Stevent Hee - WCT 29 APRIL 2018

StallionInvestment

Publish date: Sun, 29 Apr 2018, 08:34 PM

Market Update – 29 APRIL 2018

WCT 9679

Shares Issued : 1.415B

Market Cap : 1.783B

Syariah : Yes

Short Sell Indicator : Yes

NTA : 2.22

PE : 11.74

NEWS COVERAGE

20 April 2018

“Within our construction universe, Gamuda, Protasco and WCT Holdings are known to be bidding for PBH Sabah.

“Gamuda and WCT Holdings are earlier beneficiaries of PBH Sarawak, after securing RM1.3bil to RM1.6bil contracts via their own JVs with Sarawak players.

https://www.thestar.com.my/…/gamuda-protasco-and-wct-eye-s…/

3 April 2018

Analysts are mixed over property conglomerate WCT Holdings Bhd's proposed acquisition of a 60 per cent stake in Subang Skypark Sdn Bhd.

The group had on Monday said it would buy Subang Skypark from Tan Sri Ravindran Menon and his partner Datuk Aisamar Kadil Mydin Syed Marikiah for RM44.56 million cash.

“However WCT remains backed by significant surplus land value and we maintained our BUY call with target price (TP) of RM1.81” it said.

RHB Investment Bank Bhd believes that if the potential deal will add comfortably to the group’s retail segment exposure.

https://www.nst.com.my/…/analyst-mixed-over-wcts-proposed-a…

26 Feb 2018

WCT said the engineering and construction segment will continue to build on its strong order book having secured several new infrastructure contracts worth about RM2 billion in 2017.

“The group expects construction margins to remain healthy given the higher proportion of infrastructure-related jobs in its order book,” said WCT.

Meanwhile, with a subdued property market outlook, WCT said it will be cautious in launching new projects and will continue to intensify the sales of its existing property stocks.

It also updated that Paradigm Mall Johor Bahru, which opened for business last November, has started showing positive results. It reached an occupancy rate of 92% for the mall's net lettable space of 1.3 million sq ft.

http://www.theedgemarkets.com/…/wct-4q-net-profit-soars-nea…

VALUATION MODEL

NTA : 2.22

MOS : 1.55 ; 1.77

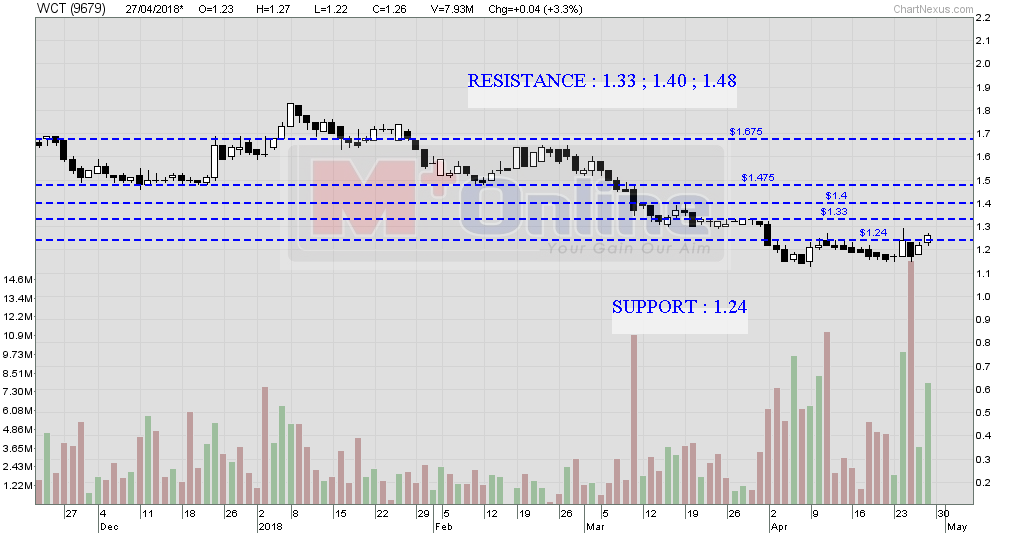

TECHNICAL OUTLOOK

WCT LAST DONE PRICE : 1.26

BOLLINGER-BAND : POSITIVE TERRITORY

5 EMA CROSS 20 MA : POSITIVE

MOMENTUM : POSITIVE

MACD : TECHNICAL REBOUND

SUPPORT : 1.24 (-1.59%)

RESISTANCE : 1.33 (+5.55%) ; 1.40 (11.11%) ; 1.48 (17.46%)

Support Resistance given above is for the time frame within 2 weeks to 2 months’ time

Catalyst :

1. Dividend Ex Date : 7 Jun 2018, Dividend 3 cent will translate to approximately 2.38% return

2. Active buying active by Lembaga Tabung Haji (since 13 Feb 2018)

3. Research House Coverage with Target Price 1.81 by HLG, 1.38 by AMMB and 2.36 by Affin Hwang. Source obtain from https://klse.i3investor.com/servlets/stk/pt/9679.jsp

Trade with wisdom ;

House of Happiness;

SMART MONEY ;

TREND FOLLOWER

https://www.facebook.com/Stevent-Hee-1669441599811471/

Disclaimer: Above information obtain at the best available source of information. Any inaccurate information, writer should not held any responsibility due to investment losses arise from above article. It does not solicit buy or sell call on the stock, it merely for educational sharing purpose. Kindly consult your investment broker pertaining any investment decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|