AGMO, CAPTURE THE RISE OF DIGITAL ECONOMIC SUPPLY CHAIN. AGMO READY FOR NEXT STAGE OF GROWTH.

Insidefluential

Publish date: Sun, 30 Jun 2024, 11:58 PM

A young start up company with a lion move.

A company who came from a reality show (start-up investment program “Make the Pitch”) with starting capital of RM300,000 in 2011 fast forward made a debut as public listed company in 2022. Isn’t it ah-maaa-zing???

This promising tech start-up just know when and where the right time to position themselves as “tech game changer” .

A little bit on AGMO

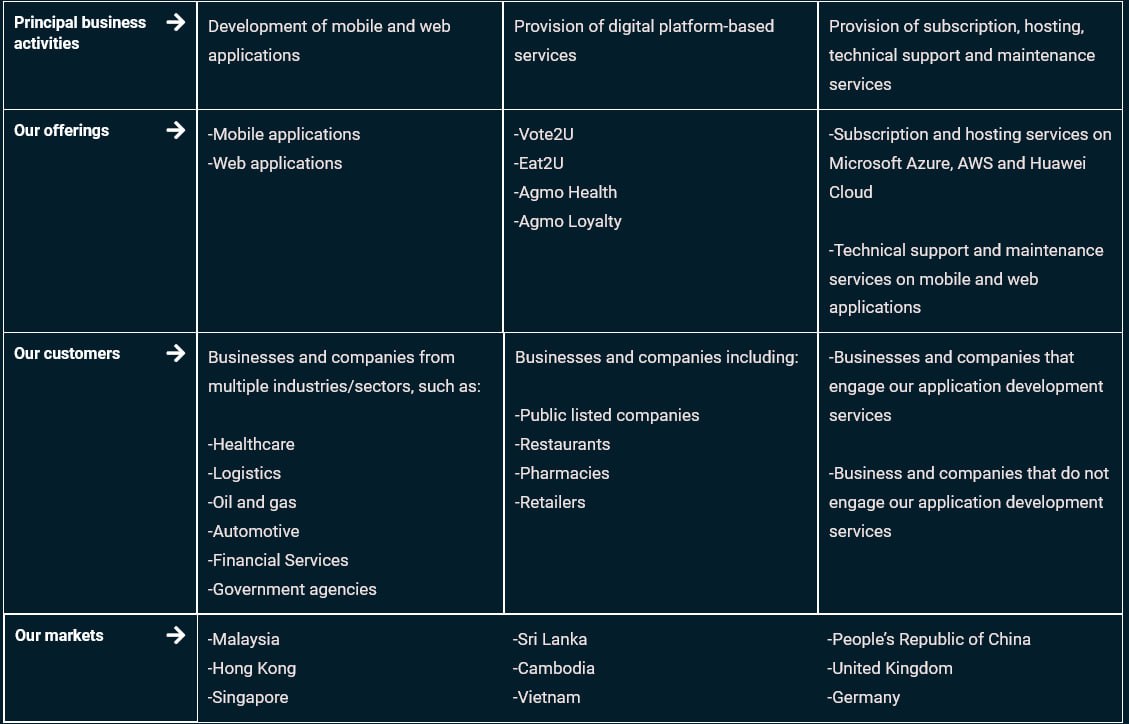

A digital solutions and application development specialist. It’s core services include:

- Development of customized digital solutions.

- Service provision based on digital platforms.

- Subscription hosting, technical support and maintenance services.

- Provision of training and development services.

Agmo has developed more than 100 mobile and web applications since its establishments. Range of clients including healtchcare, logistics, oil and gas, automotive, financial services as well as the government sector.

Some of familiar mobile apps and web applications developed by Agmo:

1. DOC2US

2. Nextproperty

3. Workgrowth

4. HRMS

5. Easylaw

6. Vote2u

7.Eat2u

8.Posrider (Pos Malaysia Bhd apps)

9.Friends of MYEG’s Zetrix

10.Mydigital ID

While Malaysia is their primary revenue contributor, Agmo has capitalised oversea market namely; Singapore, Cambodia, Hong Kong, Sri Lanka, Vietnam, People’s Republic of China, United Kingdom and Germany.

In July, Agmo has inked an MOU with Alibaba Cloud (Malaysia) Sdn Bhd. This opportunity is to explore potential business collaboration involving electric vehicles (EV) in Malaysia. Agmo is their first international customer of Alibaba Cloud EMAS Superapp. This MOU will benefit the usage of Alibaba Cloud EMAS Superapp’s strong app infrastructure and business functionalities as well as user-friendly and secure platforms.

As part of expansion plan, the company has set a new unit in Singapore as part of expansion plan. 90% of Agmo SG Pte Ltd is owned by Agmo.

What’s next for Agmo?

E-invoice

By 1st of August 2024 E-Invoice will become mandatory with the first batch implementation for taxpayers with annual income of sales exceeding RM100million. Following year implementation roll out to annual income of sales exceeding RM25million up to RM100million on 1st January 2025. Later will be made mandatory to all other taxpayers by 1st of July 2025.

Early this year Agmo and YYC Group launched E-Invoicing apps called JomeInvoice. This join forces are to capitalised the Inland Revenue Board (IRB) that will begin soon. The solution developed is a middleware solution that aims a connector to IRB’s MyInvois System. It is designed to integrate seamlessly with accounting system of any size or complexity.

Under this new subsidiary Jomeinvoice Sdn Bhd, in April 2024 the company has inked MOU with MSC Trustgate.com Sdn Bhd in effort to enhance the integrity and security of e – invoicing transaction. Later on, the same month, Jomeinvoice has appointed Proneer Global Sdn Bhd as the distributor for the e- invoice solution.

This means, Agmo is among the first to create an e-invoice in LHDN sandbox environment.

Artificial Intelligence (AI)

Recently Agmo has inked MOU with SNS Network Technology Bhd to introduce the first Digital Transformation as a service for Generative Artificial Intelligence in Malaysia. Under this synergistic collaboration together they will offer One Stop Digital Transformation as a Service (DTaaS) for Generative AI.

SNS Network provides AI hardware such as super AI server, Ai infrastructure as well as Ai-infra-as-a-Service. While Agmo to develop Generative AI software. This is another big move into the AI and data center theme.

To recap, in January 2024, Agmo has teamed up with two individuals to provide end-to-end machine learning and artificial intelligence-powered (AI) solutions. Wong Zhi Heng and Ong Yong Seng, will undertake the collaboration through a JV company, Dah Reply Sdn Bhd. The collaboration is expected to contribute positively to its future consolidated earnings and net assets.

Let’s talk what is Agmo’s worth

For the last 3 years the CAGR revenue is 62% which means average projected CAGR for the next 3 year is 35%. Net income CAGR for the last 3 years is 42% which means projected CAGR for the next 3 years is 41%.

By intrinsic value, Agmo is undervalued by 32% and looking at various valuation like P/E and EV/EBIT ratios the stock by relative value is undervalued by 34%.

What these figures tell you? Agmo has a lot more to offer. They have been actively expanding its business in the field of AI and digital transformation. With the upcoming new tech era, surely Agmo will ramp up riding the wave with more JV opportunities. The current price is still cheap. Agmo could slowly inching up to 90sen to RM1 in the long run.

Stay tuned for Agmo's imminent announcement—they're gearing up to launch an extraordinary project soon that's set to transform the market.

Regards,

Lily of the valley

More articles on How to become a resilient trader

Created by Insidefluential | Jun 28, 2024