Malaysia Stock Analysis – GKENT (3204)

LouisYap

Publish date: Wed, 16 Oct 2019, 10:58 AM

Malaysia Stock Analysis – GKENT (3204)

Gkent - a company that has changed from a water meter business to a construction business!

George Kent (Malaysia) Berhad (GKENT) was founded in 1936 as a service branch of George Kent Limited, the parent company in the UK.

In 1974, the company was listed on the KLSE through a 20% stake in George Kent Limited and a 20% stake in new shares to Malaysians.

GKENT is now a engineering company engaged in the water infrastructure, railway and hospital construction industries.

In addition, the company is also engaged in the manufacture and sale of water meters, water plant parts, etc. in Malaysia and internationally.

GKENT is a construction company mainly engaged in construction engineering and water meter manufacturing. The current market value is about RM 676 mil.

In order to learn more about GKENT, we have participated in the GKENT shareholders meeting on 7 Jul 2019.

Details of the shareholders' meeting:

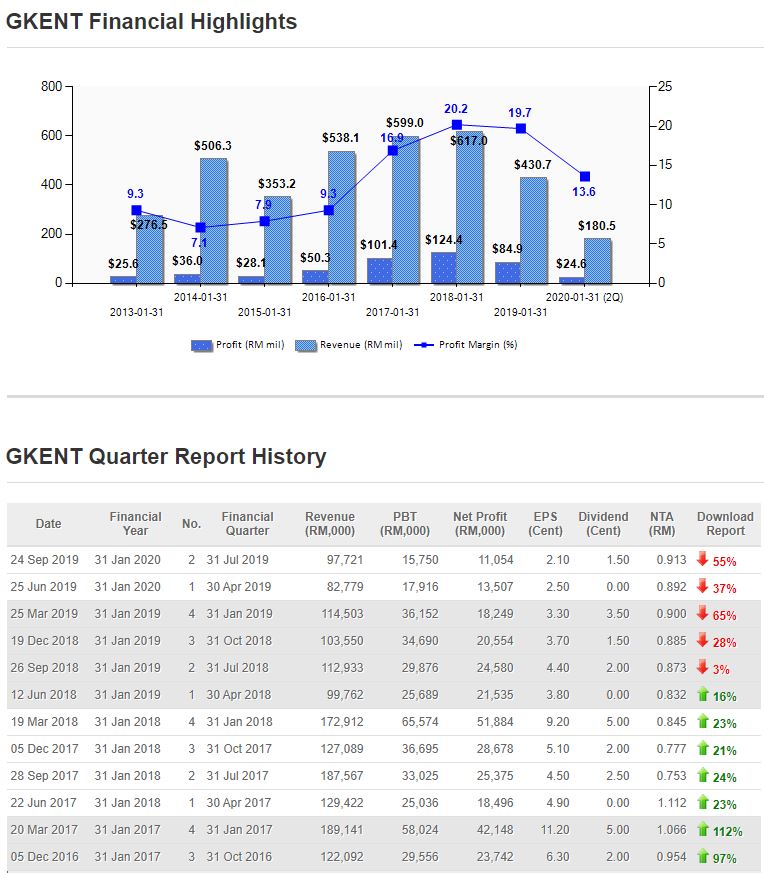

Despite the business in challenge after GE 2018, the company has achieved reasonable results. The company achieved a pre-tax profit of RM 127.8 mil, a profit after tax of RM 86.3 mil, and a dividend of RM 38 mil.

The company has successfully renegotiated the LRT3 project, which will begin at the end of 2019. But their status changed from PDP (Project Delivery Partner) to Turnkey project.

The company's current order value reaches RM 5 bil, which will bring revenue on next few years. And they are working hard to increase the turnover of the water metering business, which will increase by 30% to 70% in the next few years.

The company's automatic water meter system is currently being tested in several states and has been very successful so far and is expected to begin operation by the end of this year (2019). This will further increase the sales volume of the water meter department, which is the core of the company.

The company signed an agreement with Honeywell & Elster last month for $3 mil, enabling the company to transfer technology to manufacture precision parts. This is very important for the expansion of the company's water meter business, which provides a better positioning for the company. Under the agreement, the company now has exclusive sales rights to 15 new countries on top of their existing 42 countries.

Q&A Time:

1) Q: What is the current order of the company? What is the estimated value of the company's bids in the next 3 years?

1) A: The current order value of the company is RM 5.08 bil, and the estimated bid value for the next few years is RM 2.5 bil.

2) Q: How much money will the company allocate for the expansion and how long does it take?

2) A: RM 40 mil has been allocated for the expansion of the next two years.

3) Q: Please explain how the company strengthens its relationship with suppliers and technology partners.

3) A: The agreement with Honeywell & Elster has made us an importer of a complete manufacturer and has the technical knowledge to create the required components. Hence, this will enable us to reduce costs and increase competitiveness in the future.

4) Q: I noticed that the company's turnover and profit have declined in 2019. Will the company go downhill in this challenging environment? Or will it be better or flat this year?

4) A: The company's balance sheet is healthy. Due to renegotiation in 2019, LRT3 did not contribute anything, so the company experinced a small loss due to the idling of operating costs. In addition, LRT2 has just ended, which is why the company's revenue and profits have decreased. The company is looking to increase sales in the water meter sector in the future and gradually increase it to cover 70% of the company's profits. Since the components supplied by our suppliers are unable to meet our needs, we have been facing production problems for the past 2 to 3 years. Sometimes in order to catch up with the deadline we choose to flight in our components instead of shipping, which leads to increased costs. However, compared to the engineering sector, the water meter division will provide greater profits, which is why we have increased production capacity from 60% - 90% while signing agreements and acquiring new technologies.

5) Q: The turnover rate of employees is very high (40%). Why? Does this affect the company? Is there any problem with the company?

5) A: Our employees did not find any problems. The employee turnover rate may be due to the end of the LRT2 project. Some foreign employees and contract employees are now transferred to the LRT3 project. However, the company that undertakes LRT3 is an independent company, so this transfer of employees may result in high turnover.

Op3rs

are u sure that the transfer of specialized labor from lrt2 to lrt3 is the main reason of high turnover rate? :)

2019-10-16 11:02