VS...WHAT POINTS TO THE SUDDEN RUN UP TODAY?

BURSAMASTER BULLSEYE

Publish date: Tue, 15 Dec 2015, 12:51 PM

|

VS (6963) |

|

|

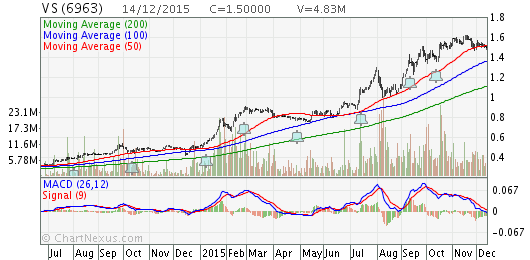

The run-up today might points to the quarter result to be released very soon. The results is rumoured to be stellar. The highest price done to date after the recent share split was 1.62 achieved on 19th November 2015. I expect this 1.62 resistance level to be broken in the immediate term possibly this week itself, from the look of the frenzied trading today. VS closed the morning session today at 1.56 with a gain of 6 cents. Hopefully it will re-test its high of 1.62 today or tomorrow and thereafter hit my initial TP of 1.80.

* Calculated based on the net profit of the trailing twelve months and latest number of shares issued.

| Date |

Financial Year |

No. |

Financial Quarter |

Revenue (RM,000) |

Profit Before Tax (RM,000) |

Net Profit (RM,000) |

Earning Per Share (Cent) |

Dividend (Cent) |

NTA (RM) |

Download Report |

|---|---|---|---|---|---|---|---|---|---|---|

| 29/09/2015 | 31/07/2015 | 4 | 31/07/2015 | 506,843 | 57,073 | 52,702 | 4.79 | 2.40 | 0.680 |

|

| 23/06/2015 | 31/07/2015 | 3 | 30/04/2015 | 420,100 | 34,456 | 26,516 | 12.89 | 6.00 | 3.080 |

|

| 26/03/2015 | 31/07/2015 | 2 | 31/01/2015 | 465,384 | 25,456 | 18,296 | 9.07 | 3.00 | 3.020 |

|

| 17/12/2014 | 31/07/2015 | 1 | 31/10/2014 | 544,558 | 42,701 | 35,224 | 17.94 | 3.00 | 2.930 |

|

| 30/09/2014 | 31/07/2014 | 4 | 31/07/2014 | 534,453 | 21,252 | 36,450 | 19.97 | 7.00 | 2.840 |

|

| 25/06/2014 | 31/07/2014 | 3 | 30/04/2014 | 375,996 | 4,137 | 3,815 | 2.11 | 2.50 | 2.680 |

|

| 26/03/2014 | 31/07/2014 | 2 | 31/01/2014 | 367,370 | 6,424 | 3,758 | 2.07 | 0.00 | 2.710 |

|

| 31/12/2013 | 31/07/2014 | 1 | 31/10/2013 | 437,263 | 10,180 | 9,562 | 5.28 | 2.20 | 2.650 |

|

| 27/09/2013 | 31/07/2013 | 4 | 31/07/2013 | 359,780 | 38,809 | 36,169 | 19.96 | 0.03 | 2.650 |

|

| 25/06/2013 | 31/07/2013 | 3 | 30/04/2013 | 242,349 | -121 | 38 | 0.02 | 0.00 | 2.220 |

|

| 26/03/2013 | 31/07/2013 | 2 | 31/01/2013 | 233,943 | 294 | 40 | 0.02 | 0.00 | 2.230 |

|

| 27/12/2012 | 31/07/2013 | 1 | 31/10/2012 | 327,839 | 10,465 | 7,663 | 4.23 | 2.00 | 2.220 |

