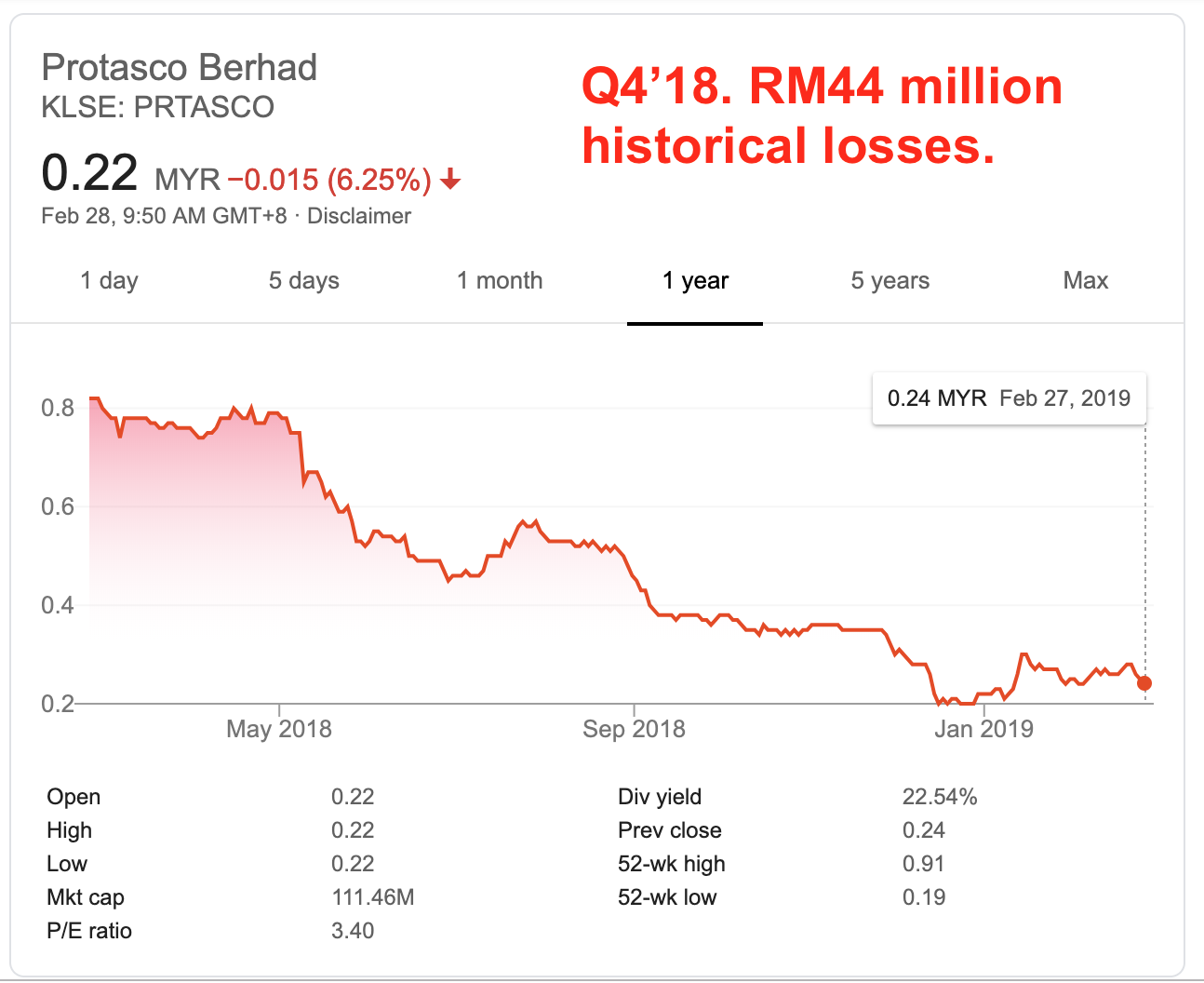

富达公司兵败如山倒,季度亏损4千4百万,内情揭秘。Losses widen. Protasco Bhd (5070) loss -RM44mil in 4Q, QoQ -5,473.91%, YoY -614.54%. What is Exceptional items?Truth unveil.

