In-Depth Analysis of DC Healthcare's Recent Transactions - Strategic Expansion or Overvaluation Concern?

Abram66

Publish date: Sat, 02 Dec 2023, 10:07 PM

DC Healthcare has recently garnered attention in the financial markets, with its share price experiencing significant volatility. The price plunged from approximately 50 cents to 33 cents, before recovering to above 40 cents. This fluctuation seems to be driven by a recent loss-making quarter and a general lack of clarity regarding the company’s strategic initiatives.

A Closer Look at DC Healthcare's Strategic Proposal

The key components of DC Healthcare's strategy include the issuance of free warrants, the high-profile acquisition of I Bella, proposed variation in the allocation of IPO proceeds, and an Employee Share Option Scheme (ESOS) at 15.0%.

I Bella's acquisition, valued at RM70.0 million, raises questions about its financial justification. The deal, structured as a half-cash, half-share transaction (RM35.0 million each), demands a careful valuation analysis.

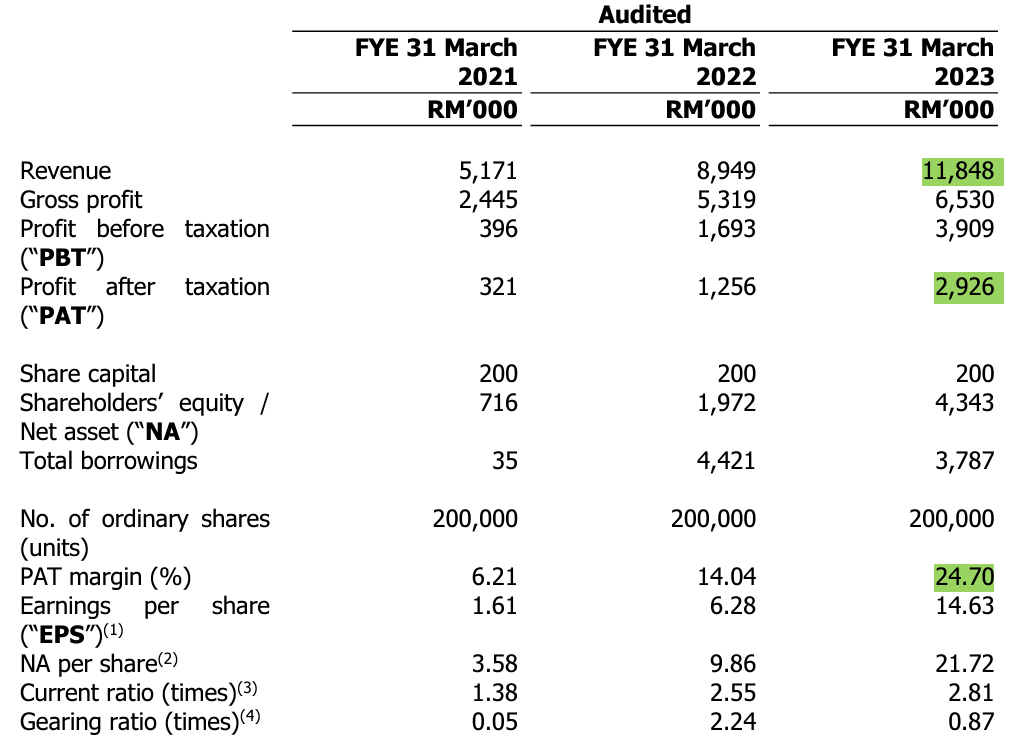

Source: DC Healthcare Holdings Berhad

According to the documents available, I Bella reported revenues of RM11.8 million and a profit after tax (PAT) of RM2.9 million, translating to a PAT margin of 24.70% in FYE2023 ended 31st March. I Bella operates two aesthetic medical clinics in Sri Petaling and Setia Alam, with a third in Taman Molek (Johor) currently under renovation. Notably, the Setia Alam branch's contribution to the FYE2023 earnings was minimal, with the Sri Petaling branch accounting for the majority of I Bella's profits.

Evaluating the Acquisition Price

The acquisition price of RM70.0 million, which equates to a price-to-earnings ratio (PER) of 23.92 times, appears steep compared to DC Healthcare's listing PER of 26.04 times. However, it's important to consider the profit guarantee of RM11.4 million for I Bella over the next two fiscal years, which significantly lowers the acquisition Forward PER to 13.46 times.

Source: DC Healthcare Holdings Berhad

The feasibility of I Bella achieving a PAT of RM5.2 million in the next fiscal year is supported by the strong performance of its Sri Petaling branch and potential contributions from the Taman Molek branch. Therefore, the acquisition, contrary to some opinions, is not simply for two clinics at RM70.0 million.

Valuation and Share Price Considerations

With RM35.0 million of the acquisition price to be paid in cash, the remaining half will be settled through share issuance at RM0.580. This represents a substantial 45.0% premium over DC Healthcare's current share price of 40 cents. Such a strategy reduces share dilution and reflects a PER of 60.19 times for DC Healthcare at 58 cents based on latest available financial year results, questioning who indeed is 'expensive.'

