Gloomy or Hopeful Hibiscus?

KCTrader

Publish date: Sun, 19 Jun 2022, 04:05 PM

Due to the hike in interest rate that causes Brent Oil price to drop, with addition to the current KLSE selloffs, Hibiscus is one of the stocks that has received a huge beating. Uncertainties, worries of recessions, possible lower demand for commodities, China lockdown, undoubtedly Hibiscus won't be able to survive on its previous support line. We have seen about 20% drop in share price in the past few weeks, so the question now is, does Hibiscus still have potential to go up? Let's see...

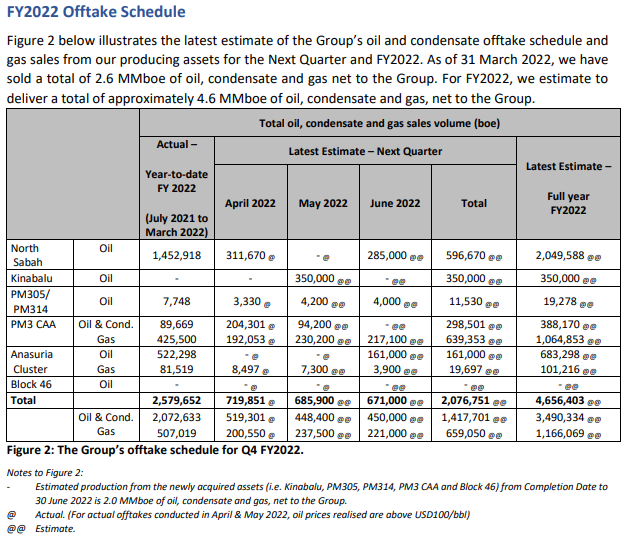

If we see from this table as provided by Hibiscus, if it happens to be about 80% accurate, assuming JUST FOR THE OIL that will be sold in this upcoming quarter, which amounts to 1,417,701 barrel of oil. To be CONSERVATIVE, let's assume they will be able to sell about 1,134,160 barrel, on an average oil price of USD109 over the price of 3 months oil, that'll be about USD124mil. To convert, let's take a conservative rate about USD4.3, that'll be almost RM533mil in revenue itself, about 80% increase in revenue. For this I haven't include the amount of gas sold, and all figures above are purely conservative.

As for profit I think it would be very subjective as there are many OPEX to be included, hence I'll take the average historical profit margin %, about conservative 18% P.M. We would see a net profit about RM95million, a 96% increase compared to Q2FY22. As for YoY%, we can see an increase of 111% and 92% on both revenue and profit respectively.

Note, all these amount are super conservative due to unexpected circumstances, and not including the gas that will be sold. Hence, is the future of Hibiscus gloomy, or hopeful?

#Hibiscs #5199

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)