Nihsin growing itself into bankruptcy in the long term

Ricky Yeo

Publish date: Sun, 22 Nov 2015, 08:17 AM

Many people do not see how & why Nihsin is growing itself into bankruptcy just because the company is in net cash position. For the record, I am talking long term here, next few months they might report better earnings due to forex gain or whatever, but overall, it is a sinking ship.

Test 1. $1 dollar test.

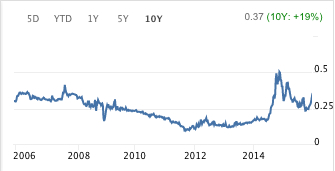

$1 dollar test is to see for every dollar retained by the company, does it increase it's market value by at least a dollar as well. From 2006 to 2014, Nihsin earn a total of $0.34 per share, paid out $0.04 of dividend over that period, so the retained earning is $0.30. Retained earning = Earning per share - Dividend paid out per share. Outstanding shares are the same over that 8 years period. Since the company retained $0.30, it make sense the share price should have gone up by at least $0.30 from 2006 right?

The share price was at $0.30 in 2006, it still is as of today, thus it failed the $1 dollar test. You ask why?

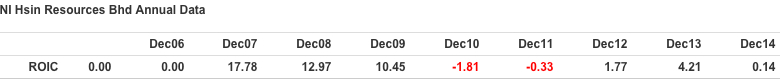

Test 2. ROIC

Return on invested capital is a test to see if the company is making money more than the cost of their capital. Below is the ROIC of Nihsin. I did not look into the annual report to verfiy the accuracy of it, but gurufocus data is pretty reliable. Except for the years 2007, 2008 and 2009, maybe there are from extraordinary gain, but basically the last 5 years ROIC looks terrible.

Now you are going to ask if Nihsin is a net cash company, how can it be going bankrupt? It comes down to their cost of capital. Yes they do not have cost of debt, but they do have cost of equity. Cost of equity is what the investors expect to earn in return for investing in Nihsin.

Risk free rate + equity premium for risk = cost of equity

If you have a time machine and go back to the year 2010 and find all the Nihsin investors, show them the chart above about the next 5 years ROIC, they would have sell every fcking piece of share and put it in FD. Why? Because FD earns more than Nihsin! and it is risk free, why would i want to risk my money put it into a stock which is more risky than FD. There you have, cost of equity. I dont want to go through all the crazy calculation of cost of equity, but 8-10% is about right, and Nihsin ROIC miss that by 1 light year.

What this means is Nihsin is 'borrowing' from the stock market (that's why they are listed) at 8-10% cost, and their only making 1-4% return from that, the difference between both numbers is what is going to drive the company towards bankruptcy.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Intelligent Investing

Discussions

hahaha KEEP IT SIMPLE. As u say in last article. What a "metaphor" word to mislead other people.

2015-11-22 12:03

If im a normal reader, i also will mislead by your title. Nihsin growing itself into bankruptcy in the long term.

Instead you can say Nihsin is not worth to invest in long term.

I not recommending any one to sell or buy on Nihsin. No deep research have been done by me.

2015-11-22 12:06

Yea okay, feel free to invest. Metaphor is a way to keep it simple, maybe not for you.

2015-11-22 12:08

in stock market TA come first instead of FA. One thing, if next qr company pay dividen and tommorow good news come out, one word for u, dont "bullshit" other investor by not telling the right favt ok. Keep my word until next qr ok.

2015-11-22 12:26

Not telling the right fact? Tomorrow news isnt fact, it is forecasting. TA come first, I agree to disagree, you have your way, I have my way. And like I say im writing for long term, in the short term, you can TA the shit out of it if you want.

2015-11-22 12:52

Par value rm0.20. Using $1 dollar test. Did not explain what is this? This is so called simple. Aiyo the company par value only RM0.20. Use what $1dollar test? Somemore every company profit changing from time to time. Sometime business good sometime not then u keep on invest that company if history result is good? As a value investor, i saw your post too naive and keep on using so called "professional terms" to cover your weakness in other section such as accounting, casting, business knowledge, current affairs.

2015-11-22 13:05

Say wan to debate but in the end continur flaming people. Say out other fact pls. Dun spin ur word again

2015-11-22 13:05

jt yeo said tommorow news is forecasting? tommorow news is a fact that nihsin will have big annoucement.