Additionally, the exclusion of I Bella's vendors from the free warrants issuance (on a 1:4 basis) aims to benefit existing shareholders without excessive rewards to the vendors.

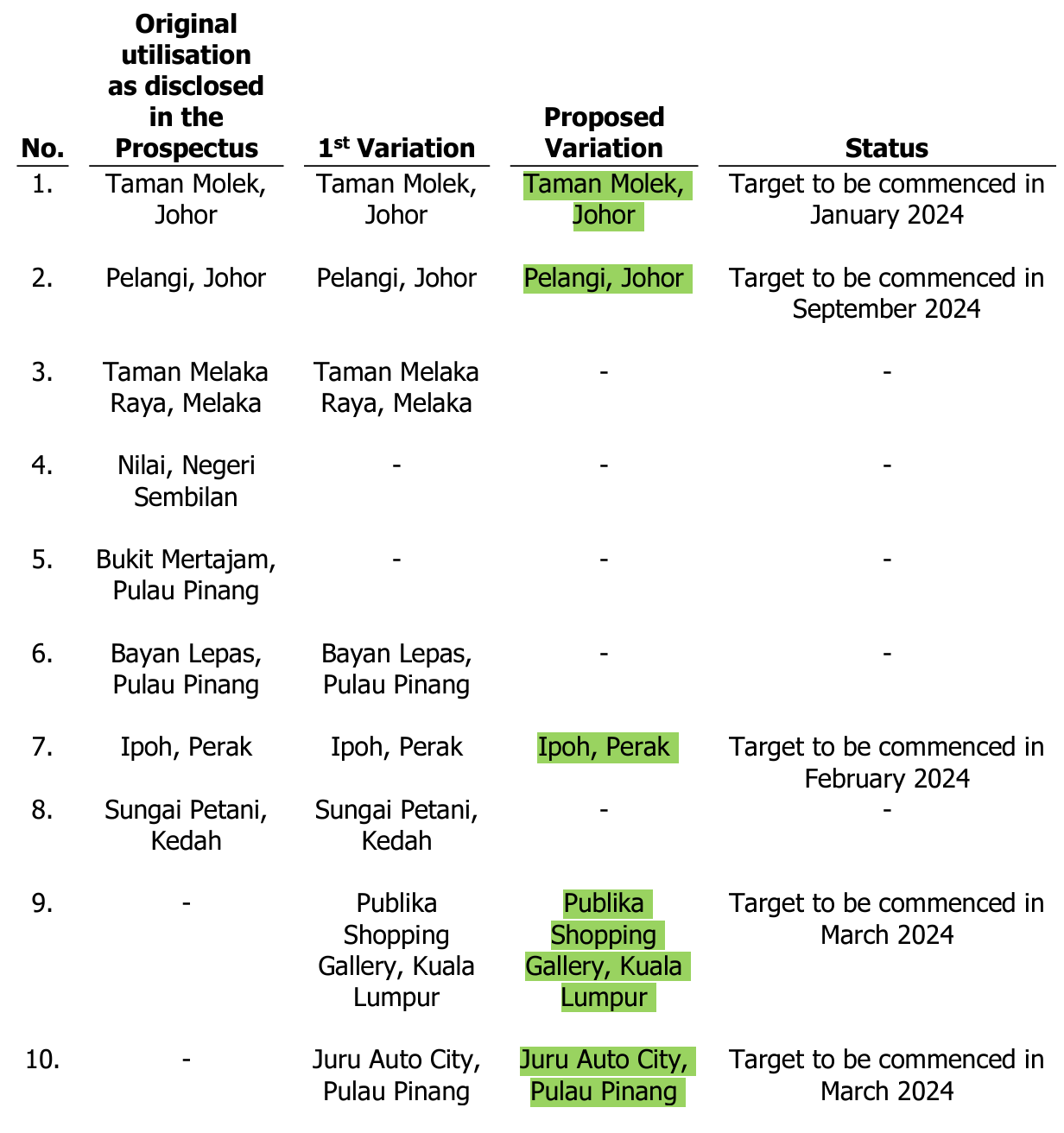

Rethinking the IPO Proceeds Utilisation

Source: DC Healthcare Holdings Berhad

The proposed reallocation of RM15.0 million from the IPO proceeds, reducing the planned expansion from 8 to 5 clinics, deserves scrutiny. The acquisition of I Bella's operational clinics, including those with access to the Malay market, offers a potentially more effective expansion pathway for DC Healthcare.

Furthermore, it's noteworthy that investors who participated in the Initial Public Offering (IPO) at 25 cents did not incur any financial losses, even amidst the significant price decline to 33 cents, and particularly considering the subsequent rebound to over 40 cents. Predominantly, the dissenting voices amongst investors appear to be those engaged in speculative trading, aiming for progressively higher returns.

