Should you subscribe to Siab Holdings’ rights issue? A confession as a shareholder

Amani956

Publish date: Fri, 31 May 2024, 11:23 AM

The Journey So Far

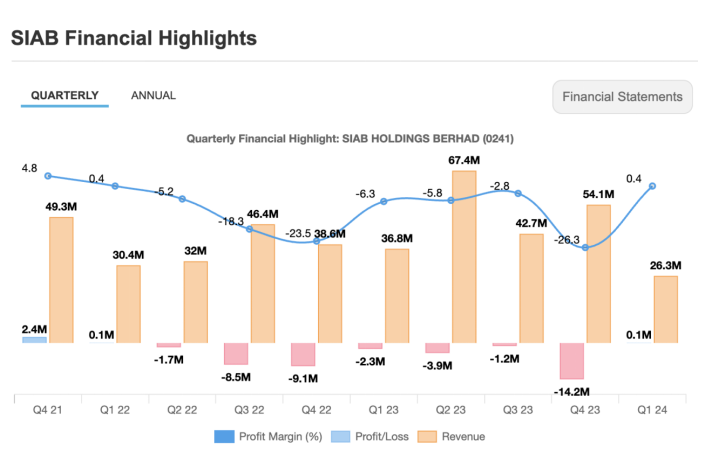

Siab Holdings Berhad (0241) has faced its share of challenges since listing, grappling with operational difficulties due to unprecedented high costs of raw materials and labour caused by Covid-19.

However, the company has turned the corner, as evidenced by their profitable Q1 FY2024 results. With legacy projects nearing completion, Siab is poised for profitability moving forward.

Rights Issue Details

In light of this significant turnaround, Siab is proposing a rights issue on the basis of 13 rights shares for every 10 Siab shares held by shareholders, along with 1 warrant for every 2 rights shares subscribed. The rights issue price is set at 12.0 cents per share, with the warrants conversion price fixed at 20.0 cents.

Example Calculation:

● If you hold 100,000 units of Siab, full subscription would mean:

● 130,000 units (100,000 units * 1.3) * 12.0 cents = RM15,600

● You would be entitled to 65,000 free warrants, while holding 230,000 units of Siab.

Purpose of Fundraising

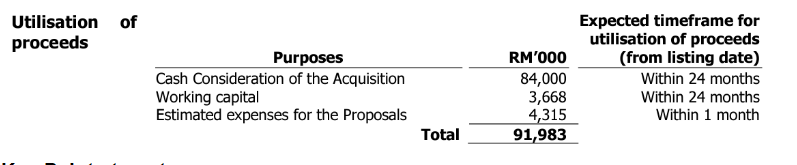

Siab aims to raise RM91.98 million upon full subscription of the rights issue. A significant portion of these funds will be used for the acquisition of Taghill Sdn. Bhd. (“Taghill”) for a total of RM96.00 million, with the remaining RM12.00 million funded internally by Siab. This acquisition is a potential game changer for the company.

Key Points to note:

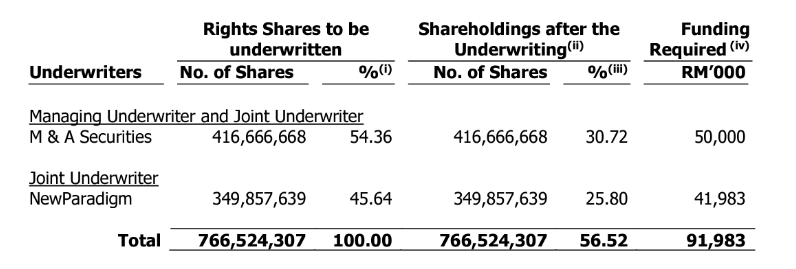

● The rights issue is fully underwritten by M & A Securities Sdn. Bhd. and NewParadigm Securities Sdn. Bhd., ensuring its success.

● The acquisition will enhance expertise in the construction industry, combining Siab and Taghill’s strengths.

Future Prospects

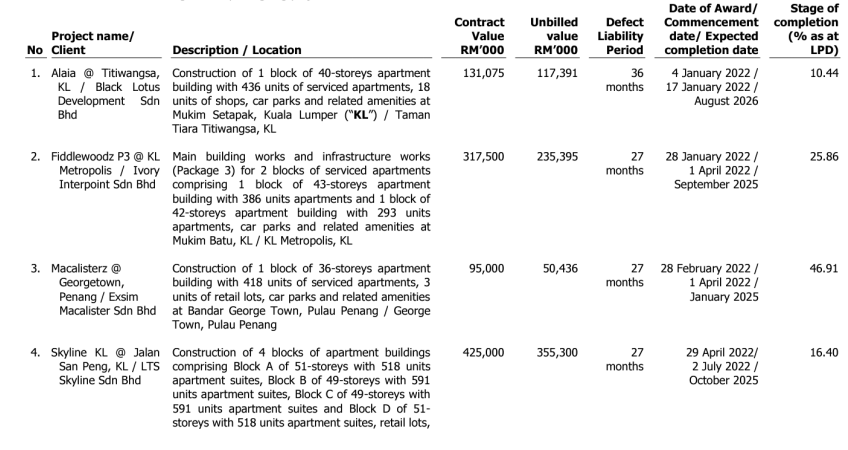

The new combined Siab will boast an order book of RM1.62 billion, with Taghill contributing RM1.31 billion. Siab’s own unbilled order book stands at RM314.48 million. Taghill also offers a profit guarantee of not less than RM24.00 million for FY2024 and FY2025, contributing RM12.00 million each year.

Taghill has a proven track record with well-recognized developers such as Exsim Development Sdn. Bhd. (“Exsim”), having completed projects worth approximately RM1.6 billion in Gross Development Value (“GDV”).

Industry Outlook

The Malaysian construction industry saw a 6.3% growth from RM53.44 billion in 2022 to RM56.69 billion in 2023. The industry is expected to expand by 6.8% to RM60.49 billion in 2024, supported by broad-based growth across all subsectors.

Government Initiatives:

● RM99.0 million allocated for development expenditure in Budget 2024.

● RM2.47 billion allocated for housing projects.

● Special guarantee fund of RM1 billion to revive abandoned projects.

● RM460 million to aid rural residents in building or renovating homes.

● Various other allocations and initiatives aimed at boosting the housing and construction sectors.

Conclusion

As a shareholder of Siab who has been following them since their IPO, I am confident that this acquisition will significantly enhance the company’s fundamentals. This marks a critical tipping point for Siab, with an improved order book and brighter prospects aligning perfectly with the current market conditions. Investors should definitely consider participating in the rights issue, especially given the potential arbitrage opportunity presented by the warrant sweetener.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|