AGESON BHD – SUNSET OR SUNRISE?

limabel608

Publish date: Tue, 06 Sep 2022, 12:13 AM

AGESON BHD – SUNSET OR SUNRISE?

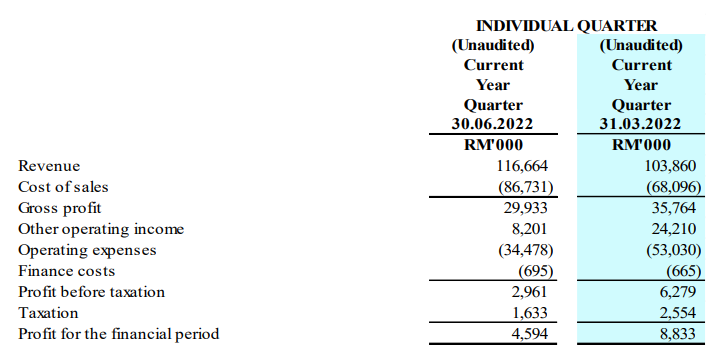

AGESON BHD (AGES) achieved a total revenue of RM116.66 million in the quarter under review, representing an improvement of 127.50% compared to preceding year under review. The increase were mainly contributed by the higher billing recognition from trading of construction material.

As for profit before taxation, AGES recorded RM4.59 million in the quarter under review, representing a decrease of 42.93% as compared to the preceding year corresponding quarter. The drop in profit was mainly contributed by the impairment of goodwill RM25.17 million. Excluding the one-off impairment of goodwill, AGES profit after taxation should arrive at RM23.72 million net of tax.

Despite a stronger performance in construction material segment, AGES profit and revenue were further discounted by a slower property development segment.

On a comparison with immediate preceding quarter basis, the group’s revenue growth by 12.38% to RM116.66 million, which was mainly contributed by a higher construction trading income. However, the group profit after taxation fallen by 47.99% to RM4.59 million, which again was mainly impacted by the impairment of goodwill.

Going forward, AGES is confident that the high vaccination rate in Malaysia will mitigate the impact of Russia-Ukraine. The group’s agile inventory management will maintain the trading margins of AGES despite a more volatile ASP.

It is satisfactory to see that the group recorded RM112.15 million in net cash generated from operating activities, resulting in a larger war chest for the group for the period under review.

To conclude, we think investors misunderstood the financial performance of AGES and the company is definitely showing sunrise performance instead of sunset features. With a low PER of 3.42 times, we think it is a bargain to invest in AGES now.