JT yeoh, you cock without fact ka? or u just hoping the price will drop and you want ro collect?

Aiyo, i think u had bad dream bro. Sleep well ok, i will eat pop corn tommorow to watch the show.

Dont tell so much bullshit if u dont know what goes around the company.

LOL, have a nice weekend.

haha

2015-11-22 13:29

Just now say wan debate. Now say complicated. Hahahahaha. Dun know what to talk is it? Anyway not i saying PE10 is the basic. Is another author. He write good then follow. Not good just dont folo. Need to flame people?

Elit96: Anyway he just know how to use historical data to analysis. I dun know what is the big announcement but i dont dare to giv comment on it. Also i dont know whether it is true or not.

2015-11-22 13:37

Whether tomorrow is big or small, it doesnt concern me, im writing based on long term fact. The economics of the business doesnt change just because a quarter turns out to be good.

2015-11-22 13:48

Debate is based on if you have certain knowledge, come back and debate when you know what is $1 test and ROIC.

2015-11-22 13:50

If u invest in long term, u didnt concern on tomorrow thing? Hahaha. Ok let assume. Just assume tomorrow this company enter into a long term contract with a great reputable supplier? Then how?

2015-11-22 13:56

Ur test is ok. But ur explaination and conclusion is totally misleading. You can use that test. But in the end ur title fail. Just like other newspaper. Just to "talk big" about non existence thing.

2015-11-22 13:59

Economy of business doesnt change? Then why u invest in flbhd? The company is beneficial from USD dollar. Are you holding for long term? If the usd excahnge rate go back to USD1= RM3.20 will u invest? Hahaha naive talk man. No matters how good is the company. As long as the environment change, u need to adapt it.

Anyway i do not deny that flbhd is a good company. Just that i using this example to discuss with you

2015-11-22 14:03

I invest in Flbhd not because of forex, it is because of the cash in the company and decision to buyback, period. I invest regardless where the forex is.

2015-11-22 14:06

But the price did not go up alot 2014. Then u can conclude that this company not good?

Also, the share price of this company only move significantly when the US dollar going up. So does the historical stastic still important for you? Yeah the company may be good in fundamental but the share still remain the same throughout 2014.

2015-11-22 14:13

If u care about cash, then u shoud invest in kseng. Over rm1.5billion cash in the company. Still cheap for current market price of rm1.8billion

2015-11-22 14:15

I didnt discover flbhd until early 2015, the price hasnt runup back then. Kssng is slightly different as in they are involved in palm oil, palm oil is a capital intensive business, to buy lands, years to grow, and sell at commodity price. Same for many cash-rich property stocks, they need the money to buy more lands for development, those cash cannot be return to shareholders through dividend or buyback, they need to be reinvested for the future. Flbhd generate 10-15mil profit a year, only need to use 2-3mil of their cash each year, with cash at 90mil, they do not know what to do with it, thats why their dividend yield is at 10.7% of my buy price.

2015-11-22 14:28

I bought focus lumber at 120,sold at 1.10 (yes, lost)

I sold because no confidence with their business (plywood not exactly an industry with moat)

But now it is 2.80

Do I regret ? No

I don't hold on to a business if I lack confidence (doesn't mean I am right)

Congratulation to those who have the wisdom and knowledge to hold on until now

If it is not my money, it is not my money

Once again - No regret

2015-11-22 14:42

Yeah it is good that they rewarding the shareholder. What my concern is:

The price have been moving up about 100percent (i dont know exactly what the is percentage i just roughly calculate) during the year. Some of the important part also need to concern. Out of rm9.6mil profit, rm4.2mil is a gain on exchange rate. So the real gain for the company is only rm5.2mil. If calculate long term, eps 5sen x 4 = 20sen. Currently rm2.74 is overvalued.

Second thing. Actually the business is not expanding. The real reason increase is because of forex. Forex have gaining 32percent. U calculate using 34mil x 132percent u will get around 44.8mil of revenue comparing last year same quarter.

For jun 2015, the result increase due to delay in custom clearance. Some ppl read it as the company business growing. Actually is delay in counting the revenue. Hence it already fully value.

