Is Ranhill still worth investing?

winsenlim68

Publish date: Wed, 06 Apr 2022, 12:35 PM

The company had announced their full year result for financial year 2021, and I must say is not the best number but not the worst as well.

On a quarterly basis, top and bottomline performance had a huge jump yoy but I suspect is due to a low base effect. However, on a full year basis, its bottomline result was mediocre.

According to a shareholder’s email to the management and was told mainly due to “HQ overhead and Corporate sukuk interest expenses”. (you may check on the comment section)

That said, I trust the overall declining profit could potentially reach its bottom. Moving forward, I believe its profit would be on an uptrend mainly driven by contribution from its services segment and better overall sentiment from the recovery from Covid-19.

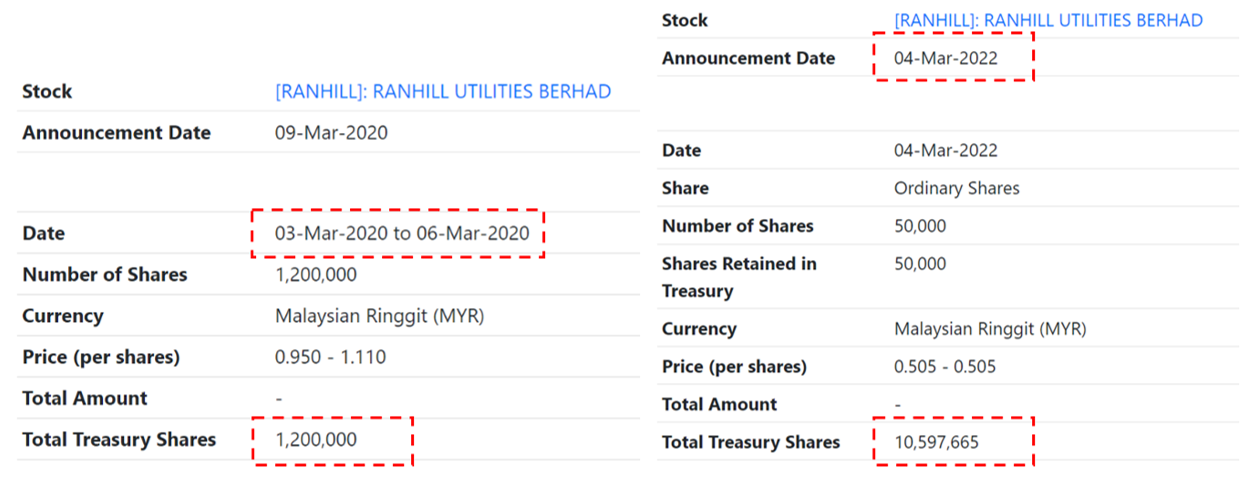

On top of that, the company had been consistently buying back its shares (roughly about 9 million shares) since the beginning of the first MCO in March 2020 till March 2022. A huge positive indication, suggesting the management remains very bullish towards the company’s future prospect.

Underlying opportunities

Here’s a recap on the potential catalysts that are still in play:

- Source to tap water supply in Indonesia - Increasing Ranhill source to tap water by almost 40%

- Future / ongoing RE tender projects - Potential future bidding for projects such as LSS, WTE, geothermal

- Completion of Sabah East-West Transmission line - Improve their utilisation, hence better economies of scale

- New NRW projects from other states - Leveraging their track records and strong competency in NRW technologies and skill

- A natural ESG selection - The current major investment group (the likes of your EPF, PNB, KWAP) focus heavily on ESG – and Ranhill business nature is strategically focus on that

- High oil price potentially benefiting Ranhill Worley - The current oil barrel price is hovering around USD100, which potentially lead to more jobs / business activities from upstream O&G companies

- Macroeconomics conditions improving - The reopen of the economy would provide other business sectors to slowly resume operational at higher capacity, which would translate better job opportunities to Ranhill in terms of infrastructure / construction works

Technical point of view

On the technical side of things, it seems the price has bottom out. In terms of risk reward, this could potentially present a good opportunity for traders or long-term investors to have some position in their portfolio. However, this is not a financial advice – just my personal opinion.