Deep value: In search of the fallen - APM Automotive

Ricky Yeo

Publish date: Sat, 02 Apr 2016, 03:07 PM

If one end of the spectrum sits all the great companies that have wonderful future prospects; the other end belongs to the deep value - companies that are selling so low because they are mired with all sorts of problems from poor prospects, lawsuits, industry in secular decline to financial irregularities, high debts etc. If investing in great companies is akin to finding the most beautiful wife; deep value means marrying the ugliest of the ugliest. These companies are typically shun away by majority investors, but it is also where mispricing happens the most.

Although APM is far from being the ugliest, I think it is certainly a company that has been shun away by most investors, which isn't hard to see why.

Multiple headwinds

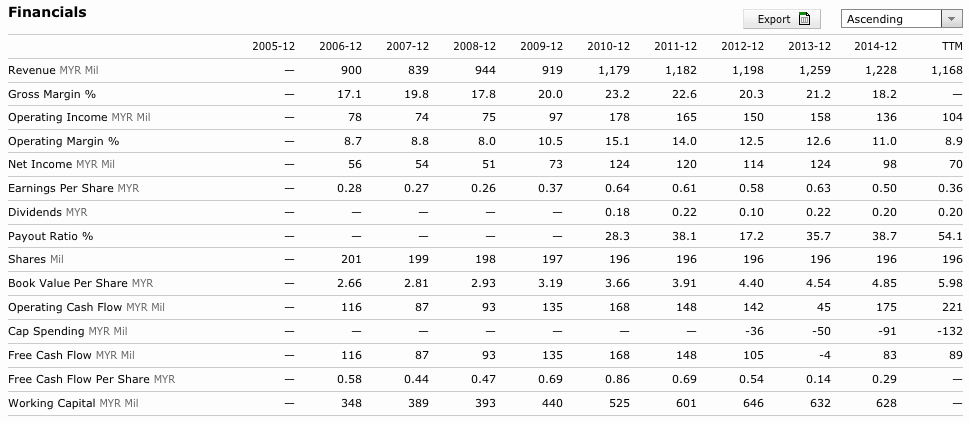

APM is an autoparts manufacturer involve in manufacturing suspension, coil springs, interior car seats, electrical system, air-conditioning system etc with presence largely in domestic market and Australia, Vietnam and Indonesia. Their customers are a combination of original equipment manufacturer (OEM) & replacement equipment manufacturer (REM) with both Proton & Perodua comprising more than half of their revenue and followed by Nissan (10-12%). Tan Chong Consolidate is a key shareholder of the company.

APM's share price hit the peak of $6.40 at mid 2014 before starting to unravel as it faces multiple headwinds.

Timeline:

- Compressed margin - Higher electricity cost & pricing pressure from car manufacturers (2014)

- Hike in raw material price

- Introduction of GST (2015)

- Slower domestic growth

- Weak consumer spending & low auto sales

- MYR weakening against USD

And of course it is not just APM but the whole automobile sector, from car manufacturers to autoparts suppliers that are facing challenging prospects.

Currently the share price is sitting at $3.95 with an enterprise value of 588 mil, earning yield of 19%, EV/EBIT of 5x

Market expectation

Before we can find out if the market is mispricing APM we need to roughly estimate what is the market expectation when they give APM an enterprise value of 588 mil.

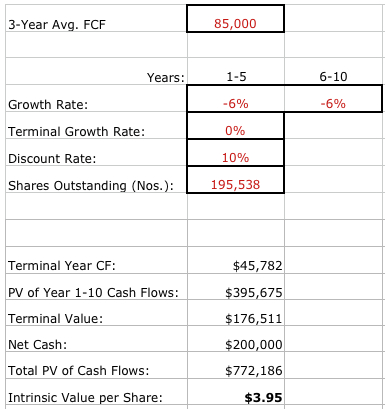

We will use reverse DCF and FCF of 85 mil as an anchor. I believe 85 mil is a conservative number for several reasons. First, this is the FCF APM still managed to achieve 16 months into the headwinds, without any reduction in capex. 2nd, it is the lowest FCF from APM in a decade, with margin and ROE at the trough. And of course things will continue going downhill from here but it is not an overly optimistic number either, so that's what we want.

