Use Net Tangible Asset (NTA) to determine a stock’s value (用有形资产净值来决定一个股的价值)

YOLO123

Publish date: Tue, 15 Dec 2020, 12:30 PM

We all know that fundamental analysis consists of analysing a company’s future, ROE, PE ratio and profits. However, there is another value that people likes to use other than PE ratio, in order to determine whether a stock is undervalued or overvalued. That value being the net tangible asset (NTA).

The writer had explained what is NTA before, and I will put the link below for you to revise. Basically, NTA is calculated by taking its total assets and deduct all intangible assets and total liabilities, and obviously we can divide it by total number of shares to acquire NTA per share. In another word, NTA is assets that can be sold and is able to show the company’s financing power and risk levels. However, NTA will vary between different industries, where internet-based companies will have a lower NTA due to most of their assets are stored in the cloud, while consumer products companies will have a higher NTA since most of their products can be sold and liquidated into cash.

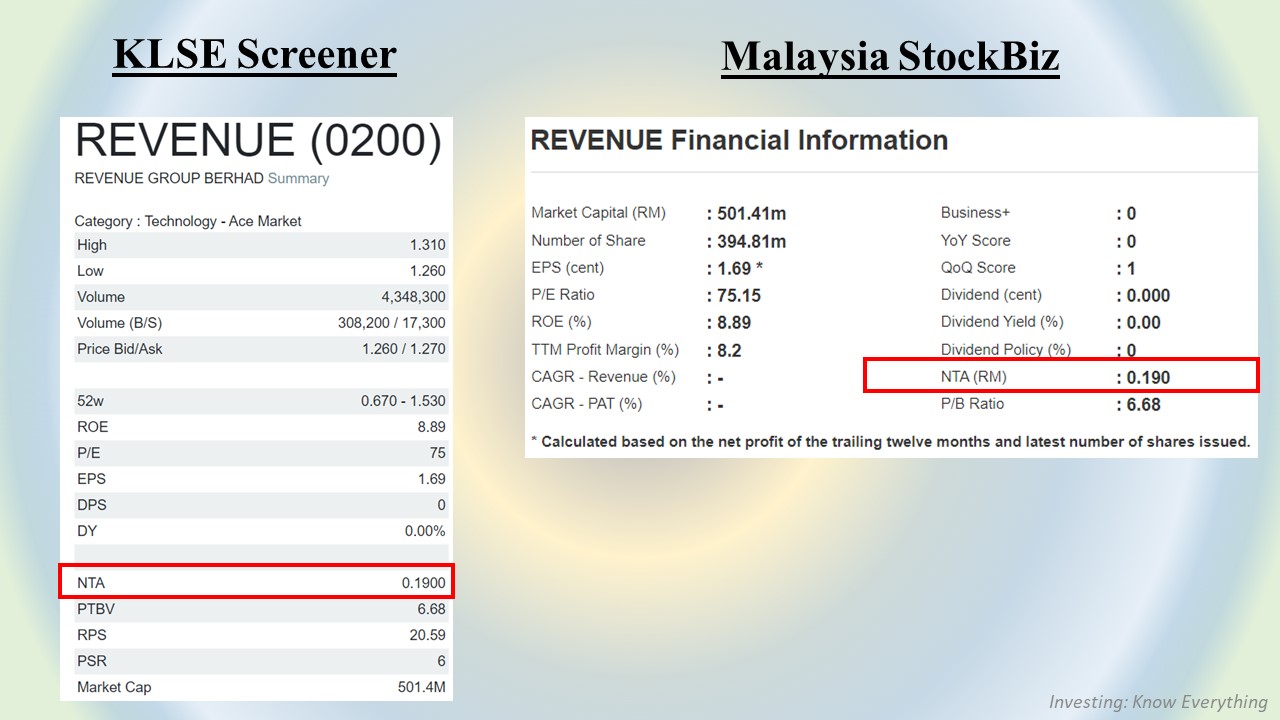

So, how can we tell whether the company is undervalued or overvalued by assessing its NTA? For this, we just need two values, which are NTA and share price. NTA can be taken from KLSE Screener or MalaysiaStockBiz, where share price can be taken from literally everywhere. All we need to do now is just compare the NTA with share price, if NTA is higher than share price, means it is undervalued; whereas when share price is higher than NTA, means it is overvalued. From the examples given, we can see that if we are just basing on the comparison between NTA and share price, PPHB is undervalued whereas MAGNI is overvalued.

In short, NTA comparison is only ONE OF THE METHOD to see whether is overvalued or not. There is absolute no rule stated that we must follow this method, but neglecting other better methods. Do note that NTA can only be set as a guideline, growth and future prospects are still the most important elements when comes to company selection.

我们都知道基本面分析包括了评估公司的未来,股东回酬率,本益比,以及盈利。但是,也有一些人是喜欢用本益比以外的数值来评估公司是否被高估或低估,那便是有形资产净值。

笔者曾经有解释过有形资产净值,有兴趣的人可以浏览笔者放在文章底下的链接来复习。简单地说,有形资产净值就是拿公司的总资产减去无形资产净值以及总负债,而我们当然也可以再把它除于公司的总股数以得到每股有形资产净值。换句话说,有形资产净值就是可以被卖掉的资产,而这个数值便可以代表公司的财政情况以及他们的风险水平。但是,有形资产净值是会因为不同的板块而改变的,一个以互联网为主的公司会有较低的有形资产净值因为他们大多数的资料都被储存到云端去;而做消费品的公司会有较高的有形资产净值因为它们的产品都可以被换成现金。

那我们应该如何用有形资产净值来看公司现在的股价是否被高估或低估呢?其实我们只需要两个数值,就是有形资产净值和股价。有形资产净值可以再KLSE SCREENER和Malaysia Stockbiz的网站拿到而股价则可以在任何地方得到。那我们现在就要比较这两个数值,如果有形资产净值比股价高,那他就是被低估了。反之,如果股价比有形资产净值高,那么公司现在就是被高估了。从例子上来看,如果我们单纯的只是用有形资产净值来评估公司是否被低估的话,PPHB是被低估,而MAGNI是被高估的。

总结,有形资产净值只是其中一个评估公司估值的方法,而并没有任何规则说必须要这么做,而撇开那些更好的方法。我们要知道有形资产净值只能被当成一个指导,而公司的前景和成长还是选择公司时最重要的元素。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

More articles on Investing: Know Everything

Created by YOLO123 | Feb 02, 2021