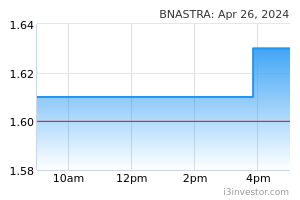

Binastra - Strong 2HFY25 earnings

PhillipCapital

Publish date: Fri, 13 Sep 2024, 04:24 PM

- BNASTRA’s 6MFY25 earnings of RM41m were in line with our and consensus expectations, representing 47% of both full-year forecasts

- We expect stronger earnings momentum in 2HFY25, underpinned by its robust RM3.3bn outstanding order book

- Reiterate BUY rating with unchanged target price at RM2.15.

Result met expectations

BNASTRA’s 6MFY25 core earnings came in at RM41m (+187% YoY) on the back of higher revenue of RM411m (+170% YoY) attributable to improved progress recognition, with the order book more than doubling to RM3.3bn, from RM1.5bn as of end 2QFY24. The EBITDA margin improved 1ppt YoY to 14.1% as a result of stronger operating leverage. Overall, 6MFY25 results were within both our and consensus estimates, representing 47% of both full-year forecasts.

Expect stronger 2HFY25 earnings growth

BNASTRA reported strong sets of results, with revenue and net profit reaching a record high. 2QFY25 revenue increased 29% QoQ to RM231m, driven by better recognition from ongoing projects and the commencement of five new projects. 2QFY25 core net profit rose 26% QoQ on the back of EBITDA margin improvement (+0.5ppts), but partly offset by higher depreciation and interest costs. The latest outstanding order book stands at RM3.3bn, which has more than doubled following RM2.5bn new contracts secured YTD, is expected to fuel earnings growth. BNASTRA’s earnings are on track for a record-breaking year in FY25, with expected YoY earnings growth of 112%.

Reiterate BUY

We make no changes to our earnings forecast. We reiterate our BUY call with an unchanged target price of RM2.15, based on a target 18x multiple on FY26E EPS. We like BNASTRA for its strong competitive advantage as a preferred contractor with key clients and superior profit margins. BNASTRA is trading at an undemanding forward 13x PE, presenting an opportunity for valuation to re-rate, given its strong three-year profit CAGR of 60%. Key downside risks include slower-than-expected order book replenishment, unforeseen project delays, and project margin cost pressure.

Source: Phillip Capital Research - 13 Sept 2024

Related Stocks

More articles on Phillip Capital Research Reports

Created by PhillipCapital | Jan 15, 2025

Created by PhillipCapital | Jan 13, 2025