Gadang (9261) AGM 2019

LouisYap

Publish date: Thu, 02 Jan 2020, 10:43 AM

[Details of Gadang (9261) AGM 2019]

The company has three major businesses: construction business, real estate development business and Utility business.

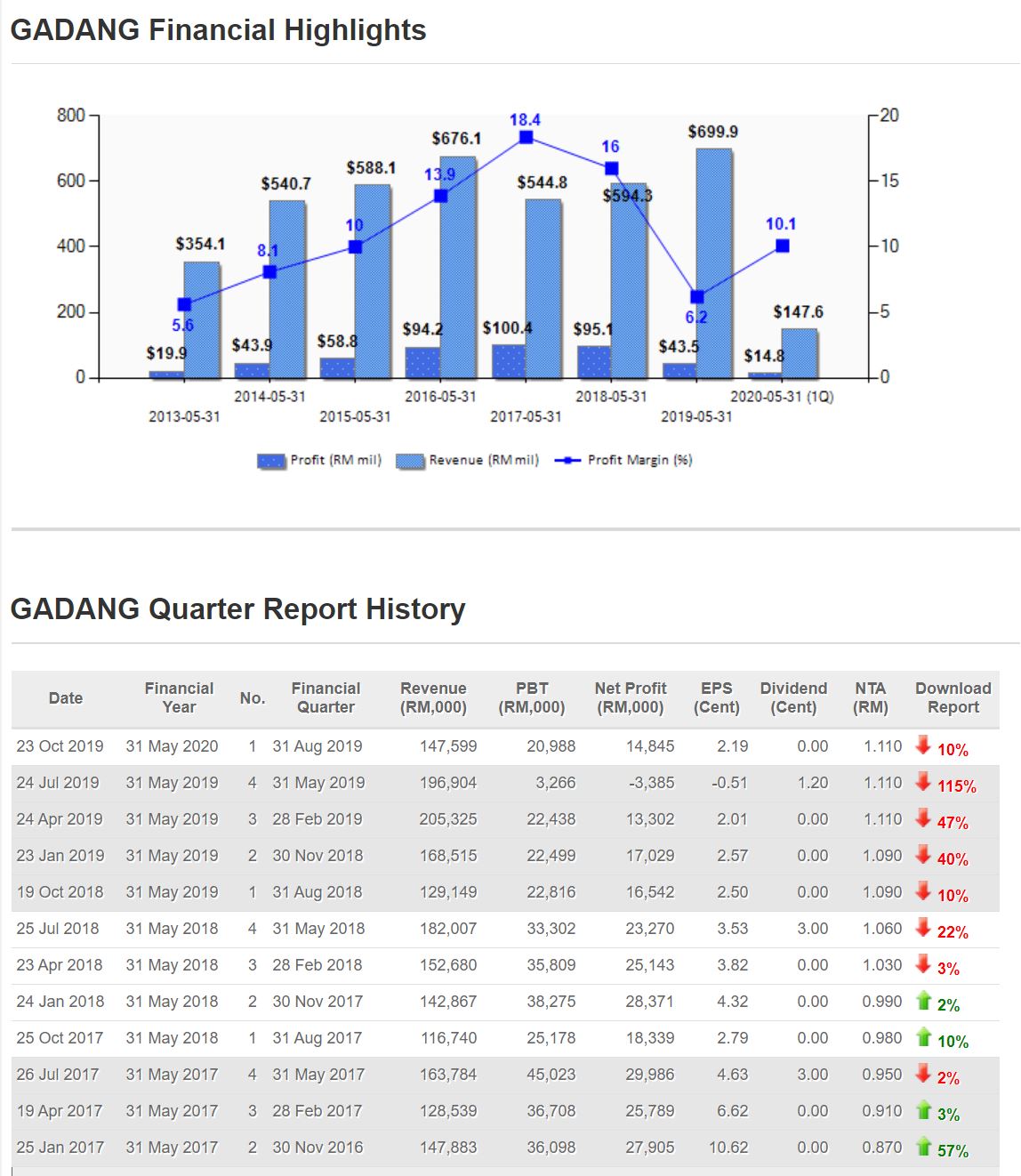

The company's turnover of FY19 was RM 687.7 mil (FY18 RM 594.8 mil), an increase of 16% year-on-year; while FY19's profit before tax was RM 71.7 mil (FY18 RM 134.1 mil), a year-on-year decrease of 47%, mainly due to the majority of projects completion at FY18, and coupled with the decline in profit margin of FY19 project.

The business that currently accounts for the largest proportion of turnover is the construction business (70%), followed by the real estate development business (27%), and finally the Utility business (3%).

✅ Construction business

-At present, the company's unfinished engineering order is about RM 1.14 bil, which is expected to keep the company operating for more than two years.

✅Real estate development business

-Sales of real estate development business in FY18 reached RM 185.5 mil, FY 19 achieved RM 162.6 mil, and the company's sales target for FY2020 is to reach RM 272.6 mil.

-The property development business (as of August 2019) also has uncalculated sales of approximately RM 126.5 mil, which will gradually translate into company turnover in the coming quarters.

-The company has planned but not launched projects in the future with a total development value of about RM 2.5 bil. The launch date is not confirm yet.

✅ Utility business

-The completion rate of the company's 9 Megawatt small hydropower plant in Indonesia is 73% (as of August 2019), which is still within the expected progress.

✅Management Outlook

Management is vigilant and optimistic about the revival of major infrastructure projects such as ECRL, Pan Borneo Highway and facilities in Malaysia.

The construction business will continue to bid for more infrastructure contracts to increase the company's engineering orders. At the same time, it will focus on executing ongoing projects to ensure that it can be completed within the expected schedule.

The real estate development business will readjust newly launched real estate development projects to meet market demand and expand its customer base to promote sustainable growth.

As for the water treatment assets of the Utility business, it is expected to continue to contribute sustainable revenue. The 9MW small hydropower plant project in Indonesia is expected to be completed in the next financial year, which will increase the sustainable revenue of the Utility business.

Q&A:

✅ Q: Why are the variation orders for construction projects completed last year so high? Why are Capital City projects is low profitable?

A: The Variation order is so high because the customer requested to rush work, which led to the completion of the project ahead of schedule. As for the low profitability of the Capital City project, it is due to the decline in market demand.

✅ Q: How will management respond to future cost management challenges?

A: The strategy we will implement when:

1. Timely reduce the number of employees who are extra when the project is completed to improve overall production efficiency.

2. Invest in technology applications to speed up project completion.

3. Maximize asset utilization to maximize project returns.

✅ Q: What is the occupancy rate of Elegan Residensi Phase 1?

A: As of October 31, 2019, 31% of sales have been confirmed.

✅ Q: What is the rate of return of the company's water concession in Indonesia?

A: Although the current water concession is already at the best hydraulic capacity, the tariff rate will be adjusted according to the local cost of living index, so the return rate will also be change. The current rate of return is about 15%.

✅ Q: Why does the company invest in DWL? As far as I know, now their stock price has fallen and the company's investment is losing money.

A: This is a strategic investment. We can only bid for more infrastructure projects by investing in DWL. At the same time, they also have profit to share as a shareholder, it is a win-win situation, the loss is just a temporary measurement.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site: