What is Free Cash Flow (什么是自由现金流)?

YOLO123

Publish date: Tue, 27 Oct 2020, 01:17 PM

Free Cash Flow (FCF) is the income that excluded all non-cash expenses and include all the capital expenditure, such as the purchase of property, plant and equipment (PPE). It also shows the available cash for the company to repay the loan or pay dividends to investors. Some investors would prefer to use FCF over the net income or Earning per Share (EPS) because non-cash items (depreciation, one-off items) are eliminated.

The benefit of using FCF is that it sometimes can reveal the weakness of a company’s cash flow. For instance, if Company A earn RM10 million, but the FCF has been decreasing due to higher inventories and delay payments, it shows the company is undergoing a serious financial weakness.

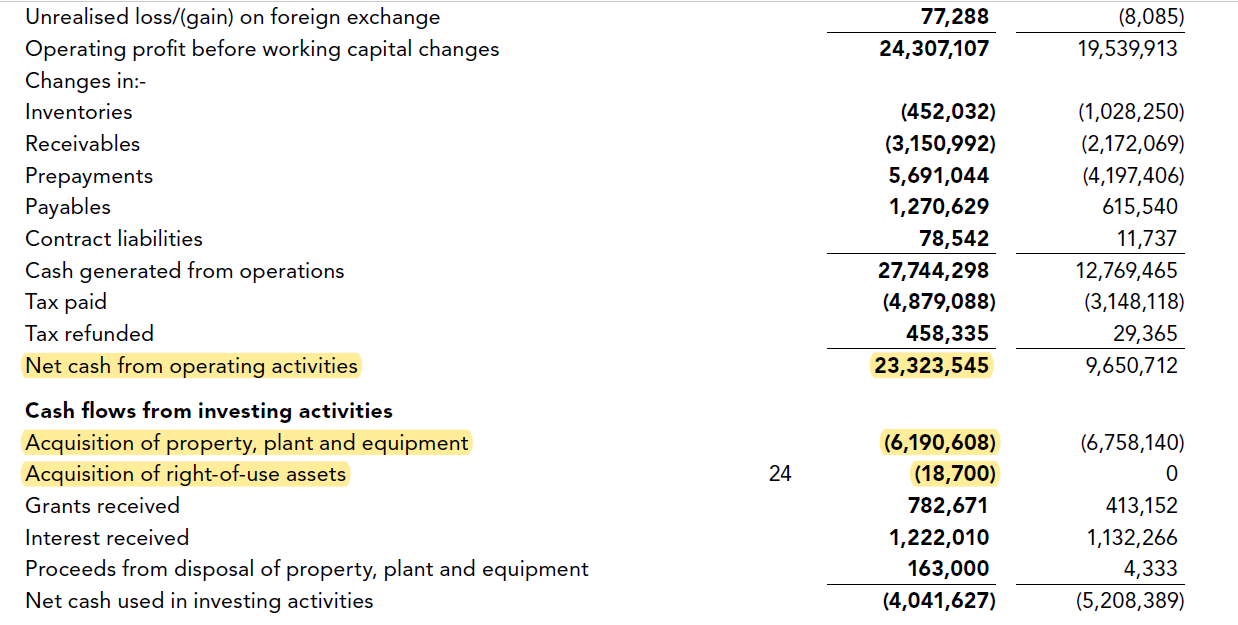

In order to calculate FCF, you shall use the formula attached in the picture:

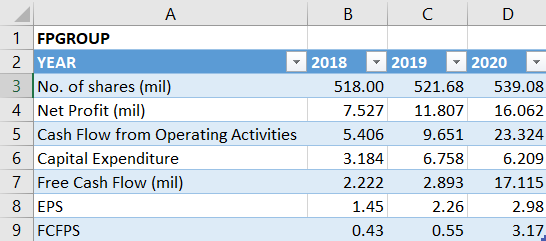

Use FPGROUP as an example, we shall use this formula to calculate the Free Cash Flow

FCF = 23,323,545 – (6,190,608 + 18,700) = 17,114,237

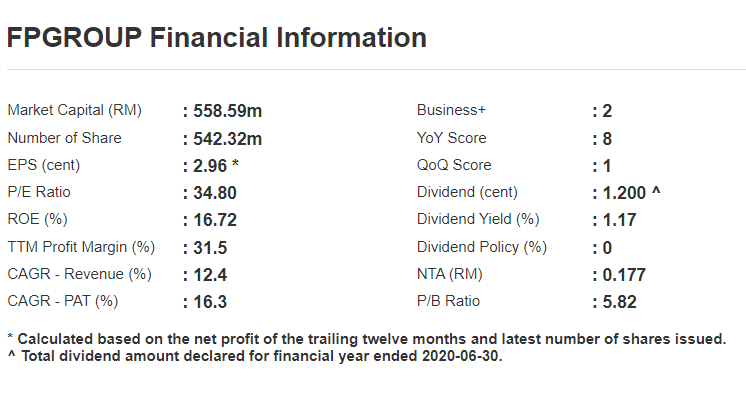

We can also further compare its EPS with FCF per share, by dividing the FCF with total number of shares. As shown in the picture below, FPGROUP has 542.32mil of shares. Thus, we can use (17,114,237 / 542,320,000 x 100) to get 3.16 cents per share.

FCF per share is often more accurate because when a company is doing lots of expansion, its depreciation will increase as well, dragging the entire profit down, hence by calculating FCF per share, a company’s value can be assessed in a more accurate way.

要获取自由现金流,必须先将你的利润去除掉所有非现金物品的费用,并把所有的扩张费用加回进来。这可以显示公司可以还债以及派利息给股东的现金。一些投资者会比较喜欢算出自由现金流因为这里面并没有包括任何的非现金物品(折损,一次性赚幅)。

算出自由现金流的好处在于它可以显示公司现金流的弱点。打个比方,就算公司A的利润有一千万马币,但自由现金流却可能因为囤货或者迟还的贷款而大大减少,并显示出公司在经济方面的疲弱。

自由现金流可以用以下图片的算式来计算:

我们拿FPGROUP来当例子,我们将用算式来计算出此公司的自由现金流

FCF = 23,323,545 – (6,190,608 + 18,700) = 17,114,237

我们还可以拿每股自由现金流和每股净利(EPS) 来做比较。图片中有显示FPGROUP有5.42亿股,所以我们可以用 (17,114,237 / 542,320,000 x 100) 来得到每股3.16 仙的自由现金流。

每股自由现金流会比每股净利(EPS)来得准确,因为当一些公司做出大幅度的扩张时,利润往往会被折损所拉低,所以计算每股自由现金流可以更准确地评估一间公司的价值。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021