Dividend Yield and Dividend Policy (周息率和股息政策)

YOLO123

Publish date: Sat, 07 Nov 2020, 11:59 AM

Sometimes we all think that when dividend yield is high, then a stock is worth to keep for long term, for dividend purpose. However, this is only a myth but not the fact. Dividend yield in fact is not the best value to measure a company’s payable dividend, because it will be affected by its share price. For example, if a stock is RM10 and pay a dividend of RM1, then its dividend yield is 10%; however, if its share price dropped to RM5, then its dividend yield will be 20%. Do note that in both scenario, the company give out the same amount of dividend, but the dividend yield in second scenario is significantly more attractive. Hence, dividend yield can be considered as trap if it is not assessed properly.

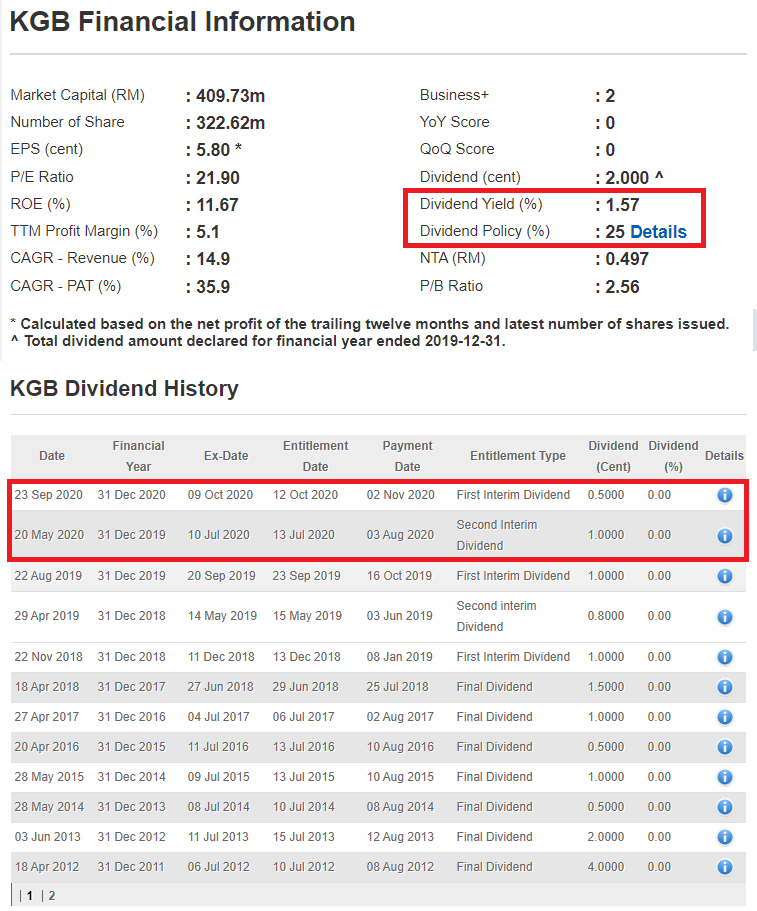

On the other hand, some companies will impose dividend policy to secure the consistent dividend to shareholders. We can also calculate the expected dividend we can obtain if dividend policy is imposed. We use KGB as an example, we can first calculate their TTM EPS, which sums up to a total 6.02 cents. Alongside with the dividend policy of 25%, we can calculate the expected dividend of 1.5 cents, which they in fact did pay the exact amount of dividend.

Dividend is in fact suitable for companies that are big enough, and slowing down their growth. This happen occasionally on banks, where they will pay most of their profit as dividend, because they are companies that are stop growing, and will not reinvest their profit into capital expenditure. In fact, if you would look at growth companies such as PENTA, GREATEC, UWC, they all do not impose dividend policy because they are more willing to reinvest their profit into capital expenditure, hence grow bigger.

In short, if a dividend investor will like to filter their stocks, it is advisable to use both dividend yield and dividend policy to select them, to prevent yourself from the dividend yield trap.

有时当我们看到一家公司的周息率很高时,我们会觉得这只股的股息值得我们长期守着它。但是事实并非如此,周息率不是一个最适合用来评估一家公司派股息的能力的工具,因为他是会被股价影响的数值。譬如,一家RM10的公司派出了RM1的股息,它的周息率就会是10%;但同一家公司如果股价跌到了RM5时,它的周息率便会变成20%。要谨记的是,它们还是给着一样的股息,但是周息率却因为股价的浮动改变了,亦因为这样,20%看起来更吸引。因此,周息率在不被小心评估的情况下也可以被喻为股息陷阱。

除此之外,一些公司会有自己的股息政策,以确定投资者会得到一定值的股息。我们也可以算出我们大概可以得到的股息,用KGB举例,我们来算它近12个月的每股净利,相等于6.02仙。而在它25%的股息政策下,我们可以预估他派出的股息可能会是1.5仙,而事实上它也真的派出了相等的股息。

股息其实只适合大公司来派出。这种情况我们可以联想到银行,毕竟它们会用它们大部分的盈利以股息来派出,这是因为他们的规模足够大了,也不需要任何的扩张。相对的,当我们去看那些成长中的公司(PENTA, GREATEC, UWC)时,他们并不会有任何的股息政策,因为他们宁愿拿它们的盈利来进行扩张,以加速成长。

总结,当股息投资者要选者公司时,最好时把周息率和股息政策一起用,这样才可以避免自己掉入周息率的陷阱。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021