CrocCaptured

Publish date: Thu, 28 Feb 2019, 09:45 AM

27 February 2019, Kajang, Selangor - Protasco Bhd (5070), the road maintenance oligopoly legacy left over from former government suffers another huge quarterly losses under current management supervision, lead by Group Managing Director Dato' Sri Chong Ket Pen.

The losses widen to -RM44,647 million in 4th quarter, or comparable QoQ -5,473.91%, YoY -614.54%, the worst financial quarter and total disaster caused by current management team. Protasco Bhd senior management and board of directors fees trippled from RM3mil to over RM10mil since the year 2014, which is the highest paid civil servant taking salaries from the people of Malaysia thanks to the passive caretaker role riding on JKR road maintenance contracts.

Financially "Engineered Profit" Evidence Cover Up

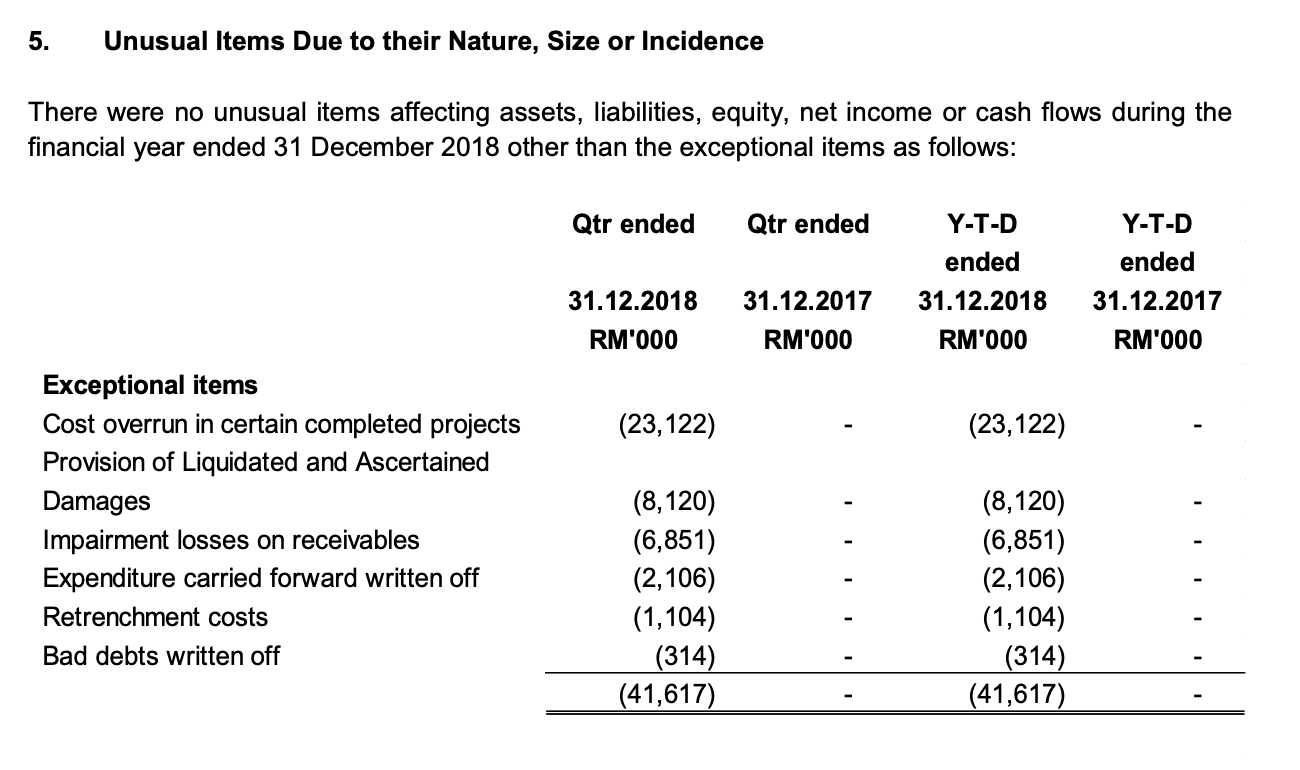

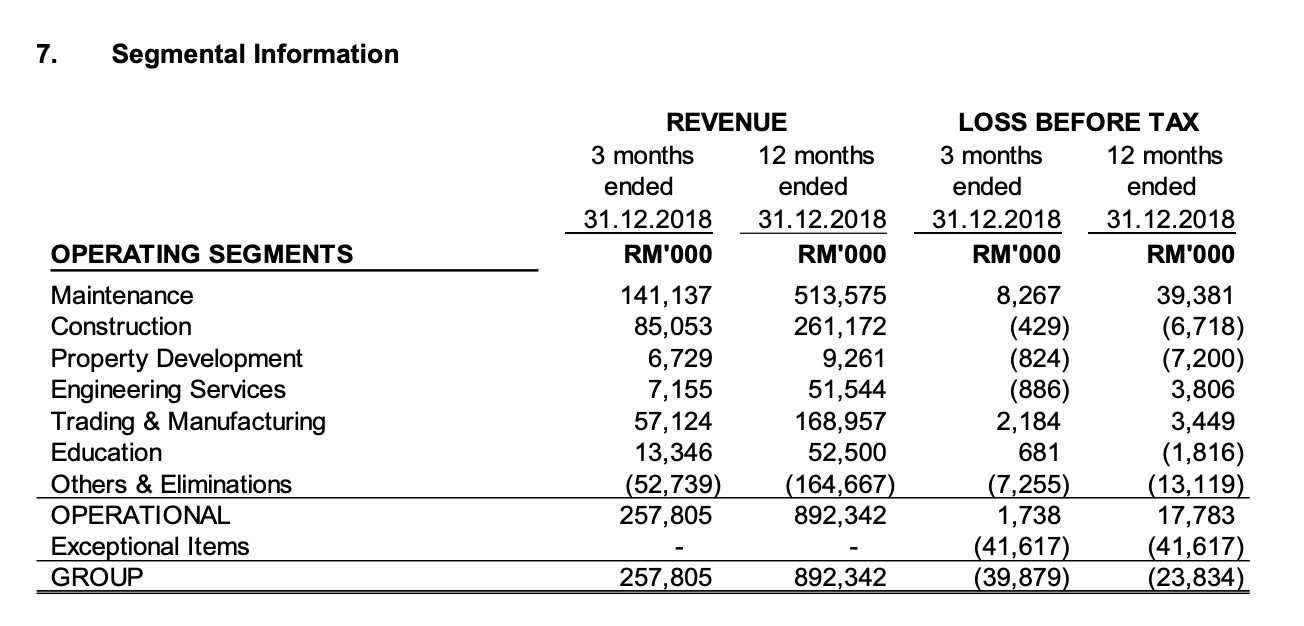

Most perculiar in this latest financially engineered quarter report is the "Exceptional items". What is hidden inside the Exceptional items that Chong Ket Pen's management trying to cover up? According to the notes in the latest quarterly report item number 5 especially the "Cost overrun in certain completed projects", the cover up seems to be fooling MIA, Bursa Malaysia and Securities Comission, as well as SPRM and IRB all together on 1 particular failure - PPA1M camouflage. Here are the items:

