INNO (6262) – Star just started to shine

Grandmustah

Publish date: Sat, 23 Nov 2019, 10:17 PM

INNO (6262) – Star just started to shine

Syariah: Yes

Market Listing: Main

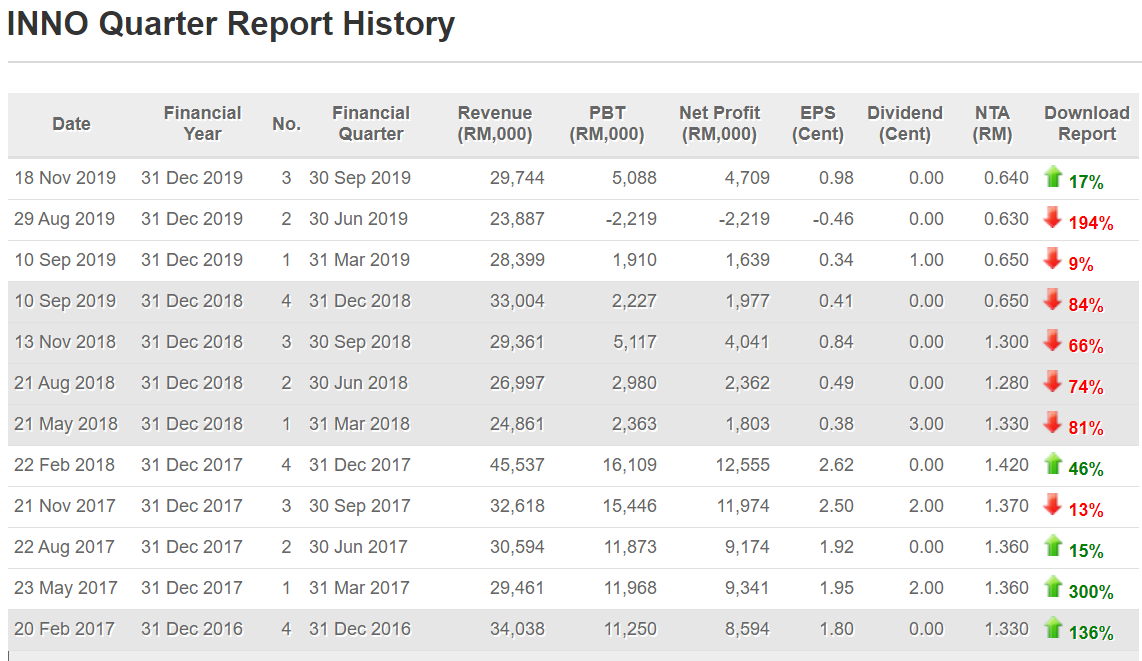

Current Price: 0.835

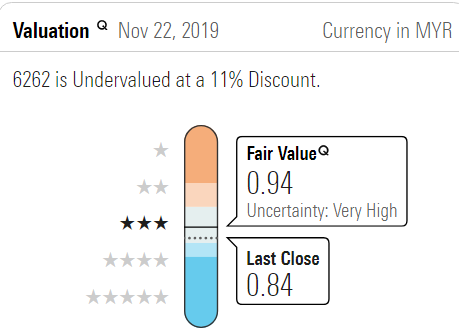

Fair Value: 0.94 (based on Morning Star)

Company Background

Innoprise Plantations Bhd is engaged in the business of cultivation of oil palm. The company operates through three segments namely Palm and bio-integration, Timber and Corporate. It's Palm and bio-integration segment is involved in the cultivation of oil palm, manufacture and sale of crude palm oil and palm kernel, and generation and supply of electricity from a biomass plant. The Timber segment includes services related to log extraction. Its Corporate segment consists of corporate services and treasury functions.

Reasons to look at INNO

1. FCPO is on a strong uptrend in which FCPO Feb 2020 is now trading at 2748 as we can expect FCPO to test 2800 in short term and probably to even 3000.

