YTL & YTL Power Q1 FY2025 - Resilience is the Key

dragon328

Publish date: Wed, 27 Nov 2024, 12:23 PM

YTL Power Q1 FY2025

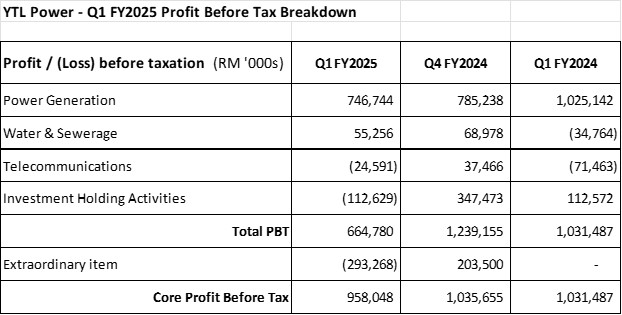

YTL Power delivered a decent set of results for Q1 FY2025 with headline profit before tax of RM665 million and core PBT of RM958 million . A breakdown of its Profit Before Tax (PBT) is tabulated below.

The extraordinary item shown above for Q1 FY2025 is an unrealized forex loss arising from a shareholder loan to the Jordan Power project entity, while the extraordinary item shown above for Q4 FY2024 was the fair value gain from the acquisition of Ranhill Utilities. Taking out the extraordinary items, YTL Power core PBT remained resilient at RM958m, a small drop of 7.5% from Q4 FY2024 and Q1 FY2024.

Of note is that the forex loss of RM293.268m booked in this Q1 FY2025 shall be partly or fully reversed in the current Q2 quarter should ringgit remain at current weak level (weaker than RM4.17 as of 30 September 2024) against the US dollar by 31 December 2024.

As expected, PowerSeraya delivered steady net profit of SGD183 million (PBT of RM746.7 million), just a tag lower than the SGD188m registered in Q4 FY2024. Despite the low USEP prices in the quarter, retails contract margin was holding up. We can also see that the price dumping by one genco was easing in the quarter, compared to Q4 FY24 (April-June 2024). That genco had earlier secured a batch of spot gas for it to ramp up generation market share, but it seems that the batch of spot gas is running out soon.

Wessex Waters continued to report a small profit of RM55 million after turning around in Q4 FY2024. Such trend is expected to continue into Q2 and Q3 FY2025 based on the water tariffs hike secured from 1st April 2024 for the regulatory year ended 31 March 2025. For Q4 FY2025 (April-June 2025), the financial performance of Wessex will depend on the water tariffs as determined by Ofwat in its final determination in December 2024 for the next 5 years of regulatory period. Signs continue to point to a favourable outcome in December as Ofwat will need to consider granting higher returns to water companies (especially Thames Waters) for them to be able to carry out the continuous business operations and higher capex programmes to comply with the stricter environmental requirements.

Jordan and Jawa Power continued to deliver steady earnings (around RM180 million of PBT) in the quarter. This is expected to continue in the following quarters as the power plants in Indonesia and Jordan are running at almost full capacity.

Yes 5G reversed into a small loss of RM25m after it booked in a small profit in Q4 FY2024. It turned in a smaller loss compared to last year as it booked in higher project revenue from its continued project implementation in Sabah which will last for 3 years.

Data centre contribution is not yet visible as there was still only 8MW of colocation data centre (for SEA Ltd) in operations in Q1 FY2025. The AI data centres are in various stages of construction, with the first 20MW for Nvidia to be completed in early 2025, followed by the 80MW for a hyperscaler and another 40MW for a MNC in mid 2025.

Headline net profit of RM510 million is low, but if I add back the forex loss of RM293m, the core net profit of YTL Power remained credible at RM803 million in the quarter. Going forward, I expect quarterly net profit to remain stable at around RM800 million, plus or minus RM20-30m due to fluctuations in earnings from Wessex and 5G Yes.