You can see that with the current price, the market is implying APM is going to decline on average 6% for the next 10 years, or -9% for 5 years followed by no growth, to put it another way. The market is pricing APM as a sunset business in secular decline. Even if we take out the 200 mil cash sitting in their balance sheet, the market still thinks APM will never be able to grow again.

Challenging the price

Is the market right? You asked. If we look at the headwinds above, none of them are new. They are just part of the economic cycle that ebbs and wanes. And the auto industry is cyclical in nature.

Do we have enough grounds to challenge the price? I think we do. Although there aren't that many tailwind for APM, besides the strengthening of MYR, there is a strong reason to believe the auto industry is sitting around the trough already. There's actually another tailwind, reversion to the mean.

Sapura Industrial, another relatively unknown autoparts supplier and subsidiary of Sapura had a similar fate that saw its share price falling from $1.20 to $0.80 recently announced a better than expected quarterly earnings, actually the highest since 2014, with improvement in both gross and net margin, causing it's share price to jump 16%.

Conclusion

From my judgement the market has already priced in all the downside of APM, and as our DCF shows, there is a clear mispricing between the market expectation and what APM should worth. What APM is facing is nothing more than the nature of economic cycle that is bound to pass and come again.

Will the auto industry recover? No one knows. Remember end of last year those insisting MYR will continue to stay weak throughout 2016? They are changing their mind 3 months later. But if we extend our time frame out into 3 years, the probability is high (90%) that it will and I am looking at the share price of $5.50-$6.50 that better reflect the value of the company.

Appendix

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Intelligent Investing

Discussions

if your intrinsic value for APM is 3.95 and the share price now is 3.95, that means dont buy now coz there is NO margin of safety!

2016-04-02 22:18

Reversed discounted cash flows analysis, a powerful tool to gauge whether the market expectation of the growth of the business in the future is reasonable.

Where did JT Yeo say the IV of APM is RM3.95?

Posted by speakup > Apr 2, 2016 10:18 PM | Report Abuse

if your intrinsic value for APM is 3.95 and the share price now is 3.95, that means dont buy now coz there is NO margin of safety!

2016-04-03 00:04

"if your intrinsic value for APM is 3.95 and the share price now is 3.95, that means dont buy now coz there is NO margin of safety!"

please bare in mind that the number is calculated by -6% growth for 10 years, and zero terminal growth. it is extremely conservative.

2016-04-03 00:17

Pls bear in mind tat all the companies written in tis blog we should not buy at all...we wanna buy something tat no analyst wrote about and not under coverage by investment analysts...

2016-04-03 12:20

I would disagree with you regarding this statement:

"If investing in great companies is akin to finding the most beautiful wife; deep value means marrying the ugliest of the ugliest.".. it should be "If investing in great companies is akin to finding the most beautiful wife; deep value means finding the natural beauty women/man which has been overshadow by their worst makeup" I suppose it should be like finding hidden gem right?:)

other than that good write up.

2016-04-04 09:42

JT Yeo mentioned the IV of RM3.95 at his table. Look at last row of his excel table.

2016-04-04 09:48

Hmm interesting.

However, why not NHFATT then if we want automotive stocks, similar companies. though NHFATT is more focused on making replacement exterior parts. Or Favco etc etc.

The thing about APM for me that i worry about i that, i have no idea what their competitive moat is. Is this drop in profit due to a temporary change in vehicle demand, or a more permanent condition due to inability to compete. Their main shareholder Tanchong is really fucking up over the last couple years when vehicle sales is actually rather stable.

2017-11-26 13:02

buddyinvest

Apa khabar Favco?

2016-04-02 17:36