Every company have their own value. For me buy low sell high is the ways to earn a decent profit. Flbhd will be a very good buy at rm1.40, decent buy at rm1.80 but not a good buy at RM2.74

2015-11-22 14:43

PE10 just a simple concept to value a company. Just like coldeye say. But if PE10 support with other reason such as business grow and good fundamental, it will be more good and realible investment

2015-11-22 14:47

You are correct, the business itself isnt a strong growth biz, mainly because they dont intend to expand, and as Icon8888 say, it is a very commodity business as well. Without the forex gain, the revenue/profit would have gone up a bit only. In my opinion fair value is at 2.50-3.00, so current price upside is very limited. Unless they decide to return a large portion of cash to investors.

If you are interested you can look into Mercury. They used to have a lot of cash too, now they went and acquire 70% of a construction company for $37mil. Most from cash and borrow some. The construction company guarantee them $6.6 million profit for next 3 years, or $20mil, (70% = 14mil) because of outstanding order book of $120mil. Mercury main biz (paint) earns about 5-6mil a year. So the construction biz will almost double the profit. The recent q result release few days ago already show 100% jump on revenue qoq and 50% jump on profit. The only downside risk is main business is not growing due to GST and consumer weak spending.

2015-11-22 15:24

Just that the bank borrowing increase RM30mil so much while cash left RM9.4mil only. Anyway they acquire new company make me interested to know more about the company. Anyway thx for the recommendation for mercury. I will try to do research on it.

2015-11-22 15:46

the momment nihsin reach 40sen or 50sen, please call me back ok. bye2. LOL. too much fundemental analysis sometimes waste of time

2015-11-22 17:30

the more u study on FA, u should not forget TA. Ones you forgot the TA, u may miss the train. In stock trading got two rules.

1. earn money and take proft

2. dont forget rules no.1

2015-11-22 17:35

Thats your rules, not mine. I don't mind missing train. There are trains everyday.

2015-11-22 17:46

Nice article keep it up. I would suggest using the Altman-Z score to determine if a company will go bankrupt within 2 years time. Its accuracy since the 80s is roughly 90% so it should provide a better insight on this subject.

2015-11-22 22:17

My opinion on Mercury. Dont shoot me if im not correct. Just for discussion.

1) Profit guarantee of RM6.6million per year - 70% = RM4.62million

2) Profit for manufacturing factor (using 1/10/2014 to 30/9/2015) - For 30/9/2015, i will excluded construction part - 7.6mil minus 2.6mil + 1.3mil = RM6.3mil

Total = RM10.82mil

EPS = 26.92sen (estimated future)

Current price : RM1.46

2015-11-22 22:19

Revenue for PBSB

2012 : RM96 mil

2013 : RM119 mil

2014 : RM61.8 mil

2015 to 2017 : RM120 mil (according to the contract and might be more) - so one year around RM40mil

Profit for PBSB

2012 : RM2.7mil

2013 : RM2.2mil

2014 : RM6.5mil

2015 to 2017 : RM19.8mil (profit guarantee and might be more)

From the top, you can see the profit is increasing after acquisition. It is abit strange from the past record and im very doubt the the company are able to achieve the result of RM6.6mil per year. Keep in mind that with the depreciation of ringgit, the cost of material have increased. This have eat the profit margin for construction company.

But since there are profit guarantee given, the profit surely reached RM19.8mil in 3 years or RM6.6mil per year.

Good investment until 30/9/2016. The share price of Mercury might reached peak after the release of result on 30/9/2016 as all of the impact from the subsidiary will inside the quarter result.

2015-11-22 22:27

After release of 30/9/2016, unless PBSB get new project, if not this company will just sink down the revenue of Mercury. Keep in mind the revenue keep dropping. Im scare it is the intention of director to cash it out the company to listed as he foresee they are no future in this company. But i just guessing. Maybe im wrong.

2015-11-22 22:30

Impact to balance sheet after acquisition of PBSB

Mainly their debtor increase by RM40mil. I guess it is from diamond residence phase 2 as the contract ended during the year. (RM43mil contract)

Cash decreased by RM13mil even included the cash in PBSB. Mean no cash in PBSB???

Borrowing increased by RM30mil due to borrowing to buy PBSB

Trade and other payable increased by RM23mil. Most of that should be the amount due to their sub-contractor or supplier of material

Bank overdraft increased by RM4mil. So mean PBSB no cash and have bank overdraft which eat alot of interest??

