference :-

http://klse.i3investor.com/blogs/rhb/86056.jsp

http://klse.i3investor.com/blogs/kenangaresearch/85836.jsp

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

|

|

HAPPY TRADING & GOOD LUCK

BURSAMASTER

|

|

georgeonfire

thanks for sharing

2015-11-16 10:43