Technical View of Jaks

StallionInvestment

Publish date: Sat, 28 Jul 2018, 11:35 PM

There is many people has been posting on Jaks should buy or sell. So, there is mix signal which lead to the argument whether to buy or sell. Since there is noise, i choose to interepret base on technical point of view.

what you can see the two blue color trend which i plot the difference showing 0.905 and 1.00 which is much telling much on the upside price movement .

Where there is correction from 1.28 to 0.8.

Pull back percentage : (1.28 - 0.8)/ 1.28 * 100 = 37.5%

Second part of calculation which the peak at 1.80

Pull back percentage : (1.80 - 1.10 ) / 1.80 * 100 = 38.9%

What this calculation show it to you is there some sort of correlation of the price movement which telling you where is the upside and pull back phase.

Now, we will look into support resistance to know where are we standing rite now. What are the risk/reward ratio?

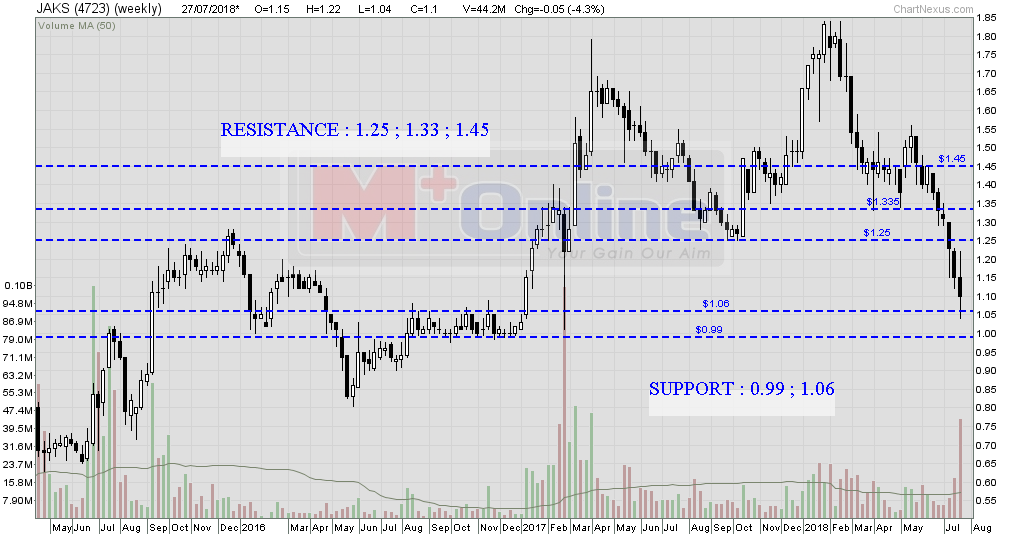

SUPPORT : 0.99 ; 1.06

RESISTANCE : 1.25 ; 1.33 ; 1.45

Trading Plan : As long it hold above 1.06, those trader can look into it, once it break then next support level to watch out is 0.99. Once it break, then it should be further down all the way.

Assume Entry at 1.13, return in term of percentage if hit resistance level at 1.25 (10.6%) , 1.33 (17.7%) , 1.45 (28.3%)

Look into 28 Feb 2018, there is sudden sell down with huge selling pressure which contribute 46.93m shares traded in a day which is nearly 8.5% turnover.

As of Friday closing, it appear similiar pattern compare to the 28 Feb 2018. but what different is one is bullish candlestick reversal pattern occur in the year 2017 but 27 July 2018 also show recovery but it still a negative closing candlestick which telling us the momentum of the recovery is not that strong compare to the year of 2017 eventually break the earlier high and trend up higher. For this case, it will be merely on the technical rebound instead of strong recovery. Those who has bought earlier, base on technical reading it should be sell on strength if you have been trap earlier. Reversal signal will only come in base on chart reading is when it go above 1.18 for Jaks.

Again, many people alway like to ask what if break 0.99. Where is the next support?

In this case, i adopt Fibonacci Retracement which give me the next support shold be peg 0.94. Once it break then next Fibonacci level will be 0.725.

Conclusion, there is many uncertainty and this counters has been surrounded by many negative news which possible limit the upside. Those who wish to trade on potential rebound better keep your profit margin low else you might be get trap eventually.

If I am trader, I would monitor the buying interest in the morning, if the first 5 minute is strong buying interest and never really gap up much, then we may consider taking position but if there is mix signal occur. I would rather focus on other stock instead of this. why so stubborn enter into this while there is plenty of better trading stock compare to Jaks unless you plan to buy and keep it.

Conclusion : Investment may not be a wise decision at this juncture as there is many negative news, but risk taker alway earn the most if your view is correct. Where else for me, I would rather stick to technical trading view or look for better stock instead of Jaks.

Disclaimer : Above is my personal point of view. Trade at your own risk.

FB : https://www.facebook.com/Steventheeinvestment/

Telegram : https://t.me/steventhee628

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stevent Hee

Discussions

REMEMBER THIS IMPORTANT STATEMENT BY THE OLD FOX CONMAN KOON YEW YIN:

"The above price chart shows the price has been dropping from Rm 1.83 in mid Feburary to current level, a drop of about 30% within 6 months. As a result, all shareholders are losing money. Unfortunately, many shareholders are having margin call and forced to sell. All bankers must remember, forced selling is a vicious cycle. The forced selling will depress the price lower and resulting more forced selling."

No talk rebound loh....!!

It is sell...sell...sell loh....!!

No mark around for Jaks mah.....!!

Posted by stockraider > Jul 29, 2018 11:15 AM | Report Abuse X

Always remember the 1st rule of margin investors loh...!!

1. If u got a margin call...u sell...sell...and sell until....u clear ur debts loh....!!

U don go and mark around....bcos margin call....is your savior alarm bell loh...!!

So if KYY an old fox...if he got a margin call..u think what he will do?

2018-07-29 14:01

Don't worry, stockraider, TA is nothing to do with margin call & profits, please trust CHART, chart will tell those believers the future of a stock.

2018-07-30 16:26

Jon is too polite and gentlemen. Technical is rubbish, your article is the rubbish...

2018-07-30 20:58

My Technical reading is rubbish? Fine. Please ignore it. May be what you want is the answer can i buy or hold or sell? as simple as this. Why dont you tell me bluebiznet is it jaks can continue go up or the way or going down from now?

2018-08-08 22:57

focus on women is better time spent than focus on chart. in my opinion. when jaks go to 40cents then only FA+TA.

2018-08-08 23:04

Sharewitch

So much news on Jaks. Syndicate planning to crash this share?

2018-07-29 13:58