2. The Group’s oil palm ages are between 1 to 11 years with about 8% being immature palms. About 35% are young mature palms (4 - 7 years) with an increasing yield trend in coming years and 57% of the total palms are of prime mature (8 years and more). As such there will be no necessity for replanting for the next 15 years

Source: Annual Report 2018

3. More new area will be planted with TSH Wakuba clonal oil palm materials which have proven to produce high oil yield per hectare.

Source: Annual Report 2018

4. Management is confident of a double digit percentage growth in FFB production in 2019 due to favourable weather in 2018 and in the case of the Group, production should also be boosted by the better age profile as more area comes into higher yielding age and with additional area coming into maturity and harvesting.

Source: Annual Report 2018

5. TSH is a major shareholder of INNO as we can see that TSH share price has risen quite a lot in tandem of the strong price of FCPO recently as there’s a possibility that INNO will follow in the footsteps of its subsidiary.

6. INNO’s recent 3QFY19 result were impressive as the revenue grew positively QoQ and YoY. Net profit turned to positive comparing QoQ and higher YoY as this is a positive sign following what is stated by the management.

7. FFB production in coming quarter is expected to increase due to seasonal factor. Given the current level of CPO and PK prices, the Board is confident of achieving reasonable profit in the coming months.

Source: Prospect commentary on 3QFY19

Technical Analysis

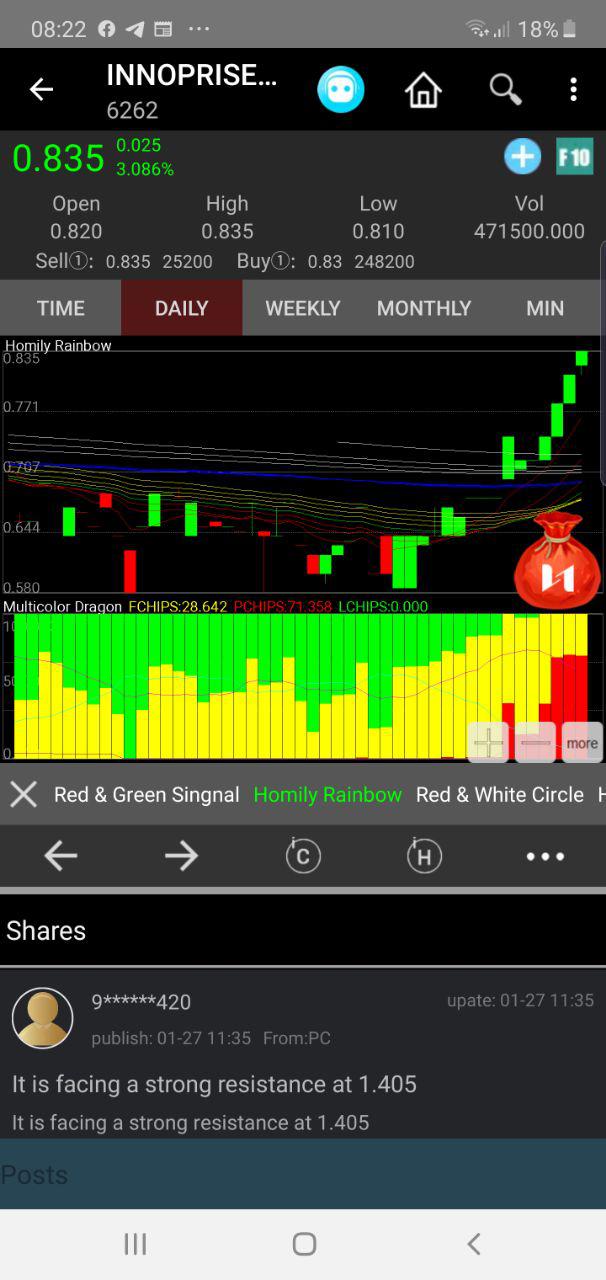

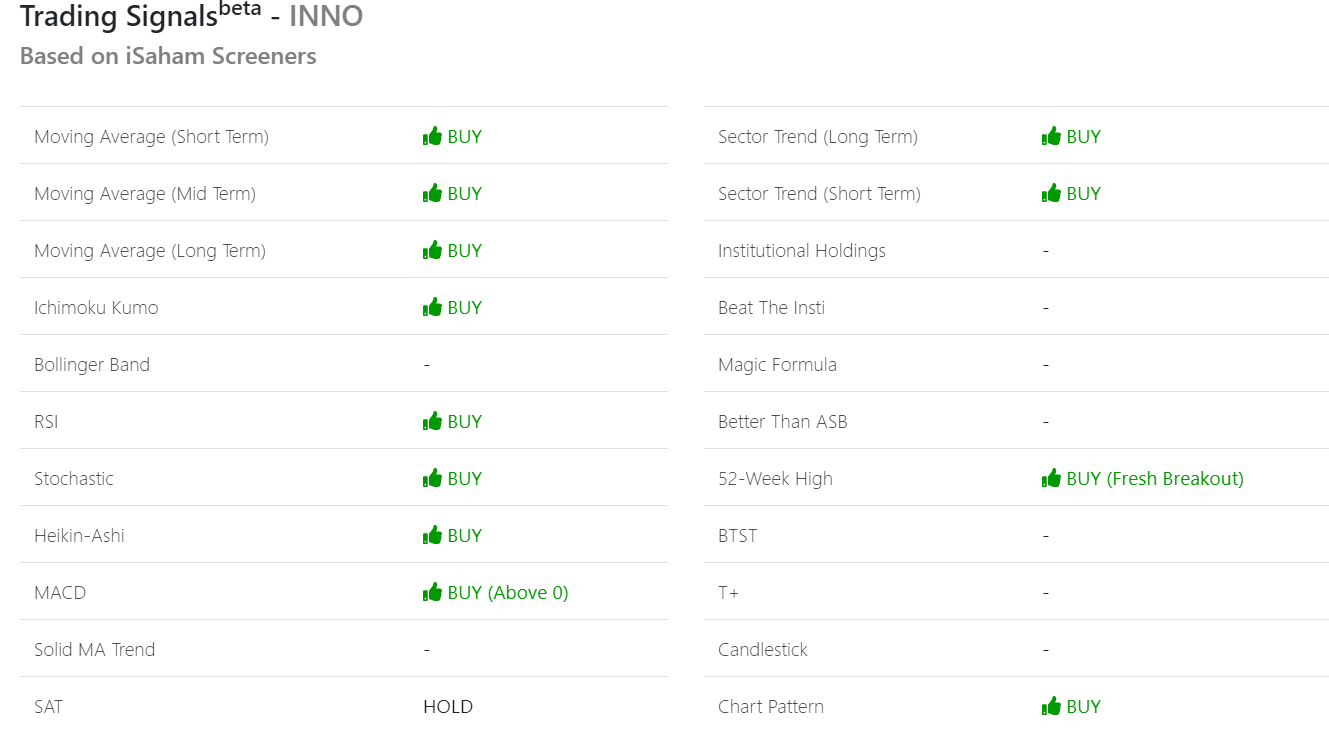

INNO broke the resistance of 0.83 on 22/11/2019 with an improved of volume. We can anticipate INNO to test 0.86 before going to 0.90 short term.

For a mid-term perspective 0.94 should be achievable if INNO could continue to post strong result and also CPO price continue to be strong.

Source: iSaham.my

Conclusion

INNO could be real star in the plantation sector as it has shown in 2017 the share price went up all the way to 1.50 and currently CPO price is on a uptrend with a huge potential to go higher due to stronger demand from Europe. INNO’s oil palm age together with the usage of TSH Wakuba clonal oil palm materials could yield a stronger FFB and therefore potentially increasing INNO’s profit in the coming quarters.

Disclaimer

At this point of time the writer has a position in INNO. This article is purely meant for educational purposes only and it’s not BUY/SELL recommendation. Please consult your remisier /dealer before making any decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Grand Mustah Trading Journey

Created by Grandmustah | May 27, 2020

Created by Grandmustah | May 19, 2020