When Do You Sell?

Ricky Yeo

Publish date: Mon, 08 May 2017, 07:51 PM

***

When do you sell will depends on your investment strategy and previously, I wrote about how to create strategy here when discussing position sizing. The strategy that you choose will determine how you pick and what you buy, which in turn decides how you allocate your capital and ultimately, when do you sell them. In this post, I will dive deeper into the thought process behind selling. That includes the reasons, dos and don’ts, the cost factor and how to create your own rules. Selling is similar to position sizing or valuing a business, it requires a lot of judgment because there’s no formula. And beyond this post, it is essential to study great investors and understand why they make certain decisions. They all have their own selling process so look deeper and ask ‘Why they do what they do?’, it will help you become a better investor.

Why do we sell? The reasons are many but the main ones are:

- Opportunities

- Valuation to price

- Fundamentals

- Perspective

- Position size

- Macroeconomic

Opportunities

You sell if you discover there are better opportunities compared to what you are currently owning. And a stock with a higher expected value is the one with a better opportunity. What is expected value? Here’s an example below.

The 1st stock has a 20% upside, so you would say okay I am going to sell this and buy the 2nd stock that has a 50% upside, an extra 30%. However, the expected value for the 2nd stock is lower (2% compare to 8%) because it carries a higher downside risk of 70% compared to 10% for the 1st stock. In this case, selling does not make sense.

That is the case for speculative stocks. Speculative stocks typically have a huge upside with low to negative expected value. Same for great stocks that carry very high market expectation. Therefore, instead of thinking how much you can gain, always think about what’s the expected value and the risk. The risk is harder to quantify than return but you have to think it this way to avoid selling into a worse position.

A common mistake that most investors made when selling is anchor it to price movement. The reasoning is that if the price of a stock has not moved for a period of time i.e over a year, it is best to sell and buy another opportunity that is more active in its share price.

If you pay a dollar for a stock at fair value and the business is able to compound 15% year after year with no dividend, it should worth $4.00 in 10 years time, or 400% from what you originally pay. Even if the price barely moves over the years, as long your valuation is right, it will be a matter of time before the price catches up to its value. Price rarely moves in lockstep with value and it can be lumpy, barely moving for a long time before surging by several folds within a short time span.

This, of course, doesn’t mean you should never sell it if it is not going anywhere. Base your decisions on expected value instead of price movement because it is a poor indicator for making selling decisions.

Fundamentals

Changes in fundamentals can stem from regulations, competitions, technology, management etc that can affect the business earning power, both positively and negatively. How do we keep track of these changes? That’s when your investment thesis comes in handy. We all have poor memories. If you cannot recall what you had for lunch last week, you certainly won’t remember why you bought a stock a year ago. And here’s the danger. If you never record your investment decisions, you’ll have a tendency to anchor onto the price movement. Just as people are likely to sell when the price hasn’t gone anywhere, the opposite is just as potent. You would have heard someone saying “I am going to sell because it went up by 100% in 3 months.” But the movement of the share price tells us nothing about where it is relative to its value, all we know is whether it is up or down. The share price of a company could have gone up by 1x yet remain attractive if its value has increased by 2x at the same time due to some positive fundamental changes. And you get something similar when someone is interested in buying a stock but concerned by its recent price run up.

“Decisions should be based on the price relative to its value, not the movement of the price.”

Keep a journal whenever you make any investing decision. In particular, write down the few key reasons that you buy or sell a stock and focus on the key fundamental drivers such as return on capital, margins and so on.

Perspectives

Sometimes the reason to sell is because your perspective towards the stock has changed. Usually, after buying a stock, you would continue to learn more about the business through their competitors, industry publications, interviews, financial news and other sources of information. You incorporate all these information, synthesize them, and update your view to make sure the original investment thesis remain sound. Through this process, some information will give you a different perspective and allow you to look at your holding with a fresh pair of eyes. The business fundamentals could remain the same, but you’ve decided to sell because you changed your mind.

Valuation to price

Another reason to sell is when the price reaches fair value or become overvalued. But there are some differing opinions on this. Some will tell you that the time to sell is almost never while others would advise you to sell when it reaches fair value. So who should you listen to? The answer is it depends on the characteristics of the stock you own. If you own deep value stocks – stocks with poor economics selling cheaper than their business value, you should sell them at close to (80-90%) fair value. And this applies to other categories such as net-net and special situations.

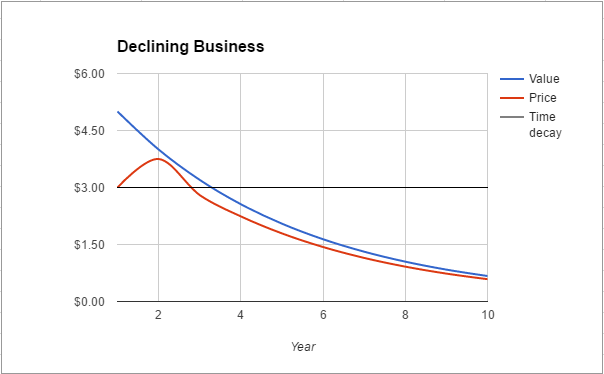

Let’s say you found a business selling for $3 operating in a cutthroat industry with earning power in permanent decline. After examining its balance sheet, you conservatively estimate it should worth around $5 so you bought it in anticipation for the price value gap to close before its value falls below your entry price. There is a ‘time decay value’ in this investment. The longer it takes for the gap to close, the lower your return will be. Time is the enemy of a poor company, the friend of a wonderful company. So in this situation, selling at or close to its fair value is a straightforward decision.

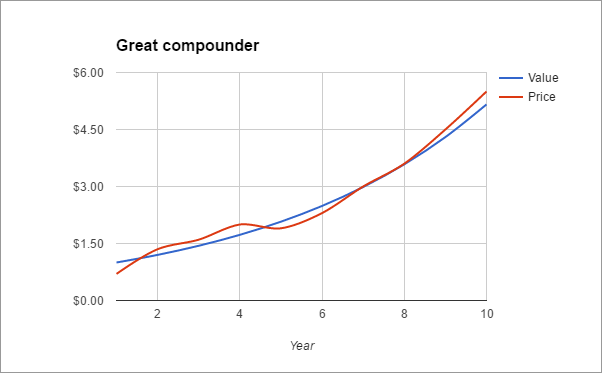

On the other end of the spectrum, if you own great companies – companies that can generate a relatively high return on invested capital for a long time, there are a few things that you need to consider.

Say you found a great company that is mispriced due to short term issue and you bought it for 70 cents to a dollar or 30% discount to its value. Subsequently, the share price recovers and eventually become overvalued. It makes sense to sell it. However, if you have a high degree of confidence that this company can continue to compound at 20% for a long time and as a result of this, you are almost guaranteed an annual return of more than 20% (since you bought it at 30% discount), is it necessary for you to sell it just because it is slightly overvalued?

As you can see, there’s no simple answer to this. There’s a huge opportunity cost when you sell a great company. And that cost comes in the form of transaction, tax, searching for a new idea and making the wrong decision. On the other hand, one might argue that he doesn’t have the ability to foresee what will happen 10 years from now, therefore, it is reasonable to sell when it is overvalued. And in most cases, companies fall in between these two extremes.

Let’s take a step back and think, why do we sell? We sell so we can redeploy our capital to maximize long-term return. We want to have a high long-term compound annual growth rate (CAGR). One principle we understand is that the long-term share price return tends to follow the business underlying return (higher if factor in P/E expansion and vice versa). If a business can compound 15% annually for a long time, the share price should do the same. So the litmus test before selling is – What is my return over the past 3 to 5 years? If your return is 11% while the business does 15%, then it makes no sense to sell, or at least you need a solid reason to do so. You are comparing who has a better ability to allocate capital. And in this case, the company can generate 15 cents for every dollar allocated to them compared to 11 cents per dollar if it is in your hand. You can do the same when the share price is overvalued as well. If you estimated that the share price future return will be roughly 10% instead of 15% as a result of the price running ahead of fundamentals (overvaluation lower future return), you will use 10% as a benchmark against your own historical return.

“Compare your historical return against the management’s – who can allocate capital more efficiently?”

Another point to consider is the company’s track record. If it has shown it can generate a wide spread between return and opportunity cost because it has a moat, there could be a stronger case to hold. Consistency is the key, not the width of the spread. A company that can consistently return 15% at 10% cost (5% spread) for the past 10 years is going to be more valuable than one that carries the same cost with an erratic return ranging from 10-30%.

Position size

You could decide to rebalance your portfolio by selling off a portion of a stock when it becomes too big as a percentage of the portfolio. The exact definition of big is very subjective. Some might say 10% is big, while others with a concentrated portfolio will put that at 20% for example. And many factors will affect your decision from the characteristic of stock, its expected value, risk and so on.

Macroeconomic

Many investors follow macroeconomic indicators when making buying or selling decisions. Indicators like GDP growth rate, interest rates, country debts level, currency exchange, inflation or even overall market sentiment. My stand has always been the same and that is you should never make any decision based on macro factors.

First, you are predicting the unpredictable. Second, you get a higher payoff by focusing your effort on company fundamentals. Third, this one is more subtle but just as deadly, at this age where we all have access to information at our fingertips, we become ‘trigger-happy’. We suck in all these noises (not signals) and there’s an itch to do something about it. Sitting there and do nothing becomes really hard. And then there’s information asymmetry (bad news dominate headlines more than good ones). All of these forces work together to give you so much irrational reasons to sell (and buy). Add price movement onto the list. And lastly, we have a poor track record trying to time the market.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

There are plenty other reasons on why you might want to sell a stock from personal circumstances to if a stock becomes too complicated. If a stock is taking up too much time and effort due to the complexity of the business, then it makes sense to sell it if there’s a similar opportunity that requires less effort.

Create your rules

There isn’t a one size fits all formula on when to sell. Everyone develops their own rules through experience. So you should create one that suits your investment strategy. If you are an income investor and your strategy involves stocks that pay dividends consistently, you could have rules surrounding that criteria for example.

Below are a few guidelines to get you started.

Leverage – 80/20

Why does Bill Gates make fighting malaria his highest priority but not other diseases? Because malaria contributes one of the highest death rates around the world. Solving it moves the needle. Same thing here. When you create selling rules, focus on those that can give you the biggest leverage. What are the 20% selling mistakes that contribute 80% of the negative outcomes? That means if you can identify those mistakes and fix them, it will improve your return dramatically.

Set buy & sell rules

Put it this way, if a person doesn’t have the right mindset, every effort is going to feel 10 times harder. Same goes for buying rules. If you do not have a right disciplinary process for picking and buying stocks, it will eventually lead to plenty of headaches on selling. While there are many outside factors that will prompt you to sell, by picking right you save up a huge amount of time having to deal with the negligence of buying.

Write decisions down

If you cannot measure, you cannot improve. Writing down the reasons why you buy or sell is all about measuring your decisions. Let’s say you sold one of your holdings at terrible losses. You refer back to your journal and found out you bought it because your best friend recommended it and how the news was selling its growth potential back then. Now, that becomes one of your buying rules to avoid making the same mistake. Same for selling. Write down the reasons for selling and refer back in the future to see if you have made the correct call. Never judge if you have made the right or wrong decision based on the price movement, focus on the thought process. Even if you made a small fortune from a friend’s recommendation, that is still a bad process.

Boundary rules

What are the things that will cause you to immediately sell your holdings? You can draw it from your personal experience or mistakes that other have made. If you find it hard to create a list of rules on when to sell, invert it and ask when shouldn’t you sell. Few examples.

- Management – Sell when the management becomes questionable

- Investment thesis – Sell when 2 out of the 5 reasons that I buy becomes invalid

- Complexity/Time – Sell when a stock takes more than 10 hours to follow up

- Valuation/Ratio – Sell when earning yield is less than 6.5% (P/E 15)

- Portfolio – Sell when position size exceed 20% of total capital

Conclusion

There are many areas that you can apply rules to simplify your selling process. You might not agree with some of the rules here but what’s important is to create rules that you can stick to. Make sure the rules are precise and measurable. You want to avoid creating rules that contain words that are up for interpretation like easy, hard, potentially etc. And focus on things that will give you the highest payoff, things that moves the needle.

If you find this helpful, share it & subscribe to be a better investor.