INARI (0166)

LouisYap

Publish date: Fri, 31 Jan 2020, 11:26 AM

[INARI (0166) -RM 1.79]

Inari was founded in 2006, and later established a research and development department in 2008 and began its first DC and RF testing service in 2009.

They were subsequently listed on Bursa Malaysia's ACE market in 2011 and were subsequently listed in the Main Market in 2014.

Inari Awards and Certificates:

-ISO9001: 2000

-ISO13485

-ISO14001: 2004

-The Edge Billion Ringgit Club award

-Forbes “Asia ’s 200 Best Under a Bilion” company

-Asiamoney Award 2019-The most outstanding company in Malaysia

-Industry Excellence Platinum Award 2019

Inari specializes in outsourced semiconductor assembly and test (OSAT) service providers for radio frequency (RF), fiber-optics transceivers, optoelectronics, sensors and custom IC technology.

Inari's other major businesses include:

Wafer processing includes probing, laser marking, die cutting, back grinding, flip chip and reel, and automatic visual inspection (AVI).

Chip manufacturing and Wafer Certification in fiber optic chips, including Wafer Scribe and dicing, bar alignment, unloading fixtures, facet coating and Chop on carrier (COC).

Advanced System in Package (SiP) assembly and testing, including fine-pitch surface mount technology (SMT), high-speed and high-precision flip chip die placement, in-line post vision, molding underfill (MUF), and post-mold oxide plating and final testing.

Other services include sensor and IC package design and characterization, process customization and assembly, product testing, box manufacturing, and direct customer direct shipping.

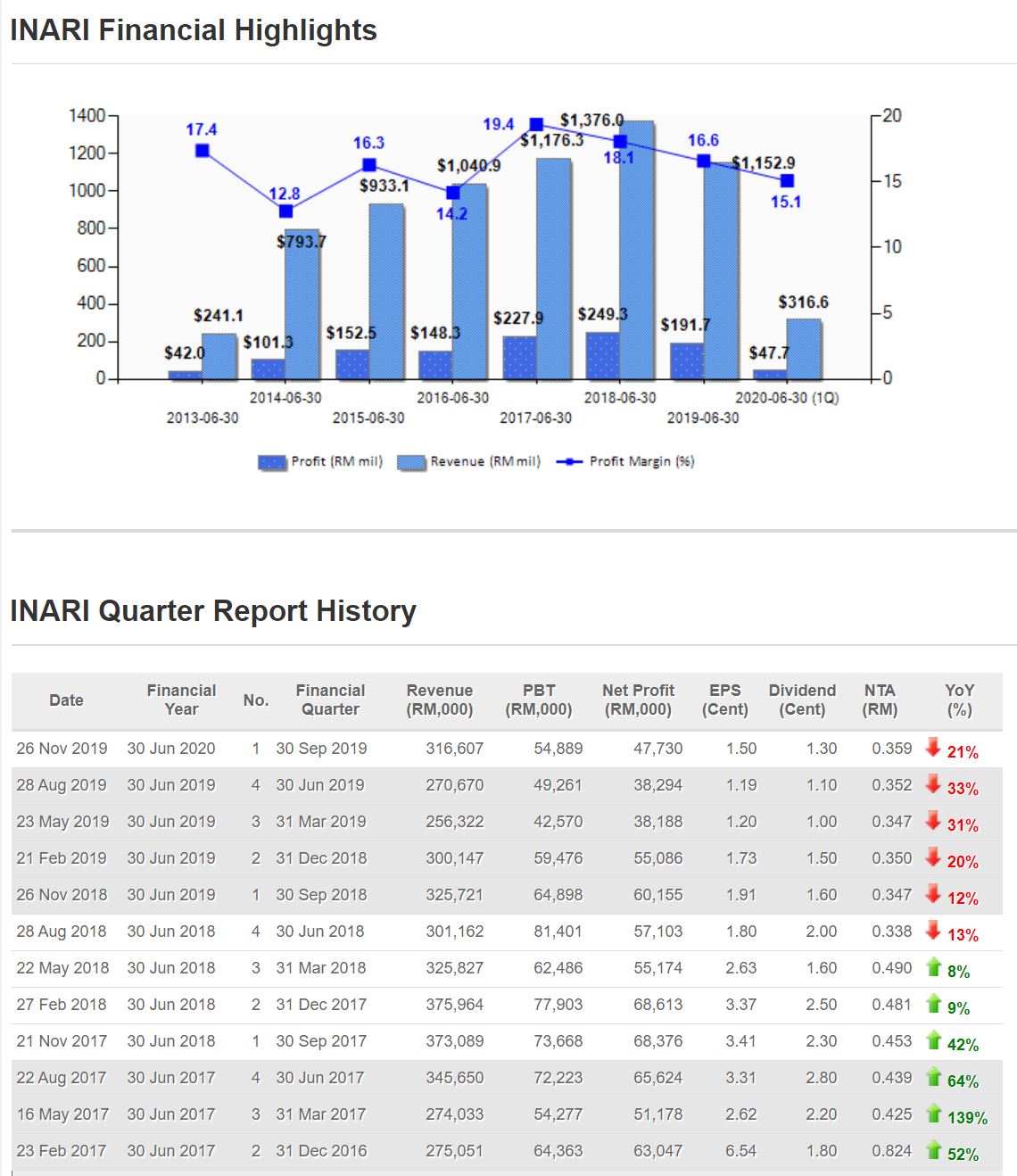

For the past 5 years, the company has continued to grow from 2015 to 2018. In 2019, as a result of the China-U.S. Trade war, overall technology exports have fallen, leading to lower income and PAT.

However, the compound annual growth rates of income and PAT over the past 5 years were 4.32% and 5.06%, respectively, achieving healthy growth.

The company's cash and bank deposit balances also increased significantly from RM 299 mil to RM 530 mil at the end of fiscal year 2018 (a 77% increase over three years), but at the end of fiscal year 2019, the company's cash fell to RM 430 due to high capital expansion plans mil (43% growth over 4 years).

Inari gearing has dropped to 0.01, which is a very healthy ratio, and the company will further leverage when needed.

As of now, the company's net cash is RM 474 mil and total liabilities are RM200 mil, so the company is net cash.

Comparative data in the latest report show that Current and Non-Current borrowings have also decreased further.

Current borrowings reduced RM 154,000 and Non-current borrowings reduced RM 1.44 mil.

Based on data from current customer forecasts, Inari's management expects the business to improve in the first half of FY 2020.

The company also plans to allocate an additional RM 150 mil in accordance with the Malaysian Government's "Industry 4.0" vision to expand production capacity and capital in test / assembly technology.

This will further increase profitability by increasing efficiency and productivity.

The latest news of Inari client Broadcom selling its RF division, shares plummeted from 1.90 to a minimum of 1.59. It also reflects Inari's sensitivity to any negative effects.

Louis Yap

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|