Secured borrowings and unsecured borrowings (抵押借款和无抵押借款)

YOLO123

Publish date: Wed, 04 Nov 2020, 01:00 PM

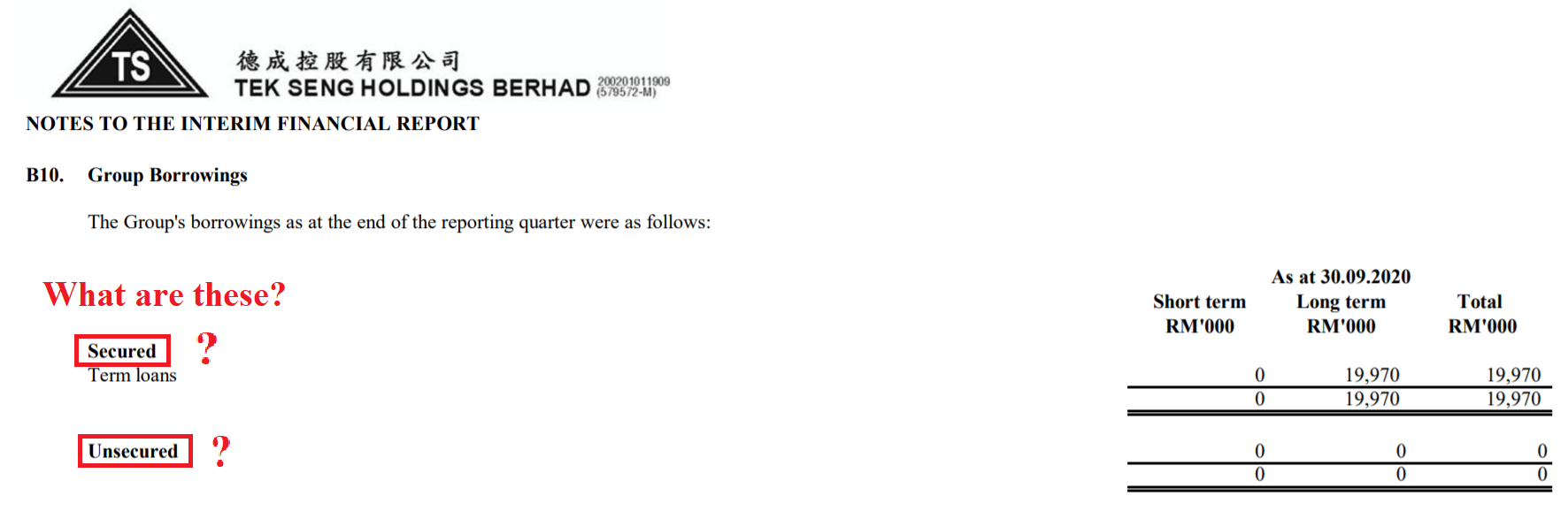

In the quarter report or annual report, we often notice there are two types of borrowings, namely secured borrowings and unsecured borrowings. Today, the writer is going to share what exactly are the differences between these two. Although knowing this knowledge may not help you when investing, but it is still a good knowledge to obtain.

Secured borrowings is when a company pledge something to the lender, allowing the lender to provide funding to the company. For example, Company A can pledge one of their property to Bank A in order to secure an amount of borrowing, but if Company A failed to pay the interest and borrowing back to Bank A in time, Bank A has the right to claim the pledged property from Company A.

On the other hand, unsecured borrowings mean that company need not to pledge anything to the lender, and the lender is confident that the company will return the money in time. For example, Company B that has a better image is able to borrow money from Bank B easily, and Bank B agree to borrow without requiring Company B to pledge anything. Company B shall always pay the money back to prevent leaving a bad image towards Bank B.

In short, unsecured borrowings will only be provided to company that left a good image to the lender before, and secured borrowings may come from a new lender that is still unfamiliar with the company, hence unable to feel at ease when lending out their money without having the opposition to pledge anything.

-----------------------------------------------------------------------------------------------------------------------------

不管在季报还是年报里面,我们都可以看到两种不同的借款,即抵押借款和无抵押借款。今天,笔者将会分享这两者的不同。笔者也明白这个知识未必会在投资路上有帮助,但是这会是一个值得吸纳的知识。

抵押借款就是当一家公司在贷款的时候抵押了某样东西。举例,A公司向A银行抵押了一件房产以获得贷款,但如果A公司不能截止日前交出利息以及贷款,那么被抵押的房产将归A银行所有。

另一方面,无抵押借款就代表一家公司不需要抵押任何东西以获得贷款,而贷款者也确信公司将会在限时内交还贷款。举例,B公司有比较好的形象,于是它便可以向B银行贷款,并且不需要任何的抵押。可是B公司必须在限时内交出贷款以在B银行面前留有好的形象。

总结,无抵押借款只会提供给比较有信用且有形象的公司;而抵押借款的出现不一定代表公司没有信用,它也可能是因为新的贷款家还对公司比较不熟悉,所以对公司的操作比较不放心。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021