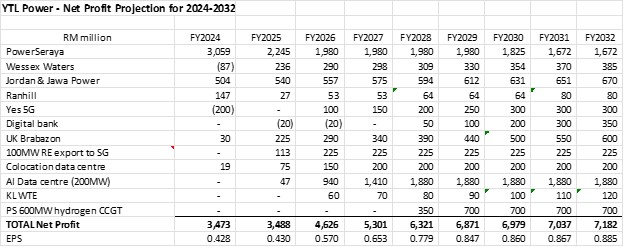

Earnings Projection for YTL Power

I have revised the earnings projection for YTL Power as follows:

The main changes are:

· PowerSeraya earnings are lower now based on a revised FX rate of RM3.30 to SGD1.00 (from earlier RM3.40+)

· Jordan & Jawa Power net earnings revised up to reflect actual Q1 FY2025 (RM180m PBT and RM135m net est.)

· Yes 5G earnings revised to zero in FY2025 to reflect actual Q1 FY25 & Q4 FY24

· Digital bank loss reduced to RM20m in FY2025 due to delay in roll out

· AI data centre earnings contribution revised down from earlier assumed 50MW for 6 months to now 20MW for 3 months in FY2025

YTL Q1 FY2025

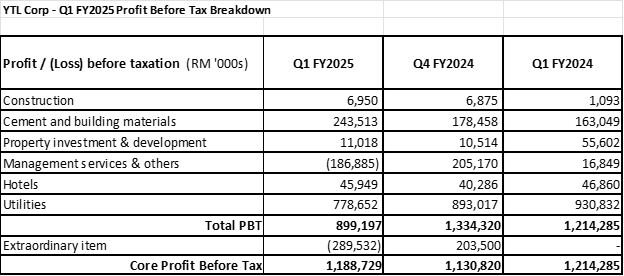

A breakdown of YTL Profit Before Tax for the latest quarter is given below:

As stated above, YTL’s Q1 FY2025 PBT is affected by a non-cash forex loss incurred at YTL Power for a shareholder loan to the Jordan Power project entity, and its Q4 FY2024 had included a fair value gain for the acquisition of Ranhill shares. Taking out these two extraordinary items, YTL actually delivered a 5.1% growth q-on-q in core PBT which amounted to RM1.188 billion in Q1.

As before, the biggest contribution to YTL profits is from the Utilities division (YTL Power) which I have highlighted above.

A positive surprise is in the Cement and building materials division that registered a strong 49.3% growth in pretax earnings compared to last year corresponding period. The stellar result was achieved from a big improvement in gross margin by 5% to 34.5% in Q1, despite the slightly lower revenue. The improvement in gross margin is due to ongoing improvements in operational efficiencies and lower production costs.

Hotels division registered steady earnings of RM46 million in the quarter, which is set to increase in the current quarter Q2 and Q3 FY2025 due to festivities and school holidays.

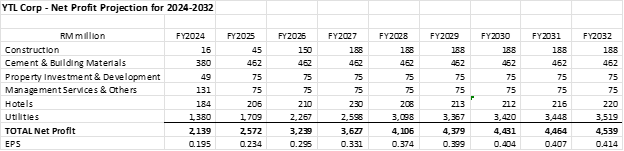

Earnings Projection for YTL

I have also revised the earnings projection for YTL as follows:

The key changes are:

· Utilities division earnings are revised to be inline with the latest projections for YTLP

· Construction earnings for FY25 are revised down to RM2b at 3% PBT margin

· Cement division earnings are revised up to RM211m PBT a quarter to reflect latest Q1 FY25 and Q4 FY24

· Property Investment & Development earnings are revised down by 1/3 to reflect latest quarters

Final Comments

YTL Power is the cheapest utility stock in Bursa with trailing PER of just 8x compared to 27x for Tenaga and 19x for Petronas Gas. That is just based on earnings from YTL Power’s traditional utility businesses (power, water, 5G etc.). When its AI data centre division starts to contribute in 2025, YTL Power earnings are set to enter an explosive phase.

YTL Power’s FY2025 earnings are expected to remain resilient from its core utility businesses with minimal contribution from the data centre business. These traditional utility businesses, together with UK Brabazon property project, shall contribute steady net profit of close to RM3.5 billion every year to YTL Power before jumping up to RM4.2 billion from FY2029 when PowerSeraya’s new 600MW hydrogen-ready CCGT comes into full commercial operations. That is already an Earnings per Share (EPS) of 42 sen to 50 sen. Purely based on this, YTL Power should be trading at minimum RM4.20 (at 10x PER) to a high of RM7.50 (at 15x PER).