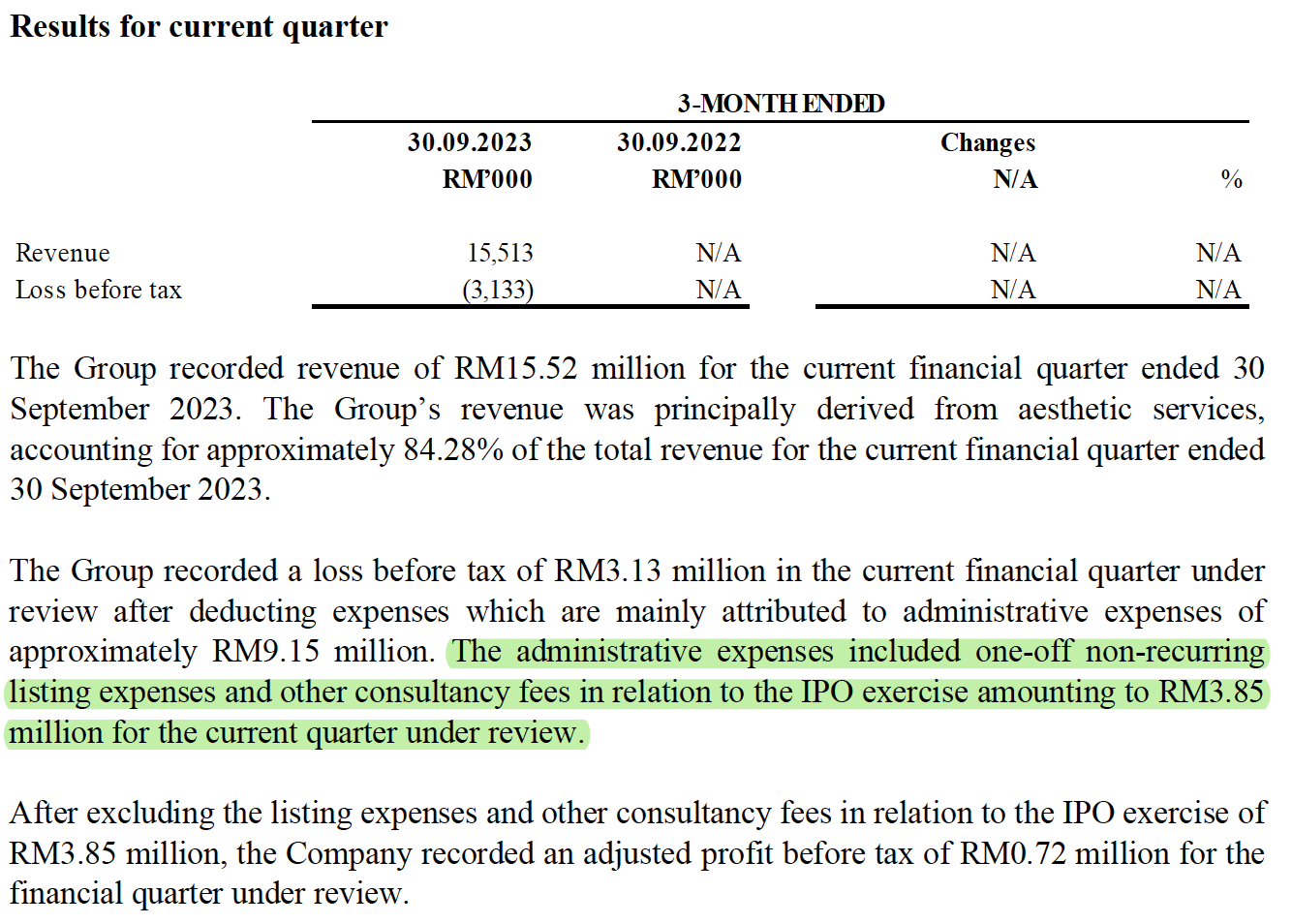

A Note on Quarterly Performance

Source: DC Healthcare Holdings Berhad

In its latest quarterly financial report, DC Healthcare disclosed a revenue of RM15.5 million alongside a Loss Before Tax (LBT) of RM3.1 million. This loss is predominantly attributed to the one-off IPO expenses amounting to RM3.85 million. However, an intriguing aspect emerges when these IPO-related costs are excluded, the Profit Before Tax (PBT) stands at RM0.72 million, raising questions about the underlying operational performance.

Delving deeper, the insights from the recent analyst briefing shed light on the revenue dynamics. The quarter-on-quarter revenue reduction of 13.4% is partly due to an 8.0% decrease attributed to the refurbishment activities undertaken in both new and existing clinics. This renovation work led to a decrease in operational time, consequently impacting sales. When adjusted for these factors, the net decrease in sales is more accurately represented at 5.4%.

Additionally, an important consideration is the concealed expenses incurred in staff compensation, categorised under administrative costs, coupled with heightened expenses related to team management. When these factors are accounted for, it becomes evident that a temporary dip in profit is a customary outcome for the company under such circumstances.

In a Nutshell…?

Subsequent to the analyst and fund manager briefing, there was a notable resurgence in DC Healthcare's share price. This rebound underscores a renewed and strong interest in the company, reflecting positively on its market perception and investor confidence.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)