How to understand Malaysia Stockbiz’s indicator (如何明白Malaysia Stockbiz的指标)

YOLO123

Publish date: Sat, 31 Oct 2020, 11:01 AM

www.malaysiastock.biz is a website that a lot of investors tend to utilize, in order to understand a company in depth. However, do you know that the indicators provided under this website such as ROE, CAGR, and Profit Margin can be calculated? Today, the writer is going to teach you how to get all these value.

www.malaysiastock.biz 是一个投资者都会比较常用的网站之一,多数人会用它来评估一家公司的基本面。但是,你们知道网站上的股东回酬率,成长,和净利润率这些指标都可以被计算的吗?今天,笔者将教大家如何算出这些指标数值。

1. P/E Ratio (本益比)

= Latest Share Price / EPS x 100

= 2.89 / 12.06 x 100

= 23.96 = 24

2. DY (股息率)

= Dividend / Latest Share Price x 100

= (3.6 / 100) / 2.89 x 100%

= 1.25% = 1.3%

3. ROE (股东回酬率)

= EPS / NTA

= (12.06 / 100) / 0.912 x 100%

= 13.22% = 13.2%

4. TTM PM (净利润率)

= TTM Net Profit / TTM Revenue x 100%

= (8266 + 6863 + 4181 + 4034) / (57223 + 49662 + 51636 + 53524) x 100%

= 11.0%

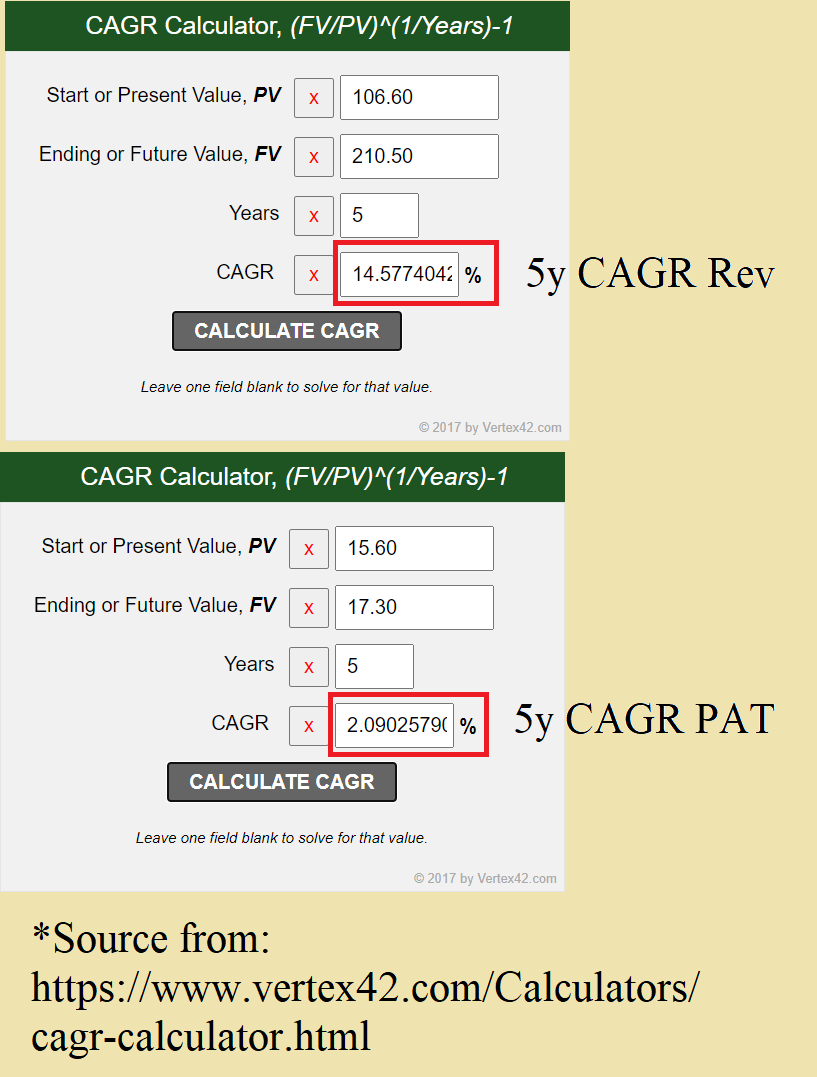

5. 5y CAGR Rev

For easier calculation, please kindly refer to https://www.vertex42.com/Calculators/cagr-calculator.html

, where it provides the calculator to calculate CAGR. The required data to be key into this calculator is the starting value, ending value, and year. Take SCGM as an example, ending value shall be the revenue of the latest financial year, which is RM210.5 million in FY2020, where the starting value shall be the revenue 5 years before, which is RM106.6 million back in 2015. As for year, we shall just refer to 5. An example will be given in the image below.

以最基本的方法,我们可以去到以上网站,它们有专用的计算机来算出这家公司的五年成长率。所需的数值包括了“起始值”,“终值”,和“年数”。我们拿SCGM为例子,它的“终值”将会是最近一财政年的营业额(RM210.5 million),而“起始值”将会是五年前的营业额(RM106.6 million),我们也设定年份为5年。以下的照片将会演示如何输入这些数值。

6. 5y CAGR PAT

This is the same concept with the earlier, just change the revenue into net profit and the result will be the same as the website.

这与 (5) 一样,只是单纯把营业额换成净利即可。

7. Business+

This value is to show whether are both revenue and profit from the latest financial year has any improvement from previous years. As we can see from SCGM, although their profit is better than previous years, but their revenue slips from 2019, hence their Business+ value is 0.

这个数值显示的是这家公司有没有在营业额以及盈利上比过去的财政年来得更高。从SCGM上,我们可以看到尽管2019财政年的盈利比来年更高,可是营业额却比较低,所以Business+值是0。

8. YoY Score

This value shows how many quarter that this company has been improving year-on-year (YoY) basis. As we can see from SCGM, their YoY profit has been increased for five consecutive quarters, hence their YoY score is 5.

这个数值显示这家公司有多少个季度是按年成长的。拿SCGM来当例子,它们已经连续五个季度有按年成长,所以那么的YoY Score就会是5。

9. QoQ Score

Same as YoY score, but this will be based on quarter-on-quarter (QoQ) basis. Again, SCGM’s profit has also been increased for five consecutive quarters, hence their QoQ score is also 5.

这个和 (8) 的一样,不过这个会按季度成长来被评估。SCGM的盈利也已经连续五个季度成长,所以它也有5的评分。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021