From FY2029, the data centre division will add a net profit of over RM2.0 billion a year to YTL Power when the scheduled data centre IT loads (200MW colocation + 200MW AI data centres) all come online. These shall drive up YTL Power earnings by another 50% and its valuation to potentially RM8.50 minimum and a high of RM12.75 from FY2029.

As for YTL, it is the cheapest conglomerate listed in Bursa with forward PER dropping to 8.1x in FY2025 and below 5.0x from FY2029. This is unjustifiably low if compared to Sunway at forward FY2025 PER of 26x, Gamuda at FY25 PER of 20x and WCT at FY25 PER of 20x.

Furthermore, YTL is deep in value with the massive landbank at Japan Niseko Village, the largest urban landbank in Sentul KL and billions ringgit worth of unlisted hotels to be monetized. The utilities, cement and hotels divisions will continue to deliver steady earnings while YTL unlocks value in its vast assets.

There has been so much noise in recent months that has affected the share price performance of YTL and YTL Power, but I am not perturbed at all. I believe in the long-term value creation by the YTL group and my investment journey in YTL and YTL Power shall continue. Resilience is the key either in YTL/YTL Power quarterly earnings or in our investment approach.

For those who have not gained entry into these two great companies, it is now an opportune time to jump onboard. I am sure this trip will be rewarding as we join YTL on its journey that will continue for many more years to come.

The original article was published on 26 November at dragonleong.substack.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-02

YTLPOWR2025-02-01

YTL2025-01-31

YTLPOWR2025-01-31

YTLPOWR2025-01-29

YTLPOWR2025-01-28

YTL2025-01-28

YTL2025-01-28

YTL2025-01-28

YTLPOWR2025-01-28

YTLPOWR2025-01-28

YTLPOWR2025-01-27

YTL2025-01-27

YTL2025-01-27

YTL2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-27

YTLPOWR2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTL2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-24

YTLPOWR2025-01-23

YTL2025-01-23

YTLPOWR2025-01-22

YTL2025-01-22

YTL2025-01-22

YTL2025-01-22

YTL2025-01-22

YTLPOWR2025-01-22

YTLPOWR2025-01-22

YTLPOWR2025-01-21

YTLPOWRMore articles on Dragon Leong blog

Created by dragon328 | May 23, 2024

Discussions

Very well said, Mabel.

Thank you so much for your support!

You are so good in choosing the right stocks and the right timing.

2 months ago

@Mr dragon328,

Please check page 4/6 of HLIB report.

According to HLIB report,

YTL Power data centre without AI is 100% owned by YTL Power.

YTL Power AI data centre is 100% owned by YTL Communications.

YTL Power only owns 60% of AI data centre via YTL Communications.

AI data centre and data centre without AI are two separate entity.

Please verify and advise.

Thank you.

2 months ago

HLIB report is correct. The colocation data centres (DC1 - 48MW currently with SEA, and DC6 - 40MW with a MNC) are 100% owned by YTL Power as I understand.

The 100MW AI data centre with Nvidia is under YTL Comms in which YTL Power has 60% stakes.

I am not sure about DC3 - 80MW AI data centre for a hyperscaler whether it is 100% owned by YTL Power or it is under the 60%-owned YTL Comms.

2 months ago

Mabel

Very Good Sharing, dragon328!

The Johor government, through Ranhill, is set to develop four new water treatment plants to meet the growing demand for water from data centers. No wonder Visionary Victorian TS Francis decided to acquire Ranhill. When the data center business kicks in, profits and revenues will remarkably grow…

A Symphony in a Cup of YTL Power Coffee

From distant lands, where sunbeams play, To your cup, they find their way. A dance of flavors, rich and bold, A story of power, yet to be told.

Like YTL and YTL Power, steadfast and true, Each sip ignites, a spark anew. Energy flows, through veins and heart, A symphony of life, a work of art.

In every drop, a promise lies, To lift you up, to touch the skies. With every taste, a journey starts, A blend of dreams, a fusion of hearts.

So raise your cup, to morning's light, To aromatic coffee, and its might. For in its warmth, we find our way, Empowered by its strength, each day.,,

Cheers dragon328!

2 months ago