Dollar-Cost Averaging (DCA) (平均成本投资法)

YOLO123

Publish date: Tue, 01 Dec 2020, 01:00 PM

DCA is an investment strategy that investors put the same amount of money into stock market, regardless of what price are the stocks. Although the average cost will increase since you will be buying the stock at a higher price sometimes, but it also increases the quantities at the same time.

Since market will fluctuate every day, DCA is the best option for investors that have researched properly on what stocks they are aiming to buy, but could not find an entry point to buy or add. This strategy is best for mutual or fund index such as S&P 500 is US that generate consistent returns, however, since Malaysia market has less option of these funds, investors need to pay extra focus on selecting some good stocks.

The downside of DCA is that the stocks must be a growing stock, where its price will go up. This is because if the stock price did not go up, you will be constantly buying on a declining stock. We mentioned in previous articles that a drop in share price does not mean the company is bad. Indeed, but this only apply on daily basis where the stock price may drop today but rebound on the next day. However, if using DCA but the stock price still drops regardless, meaning that the share price had been dropping for months, and a good stock or company would not allow that to happen because good companies often have a good amount of investors or funds that are eyeing on it.

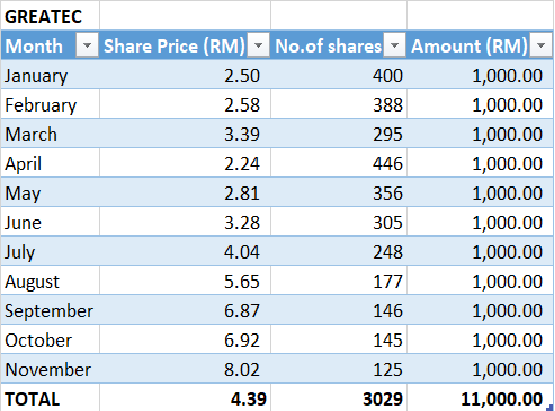

The writer will present an illustration on how DCA works below, both virtually and in reality. As we can see, if we use DCA on Stock A, although the stocks were bought on numerous occasions, but the final average cost is still the similar price compared to the price you first bought. On the other hand, if we take GREATEC as an example, and you have started to buy the share from the start of 2020, the average price will be RM4.39, with the total investment of RM11,000. However, if we take the price from 2nd November and compared it to the average price, you will still earn around 82%.

In short, DCA is only suitable for stocks that are constantly growing, both in business and share price. Besides, DCA is the most stress-free strategy to invest once you have identified few good companies to invest every month, because all you need to do is to buy the share every month and wait for long-term reward.

平均成本投资法的策略是每个月将同样的金额,无论任何的股价来投资进股市里。即使你的平均价会因为买在高点而比较高,但这也同时增加了你的持股量。

既然股市是每天浮动的,那么平均成本投资法会最适合那些已经将想要买的股研究透彻的投资者。当然,这个策略最好是用在能够提供固定回酬如S&P500般的指数基金。但是,既然在马股里没有很多这样的基金,投资者在选择股票时要更加谨慎。

平均成本投资法的坏处在于所选择的股必须要有固定的上升,无论是股价还是生意。这是因为如果股价不上反跌,那么你只会一直买着下跌中的股。笔者曾经在之前的文章说到股价的暂时下跌不代表公司的前景不好,这是对的,但是只适合用于每天的股价浮动。这是因为,平均成本投资法是以每个月来计算,那么如果好几次都连续下跌,也意味着该股已经下跌了几个月,而这并不会发生在好股的身上,因为投资者和基金都在等着好股的下跌,也代表他们的买压不会让股价持续下跌。

接下来笔者将会以一个假例子和真实例子展示平均成本投资法的效率。我们可以看到当我们在A股使用平均成本投资法时,即使在不同的价位买进,但平均价却不比第一次买入的价钱高很多。另一方面,我们拿GREATEC来当例子,如果你是在2020年一月的第一天开始买进,并每个月买进直到11月的第一天为止,那么你总共会花RM11,000,并且平均价会落在RM4.39。那么如果我们拿11月2号的闭市价,从一月到现在的总回酬会达到82%。

总结,平均成本投资法只适合成长中的股票以及公司。此外,平均成本投资法是最没有压力的策略,因为只要你选了几个好股,剩下要做的就是每个月把钱投进去买入,然后期待着以后会带来的回酬。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021