2015-11-22 22:36

From director perspective,

1) Director losing 70% in PBSB

2) Director getting RM42mil cash

3) Director selling the entity that might lose at future?? (I guessing, maybe im wrong)

4) Director able to get capital gain in Mercury share

5) Director getting better director fee for performing well.

6) Director might loss money if PBSB not earning RM19.8mil in three years.

2015-11-22 22:41

So it is a good company or bad? Yes share price will go up definitely if nothing happen.

But after you see what director gain, will you invest?

This is call grey area. In this case, statistic is not that useful. Experience in investment does.

2015-11-22 22:42

The director that sells the 70% in PBSB is the same director running Mercury now. Yea this isnt a buy and hold forever play, more like a 'special situation' or arbitrage play. The profit will only increase slightly if you taking into account the interest they have to pay for the borrowing, but im expecting an upward move on ROE, which may or may not push the price up. But compare to having a large sum of cash sitting in the bank earning 2-3%, definitely better to have it use it on assets (construction) generating future cash flow.

I cant say much about the director since my guess is same as anyone. He has quite a large stake in Mercury as well. Unless he offload all his stake in Mercury when the price has gone up, he will still need to manage both the main biz and construction biz well. I only know he is famous for turning around biz. He is the director for Eco first and having turned their property development biz around few years back.

2015-11-23 03:02

Angkasa lifted Nihsin from bankruptcy..... i suggest your next article headline

hahahaha

2015-11-23 14:14

Notice of Shares Buy Back - Immediate AnnouncementNI HSIN RESOURCES BERHAD

Date of buy back23 Nov 2015Description of shares purchasedOrdinary shares of RM0.20 eachCurrencyMalaysian Ringgit (MYR)Total number of shares purchased (units)2,000,000Minimum price paid for each share purchased ($$)0.343Maximum price paid for each share purchased ($$)0.343Total consideration paid ($$)687,596.13Number of shares purchased retained in treasury (units)2,000,000Number of shares purchased which are proposed to be cancelled (units)0Cumulative net outstanding treasury shares as at to-date (units)10,526,500Adjusted issued capital after cancellation

(no. of shares) (units)Total number of shares purchased and/or held as treasury shares against the total number of outstanding shares of the listed issuer (%)4.44907

Announcement InfoCompany NameNI HSIN RESOURCES BERHADStock NameNIHSINDate Announced23 Nov 2015CategoryNotice of Shares Buy Back Immediate AnnouncementReference NumberSB1-23112015-00005

2015-11-24 02:56

JT Yeo, what kind of idiotic assessment is this? Such unprofessional. Exactly like Icon8888

2015-11-29 19:03

I did not study Nihsin but just for discussion purposes. I believe ROIC is a good metric but there are many ways to skin a cat. There are few conditions in where I would buy a low ROIC company, not necessarily hold it forever.

1. It is a net net stock. Meaning solid balance sheet, trading at big discount to NTA or some balance sheet metric. It must also be somewhere near the all time low in terms of P/B or P/NCAV with improving fundamentals.

2. It is a turn-around stock. It could be a cyclical business on the cusp of a turn-around where ROIC may eventually revert to the mean.

3. It recently went through major expansion thus incurring high depreciation charges which depress the EBIT or EPS. Hevea is one good example. In this way, I will look at P/FCF as a metric

3. No red flags in terms of insider actions, share dilution, debts increase.

2015-11-29 22:54

hahaha~~ I really do not know a low ROIC can lead towards bankruptcy ~ you are amazing :)

I didn't study this company. I am not sure if it has FCF every year. But, based on the article below:

http://klse.i3investor.com/blogs/rhinvest/88686.jsp

RichHo was saying Nishin debt is decreasing and cash is increasing... It could tell me, the company is able to generate real cash every years...

I didn't see the share capital increased a lot over years(meaning no other type of finance leaverage)

I am seriously wondering how could a company like this could lead to bankruptcy... LOL

2015-12-26 22:25

pingdan

19% loss in capital still got return. Is low but at least there are giving small return to shareholder. Alot of share not only not giving return but the share price keep dropping. The epic example is MAS

2015-11-22 12:01