|

Background

VS Industry Berhad Malaysia and VS International Group Limited(Hong Kong, China) are public listed companies in Malaysia and Hong Kong with over 27 years of Multi-products OEM contract manufacturing/EMS experiences. We are among the top 50 Contract Manufacturing services providers in the world. Our operations locate in Malaysia, Indonesia, Vietnam and China employing over 15,000 workers and operating on more than 5 millions sq. ft. of manufacturing space and still adding. We are specialist in Plastic Injection Molding(one of the largest in the region), Plastic Secondary Finishing, Tools design and fabrication, PCB assembly via Surface Mount Technology(SMT), Auto Insertion(AI), Chips on Board(COB), Manual Insertion(MI), Final Product Box Build having the same capability like any world renowned Electronic Manufacturing Services companies. VS Industry has also demonstrated excellent capability in the production of a wide range of Remote Control units - ODM/OEM, Printers, Vacuum Cleaners, Home Appliances, White Goods, Audio, Video, DVD products for world class companies in full turnkey, pseudo-turnkey and consigned mode.

VS closed today above its resistance of 1.53 which now becomes its support. Should this support is broken; next level support is at 1.47 and its next resistance is quite far at 1.62.

Going forward, what we can expect from VS :-

1- It is anticipated that VS to release stellar Qtr Report towards the end of the month which should be better than market expectations.

Recall that the group had recently reported 4Q15 NP of RM52.7m (+99% QoQ; +44% YoY), bringing its FY15 NP (+148% YoY) to RM132.7m which beat consensus’ FY15 estimates by 8%.

2- Proposes Bonus Issue of Warrants to further increase shareholders’ equity participation. VS recently proposed a bonus warrant issuance of up to 290.8m bonus warrants on the basis of one (1) bonus warrant for every four (4) existing VS’s shares. The exercise price of the bonus warrants has been fixed at RM1.65/warrant which represents a premium of 18.06% over the five-day VWAP market price up to and including 16th October 2015.

3- Enjoying full swing benefits from strong USD trend.

VS group does not have any currency hedging position currently as the management is of the view that the natural hedging through raw materials (with 50% of its COS in USD) is sufficient to offset the risk, especially under the current strong USD trend. On the currency sensitivity analysis according to its Annual Report 2014, every 10% fluctuations in the USD will impact its FY14 bottomline by 8.8%.

4- Final single tier dividend of 1.2 sen per share

VS securities will be traded and quoted "Ex - Dividend” as from: 15 Jan 2016

The last date of lodgment : 19 Jan 2016

Date Payable : 29 Jan 2016

The final single tier dividend of 1.2 sen per ordinary share of RM0.20 each is subject to the approval by shareholders of V.S. Industry Berhad at its forthcoming Thirty Third Annual General Meeting to be held on 5 January 2016.

5- Quotes from the Managing director Datuk Gan Sem Yam said: “Going forward, despite the ongoing economic climate, we intend to continue improving our performance by ably supporting our customers, becoming more efficient in production and further developing our research and development capabilities to hone our competitive edge.”

“We are confident that these strategies will continue to take our current financial year to greater heights,” Gan said.

For the FY15, the group recorded a revenue of RM1.93bil, an increase of RM221.8mil, or 12.9% compared to the preceding year. Its pre-tax profit was RM159.7mil, up 280.3% or RM117.7mil over the same period.

“The improved earnings for the current quarter was mainly attributable to better sales mix contributed by the Malaysian operations, and the improved earnings for the cumulative quarter was mainly due to higher revenue as well as better sales mix contributed by the Malaysian operations,” it said.

The company also recorded a RM24.44mil net foreign exchange gain compared with a loss of RM2.1mil in FY14.

6- VS is My Largest Investment - Koon Yew Yin

http://klse.i3investor.com/blogs/koonyewyinblog/79049.jsp

7- My TP RM1.80 to RM2.00 (0- 3 months)

Reference :

http://klse.i3investor.com/blogs/kcchongnz/86545.jsp

http://klse.i3investor.com/blogs/kenangaresearch/85109.jsp

HAPPY TRADING & GOOD LUCK

BURSAMASTER

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on BURSAMASTER BULLSEYE

Created by BURSAMASTER BULLSEYE | Jul 11, 2016