HengYuan - Stallion Point of View

StallionInvestment

Publish date: Fri, 29 Dec 2017, 09:21 AM

What a good rally for HENGYUAN investor/trader if you have bought since early this year. So, it will be a good return for those who have bought it. But few point need to take note on this counters.

- Since 22 Aug 2017, AmanahRaya Trustees Berhad-Amanah Saham Bumiputera reduce the stake from 6.592% to 5.3%. Once it go below 5%, then any significant changing of stake do not need inform the public. Beware when It reduce below 5%

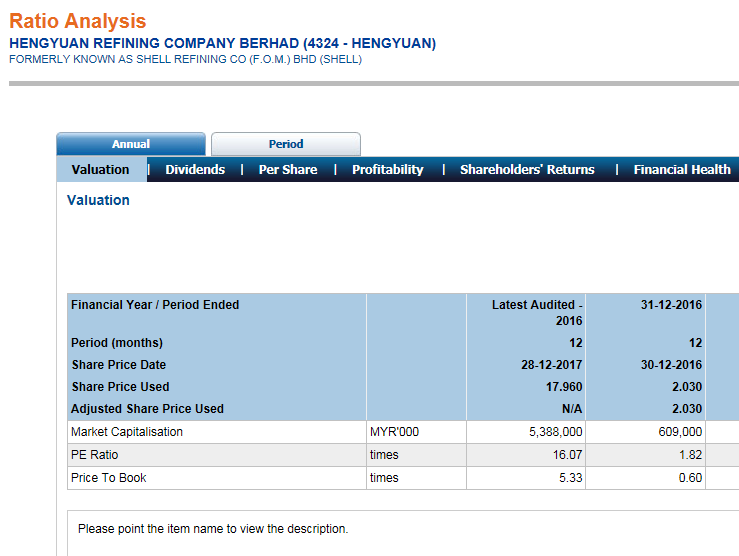

- PE IS low which is 5.77, but NTA valuation at 5.526. Not to forget SUPERLN/IQGROUP if there is 1 quarter they miss the earning expectation, then price mostly will drop drastically.

- Base on Insage TOP 30 major shareholders, rank 18 which is Amanah Trustee Berhad As 1Malaysia

- Based on the source obtain from Mr. Koon Yew Yin Blog posted at I3investor, https://klse.i3investor.com/blogs/koonyewyinblog/142099.jsp , Bank do provide Share Margin Financing to this Multi Millionaire Investor being cautious of the heaving position holding that being hold by Mr. Koon. If bank choose to tighten the policy, it may cause the buying momentum slowing down. Risk that need to be taking care if you are chasing high with heavy position.

- Why it is such a good counter being notice by the public, but there is no coverage by the research house but only those famous investor/bloggers been talking about this.

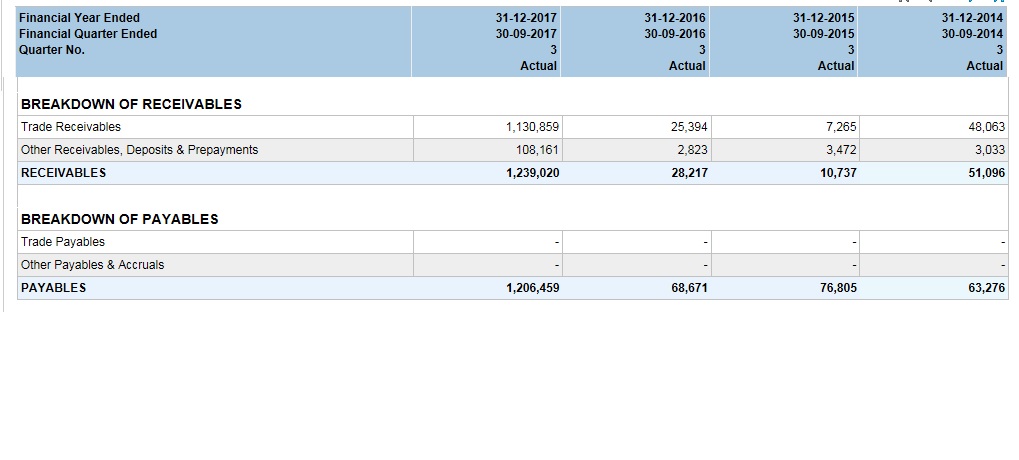

- A sudden surge of the Account receivable if there is any potential failure of collecting payment. When the management choose to write-off then it will be a disaster for HengYuan investor

- Price to Book stood at 5.33. Is it investors very optimistic with the coming quarter and the coming year of the result? Cause with such a premium, HengYuan need to deliver fantastic result so that it can keep the price continue going up.

By all mean, HengYuan still look good base on chart formation. But above are some of the area we need to think ahead when we are chasing high at heavy position.

Technical Opinion

Support : 17.30 ; 18.00

Resistance : 21.00

Disclaimer : Trade at your own risk. Kindly consult your dealer/remisier for any investment decision. Above is merely for education sharing purpose.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stevent Hee

Discussions

ENJOY THE JOURNEY AS LONG PERSISTENCE ALLOWS....THE OBSTACLES ARE CHINA COMPANY NEED 2 BE TRADED WITH CARE!

2017-12-29 10:08

thanks.. appreciate it.. more people write about HY, atleast got some balls la rather than IBs all tutup mata, tutup mulut. later at rm 30+ bru buy call

2017-12-29 10:54

If today close below 17.96 then it will form Bearish Engulfing. At such a high price, it may not be a wise decision to enter. Look at Fibonacci Retracement support level which is 15 follow by 13.75 then 12.45.

2017-12-29 15:36

Booyah, if you read it properly. I clearly stated there is few point to take note when you are buying at the high side. Risk/Reward is not justify for entry rite now. I am sorry if you were trap at the high price. All the point i listed is my personal opinion as i stated in the disclaimer. You can just ignore my article if you think is nonsense. When i post this article in the early morning today, it still a bull trend, therefore i put the current support/resistance for your reference. However, i also indicate few points to take note is it worth to enter at this moment base on current price.

2017-12-29 16:03

Mohd Fahmi Bin Jaes

now 19

2017-12-29 09:35