Assume that Protasco for the sake of reporting a "profit" to justify bank-borrowing to pay dividend, had overlooked the "cost overrun in certain completed projects", as well as "Provision of Liquidated and Ascertained Damages", plus "Impairmet losses on receivables" and "Ependiture carried forward written off", bundled with "Retrenchment costs", etc, resulted in RM41.617 million of unusual loss items. These material losses where impact is more than 5% of earlier quarterly reporting difference, may trigger Bursa Malaysia and SC alert and reprimant on all Protasco bhd directors for careless in reviewing the suspected false quarterly report. Such false report were resulted in higher bank borrowing and paid out RM25 million dividends in the year 2018 (evidence in next paragraph).

Wishfully, such cover up might fool the ordinary investors, but not the authorities. What do you think?

Financially "Engineered Dividend" Evidence Exposed

The Construction business is Protasco Bhd's current management desperate idea to proof themselves not a failure in running other business except being crown as civil servants taking care of JKR road maintenanc contracts. To fulfil one man's plan to make Construction Business his own legacy, dubious PPA1M contracts were signed and huge construction loan from UOB Bank was obtained. The result of such is the chance for Protasco Bhd management to get close for former Prime Minister, Dato' Sri Najib bin Tun Razak in hope to secure further road maintenance contracts. In deed, the lost making PPA1M show project paid off, with the secure of RM4.2 billion JKR contract on 4 April 2018, or 1 months before Malaysia General Election.

