Details of Vizione (7070) - AGM 2019

LouisYap

Publish date: Tue, 10 Dec 2019, 11:05 AM

[Details of Vizione (7070) - AGM 2019]

✅ Main Achievements:

September 2018 - The company obtained Penang Package 2 Project worth RM 815 mil. And also obtained the Penang Submarine Pipeline Project for RM 89.9 mil.

October 2018 - The company issued 369.9 mil new shares at 14 cents via Private Placement, raising RM 51.76 mil to complete 7 to 1 share consolidation

March 2019 - Wira Syukur (M) Sdn Bhd, a company acquired at 2017, the company has achieved higher profit than their commitment. In the past two financial years, it has achieved a total profit of RM 85.9 mil, which is an additional RM 3.3 mil.

April 2019 - Joint venture into a real estate developer through the acquisition of Pembinaan Angkasa Permai Sdn Bhd, worth of RM 7 mil.

July 2019 - Launch of 216 units of home, Vizione's first real estate development worth of RM 111.3 mil

✅ Company is expanding the business

The company's current three major businesses include:

1) Construction business (Wira Syukur (M) Sdn Bhd)

2) Infrastructure business (Vizione Construction Sdn Bhd)

3) Real estate development business (Vizione Development Sdn Bhd)

The company also added a new business-renewable energy business, mainly focusing on solar energy, hydropower and WTE (Waste-to-Energy).

In the future, the company intends to venture into a new business - hospital. No specific plans have been disclosed.

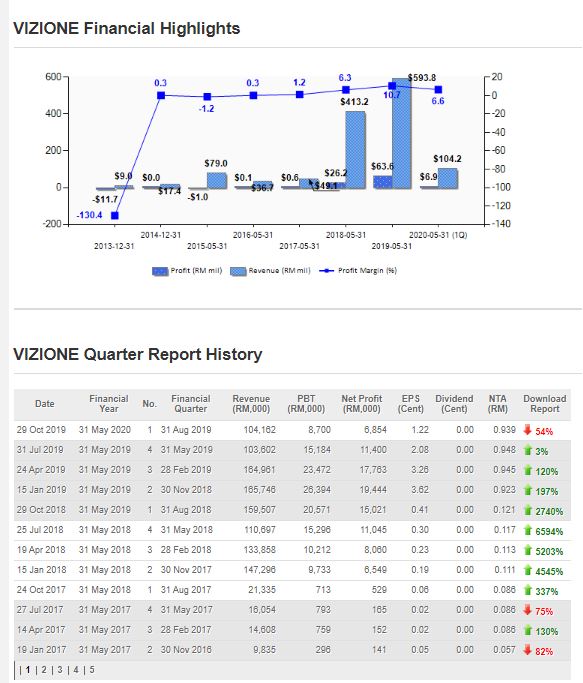

✅ Company Financial Summary:

Total Assets—RM 853.45 mil

Total Debt—RM 52.53 mil

Cash—RM 5.32 mil

Net assets per share-RM 0.948

Net debt ratio — 0.10 times

✅ Future Prospect:

Short-term goals

Will continue to focus on the company's core strengths, the construction industry, and then bid for large-scale infrastructure projects.

Long-term goals

Joint ventures with companies in the renewable energy industry to promote renewable energy business. This is the company's visions, it has already established a joint venture with the real estate developer industry to coordinate with the construction business to achieve synergy. The company plans to establish a joint venture with the hospital industry to achieve a stable source of income.

✅ Q & A session during AGM

1)

Q: What is the expected growth rate of the company's turnover and profit in the next few years?

A: The company is prohibited from answering questions about forecasted performance. However, what we can say is that the company will continue its efforts to increase turnover and profitability by diversifying its business and seizing business opportunities.

2)

Q: How long can the company continue with the current engineering contract?

A: The currently unfinished engineering contract is expected to last until 2023.

3)

Q: Vizione has several important projects in progress. What is the current progress?

A: All the projects have reached the expected progress and can be completed with the expected deadline.

4)

Q: At the end of FY2019, the company has 2 major customers who owe the company a total of RM 94.6 mil, accounting for 46% of the Trade Receivable. How will the company deal with such credit risk?

A: We will continue to track the progress of this collection and allocate credit risk evenly by allocating personal credit exposure.

5)

Q: Why did the company do Share Consolidation before, and is there any plan to change the number of shares?

A: Share Consolidation can add Share Capital so that we can become mid-cap stocks, and then Fund Manager can invest in our company, which is good for us.

As for whether there are other plans, it depends on market conditions. We will increase our Share Capital when necessary and at the right time. Because of the bidding for large construction projects, the size of the company is one of the important factor that determine success.

Conclusion:

During shareholders meeting, many shareholders is impressed with management performance, which the company was able to perform well during the downturn in the construction industry. Management expressed optimism and confidence in the outlook for the coming year

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: