What is par value? (什么是票面价值?)

YOLO123

Publish date: Sat, 05 Dec 2020, 12:07 PM

If we take par value and multiply it with number of shares, it will become the company’s minimum market capitalization.

Since some companies are forced to put a value to its par value, most of the companies put it as low as RM0.01, so that they will not be restricted with such par value.

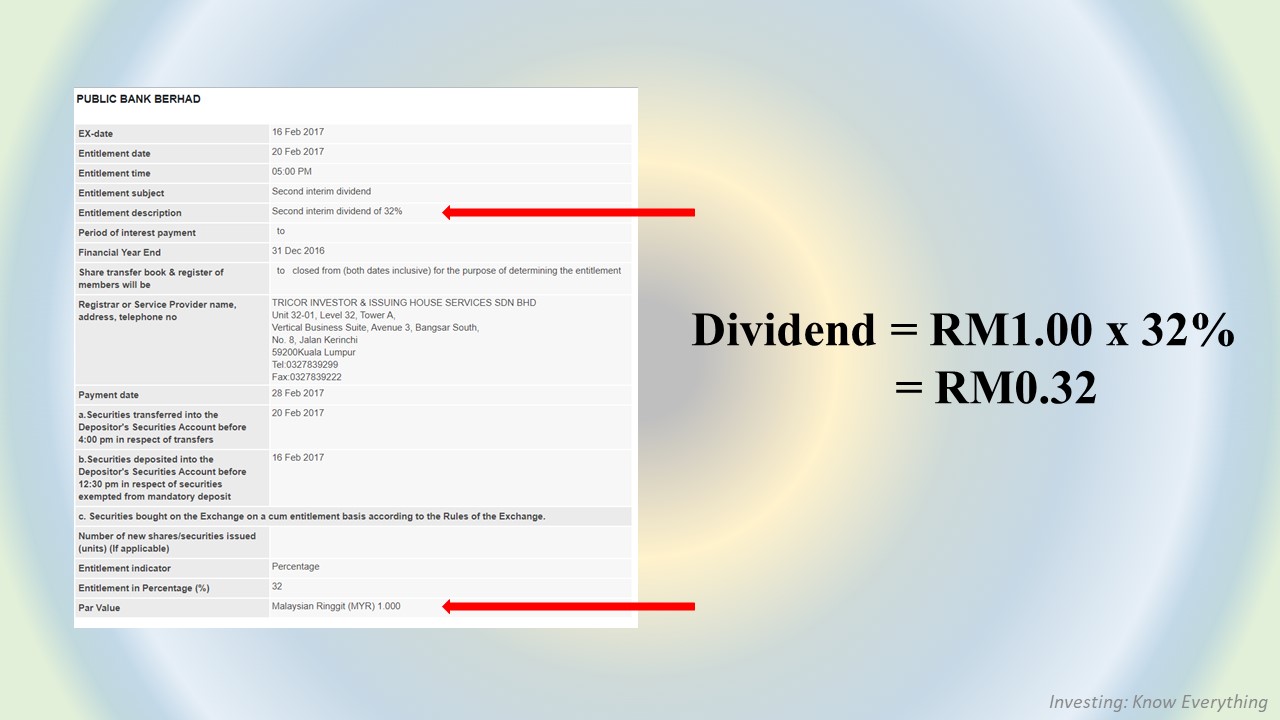

Par value can also be acted as the dividend payout. For example in 2016, PBBANK issue a 32% dividend, which means the dividend will be RM0.32 since its par value is RM1.00 and multiplied by 32% will resulted in RM0.32.

However, there are also companies that have no par value. But in reality, having par value or not for a stock means little to nothing. Par value is only important for bond, so if you are investing in bond, then par value shall be one of the consideration.

In short, par value is not that important for stock investing, but this is merely acting as information sharing, to increase investors’ knowledge.

如果我们拿票面价值乘与公司的股数,那么就会成为公司最低限度的市值。

有些公司是被强迫性置入一个票面价值的,那公司为了不要被票面价值所束缚,他们会将票面价值放到RM0.01。

票面价值也可以被当成派股息的方法。举例,PBBANK在2016年曾经派过32%的股息,也就是说当时的股息是RM0.32,因为在拿他RM1.00的票面价值乘与32%时,就会拿到RM0.32。

但是,也有一些公司是没有票面价值的。事实上,无论公司有还是没有票面价值,在股票上面是没有什么差别的。票面价值只对投资债卷的人重要,所以投资债卷的人需要把票面价值列入他们的考量内。

总结,票面价值不是在股票投资上最重要的东西,而这个也只是单纯的分享,来增加投资者们的知识。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021