NATGATE - THE EMS GEMS TO SKYROCKET!!!

sparta

Publish date: Wed, 27 Nov 2024, 01:33 PM

JOIN KIM'S STOCKWATCH

TO JOIN KIM'S PREMIER GROUP (KPG)

Kindly msg Kim HERE.

__________________________________________

27 November 2024

STOCK NAME : NATIONGATE HOLDINGS BERHAD (0270)

NationGate Holdings Berhad, an investment holding company, provides electronic manufacturing services in Malaysia, Singapore, Germany, Taiwan, the United States, Australia, France, China, Hong Kong, and internationally. It is involved in the assembly and testing of electronic components and products to produce completed printed circuit board, semi-finished subassemblies, and fully assembled electronic products; and semiconductor devices; and provision of value-added services, including prototyping for manufacturability, supply chain management, testing and inspection, and packaging services. The company also engages in the manufacture of servers, network switches, and other electronic components.

It serves end-user markets, such as networking and telecommunications, data computing, industrial instruments, consumer electronics, automotive, semiconductor, as well as medical devices, internet of things, household electronic products, and analytical instrumentation devices. The company was founded in 1999 and is headquartered in Perai, Malaysia.

THINK TANKS! :-

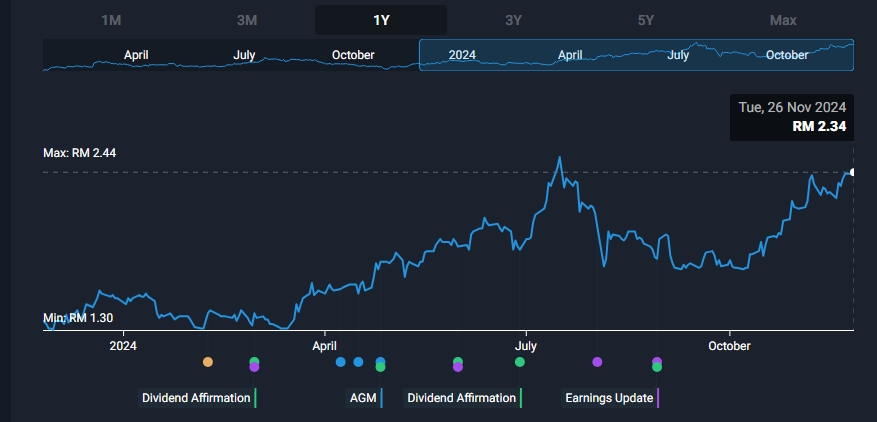

NationGate Holdings finally broke through the key resistance level at the upper edge of the handle, showing a "breakthrough market" signal favored by technical schools. Generally speaking, once this pattern breaks through, it often indicates that a strong upward trend is about to begin.

Resistance: RM2.38, RM2.52, RM2.85

Support: RM2.19, RM2.09, RM2.25 & RM2.30

Kim's Target Price : RM2.50 & RM2.80

- From a technical perspective, NationGate Holdings' stock price trend is highly consistent with its fundamentals. The growth potential in the data center and artificial intelligence (AI) fields has attracted financial attention, and the formation of the cup-and-handle pattern reflects investors' optimistic expectations for the future. The stock price has broken through key resistance levels, and fundamental stories have further ignited the stock price trend.

- Under the general trend of global digital transformation, Malaysia's data center industry has ushered in unprecedented growth opportunities, with IT capacity expected to soar from 500MW to 3,000MW.

- At the same time, the artificial intelligence server market is worth as much as RM97.8 billion, which provides unlimited possibilities for local technology companies. In this technological revolution, NationGate Holdings is undoubtedly a dark horse worthy of attention.

- NationGate Holdings is a company specializing in electronic foundry services (EMS), with services ranging from electronic component assembly and testing to printed circuit board production, precision plastic injection molding, and supply chain management. More importantly, the company provides services to a variety of end markets, including networks, telecommunications, data computing and the Internet of Things, etc., and its business layout is quite extensive.

3 SPECIAL POTENTIAL :

- Focus on high-growth industries: The network and telecommunications fields contribute about 70% of the company's revenue, and these fields are on a rapid development track. With the rise of technologies such as artificial intelligence, the Internet of Things and data centers, NationGate Holdings' customer needs are also constantly increasing.

- Technology leadership + value-added services: NationGate Holdings has advanced facilities that meet the requirements of Industrial Revolution 4.0 and can undertake highly complex manufacturing orders. At the same time, the company also provides high value-added services such as Chip-on-Board (COB), which not only increases customer stickiness but also brings higher profits.

- Growth potential of data computing business: NationGate Holdings' business in the data computing field is accelerating, especially the expansion of server production is underway. As the chip supply shortage gradually eases, it is expected that there will be stronger growth momentum in the future. External favorable factors boost growth.

- We all know that US-China trade tensions are changing the layout of global supply chains. As more and more multinational companies choose to relocate their manufacturing operations out of China, the "China + 1" strategy is a huge opportunity for ASEAN countries, including Malaysia. With its strategic location, friendly business environment and young population structure, Malaysia has become the preferred destination for many companies. Against this background, NationGate Holdings has natural regional advantages, and at the same time it has entered the explosive markets of artificial intelligence and data centers. The future growth space is exciting.

NationGate Holdings has strong fundamentals, benefiting from the growth of the data center and artificial intelligence markets. At the same time, the technical picture shows a cup-and-handle pattern, and the stock price has also broken through key resistance levels, which may trigger a new round of rising prices and further verify the attractiveness of the fundamental story.

KIM'S VIEWS :

- Foreseeing factors driving the optimism include the shift of more manufacturing operations out of China exacerbated by the intensifying US-China trade tension, technological advancements that are benefiting the EMS industry, as well as a surge in demand for data centre infrastructure in Malaysia.

Acquires Hesechan Industries in Penang for RM25m cash

- The acquisition represents a strategic investment for expansion and is undertaken in line with NationGate and its subsidiaries’ long-term plan to grow its business. As the group intends to continue expanding its business, it envisages the requirements of additional manufacturing space to facilitate the expansion.

- NationGate believes that the prospects of the acquisition remain favourable. Facing the fast-paced nature of the electrical and electronics industry, coupled with the continuously changing technological landscape globally, the group’s relentless effort in bringing up the value chain of the manufacturing services rendered shall keep us ahead in this competitive market. The group intends to continuously strive for technological advancement and cost-effectiveness, and build strong collaboration in its supply chain ecosystem to better position itself in the EMS market

- It's a BUY & HOLD in my personel opinion and this stock highly potential in range value RM3.00 above minimum.

- Data center and smartphone sectors entering more exciting growth stages. Following a 12-18 month data center construction phase, we expect the fit-out phase to start between 4QCY24 and 1HCY25, offering significant opportunity to leverage on the rising AI infrastructure.

- Generative AI smartphones, which transition user interactions from touch to voice, are projected to experience more than a 3-fold increase in 2024, with another 73% growth expected in 2025. Despite these positive trends, the automotive semiconductor segment faces near-term headwinds due to recent tariff hikes on Chinese EVs.

- Overall, the sharp decline in the Bursa Malaysia Technology Index presents a compelling buying opportunity for tech stocks. All of which are well-positioned with strong earnings visibility and exposure to high-growth areas such as AI-related infrastructure.

JOIN KIM'S STOCKWATCH

TO JOIN KIM'S PREMIER GROUP (KPG)

Kindly msg Kim HERE.

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advise.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Follow Kim's Stockwatch!

Created by sparta | Dec 06, 2024

Created by sparta | Jul 12, 2024

Created by sparta | May 08, 2024

Created by sparta | May 07, 2024