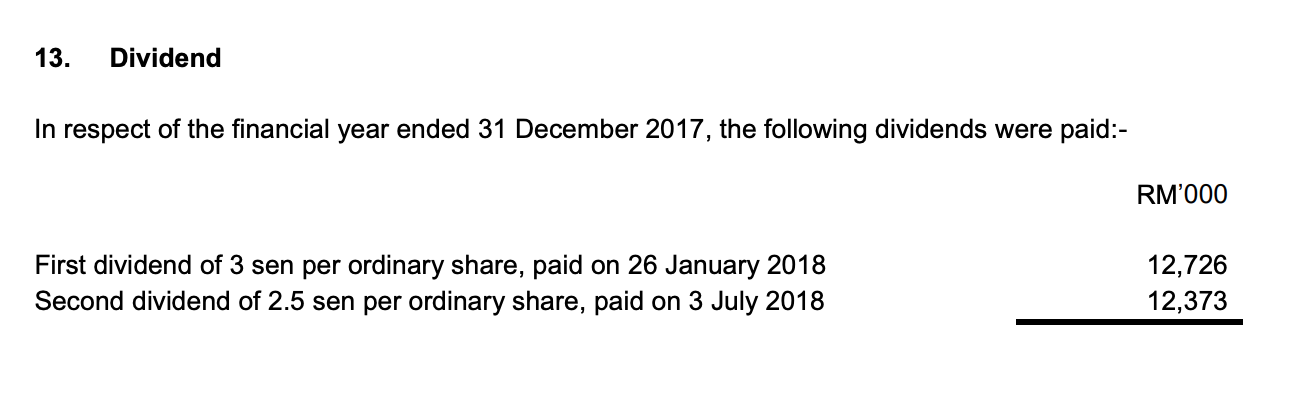

The supposedly "lost making" PPA1M project turns "profitable" in the year 2016 and 2017, with sophisticated payments paid to sub-contractors, suspected transfer pricing and accounting massage which magically spring out "profits" on the account. This "profits" becomes the excuse for Protasco Bhd to borrow more bank money and paid the cash out through "Dividends", and the cash magically landed in major shareholder's coffer - Dato' Sri Chong Ket Pen to be more precise.

The financial engineering impact took place in the year 2014 and lasted until the year 2018, evidence from this quarterly report notes No.13 as follows:

While the company suffer huge losses, earlier financially engineered "profit" numbers fooled everyone and Protasco paid out RM25,099 million so called dividend, which suspected "half" went to substantial shareholder.

The "Cost overrun in certain completed projects" of RM23,112 million compared to the RM25,099 million "Dividend" looks bizarre as if the money siphoning exercise took place on 1:1 match!

Fake Profit > Bank Loan > Dividend > Write Off?

Such questionable cash looting exercises raises alarming issue in the Malaysia corporate governance standard. The rusty governing system inherited from former government where law makers are not up to par to spot and procecute potential sophisticated corporate crime, giving birth and space for such corporate hooligans to repeatedly raking (illegal) personal gain at the cost of public shareholders and the people of Malaysia.

Except Road Maintenance, Chong's are Total Losers

The Chong's era, means after the year 2014 and spill over to February 2019 today, count Dato' Sri Chong Ket Pen and his 3 sons Chong Ther Nen, Chong Ther Shen, and Chong Ther Vern were brought in and are still sitting inside Protasco Bhd apparently not delivering any results except burdening Protasco Bhd management cost.

Here are various sectors the Chong's finger prints are all over, except self-automated Road Maintenance sector:

Disaster Outcome - Sinking Assets and Share Plunge

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

31 Dec 2018

|

31 Dec 2017

|

31 Dec 2018

|

31 Dec 2017

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

257,805

|

286,116

|

892,342

|

939,277

|

| 2 | Profit/(loss) before tax |

-39,879

|

24,993

|

-23,834

|

70,327

|

| 3 | Profit/(loss) for the period |

-41,527

|

12,976

|

-37,029

|

46,423

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

-44,647

|

6,578

|

-48,548

|

28,063

|

| 5 | Basic earnings/(loss) per share (Subunit) |

-9.02

|

1.55

|

-9.81

|

6.62

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

3.00

|

2.50

|

3.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.6735

|

0.9336

|

||

Definition of Subunit:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Big Croc That Rob Bursa - Who Are They?

Created by CrocCaptured | Dec 08, 2017