EG 27 Sept 2018 - Stevent Hee

StallionInvestment

Publish date: Thu, 27 Sep 2018, 10:09 AM

Today i will be sharing a stock called EG.

1.After the strong rally of VS, for those who miss it then what should we do? We look at their competitor. How we know who are those competitor? Very simple, by reading more news from the online portal then you will know.

https://www.thestar.com.my/business/business-news/2018/01/30/eye-on-eg-industries/

2. Based on earlier news reported, with expansion of the plant at Sungai Petani, EG should be able to generate additional 100million additional revenue per year. In order to read the news can click below linkage

http://www.theedgemarkets.com/article/eg-industries-machinery-upgrades-bring-new-sales-rm100m-year

3. Fortress Capital Asset Management director Geoffrey Ng concurs. “First, EMS players had a fantastic year last year, so a lot of investors are sitting on very handsome gains. And of course, with the strengthening of the ringgit, it gives them an impetus to sell because the ringgit’s strengthening eats away the profits they earn in US dollars.

“And with the [potential] US-China trade war, it leaves a very large overhang of uncertainty — in terms of how the trade war plays out and how it will impact their order books.”

However, there could be a silver lining if a trade war materialises. An industry source says brand owners could decide to diversify their supplier base beyond China as part of long-term risk management. “This certainly spells opportunities for EMS players in Malaysia,” the source says.

But as a subset of the technology sector, the performance of EMS stocks tend to be influenced by the performance of tech stocks, particularly semiconductor counters.

CEO Alex Kang Pang Kiang says the main revenue generator for the group remains the printed circuit board assembly and box-build segments, but it is aiming to become a full-fledged and vertically integrated player.

“We will also be establishing our third business segment of distribution in FY2018. This is especially important as our knowledge of the Southeast Asia market allows us to help customers penetrate the 650 million population, while keeping our customers’ relationships even stronger.

“Currently, we are finalising the necessary channels and we are positive that it will start contributing more substantially to the group’s revenue in the near future,” he adds.

Source obtain from http://www.theedgemarkets.com/article/tech-tech-rout-weighs-ems-selloff-seen-overdone

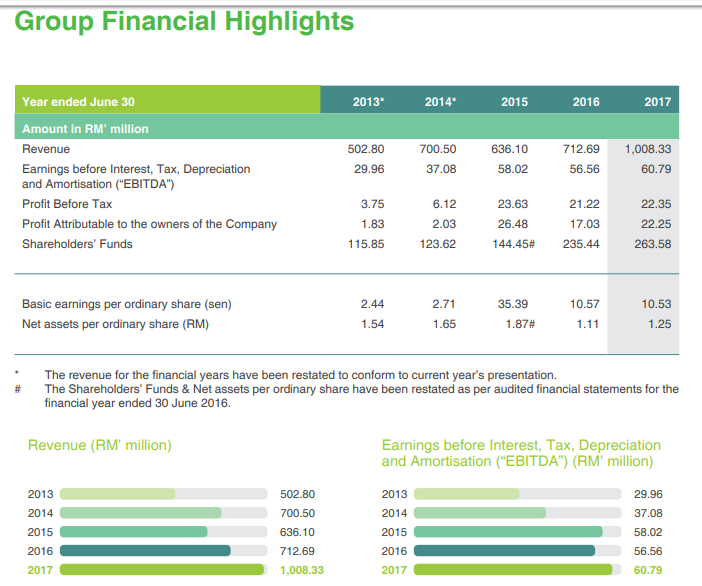

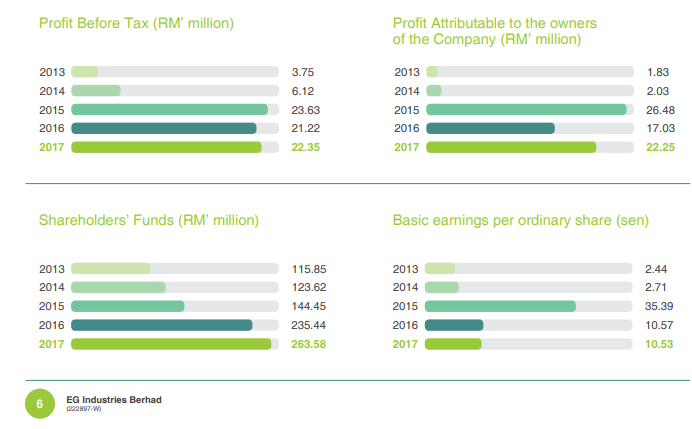

Financial Highlight of EG shown as below

What does this tell you. It tell you the shareholder fund double up in 4 years time and EPS increase by 4x.

Profit before tax at years 2013 is only RM3.75million increase to 22.35million for the financial year 2017.

So, after the heavy sell down of those EMS related stock, it may be the time for us to relook back to VS, SKP and EG.

This is what you should about the recent development on EG.

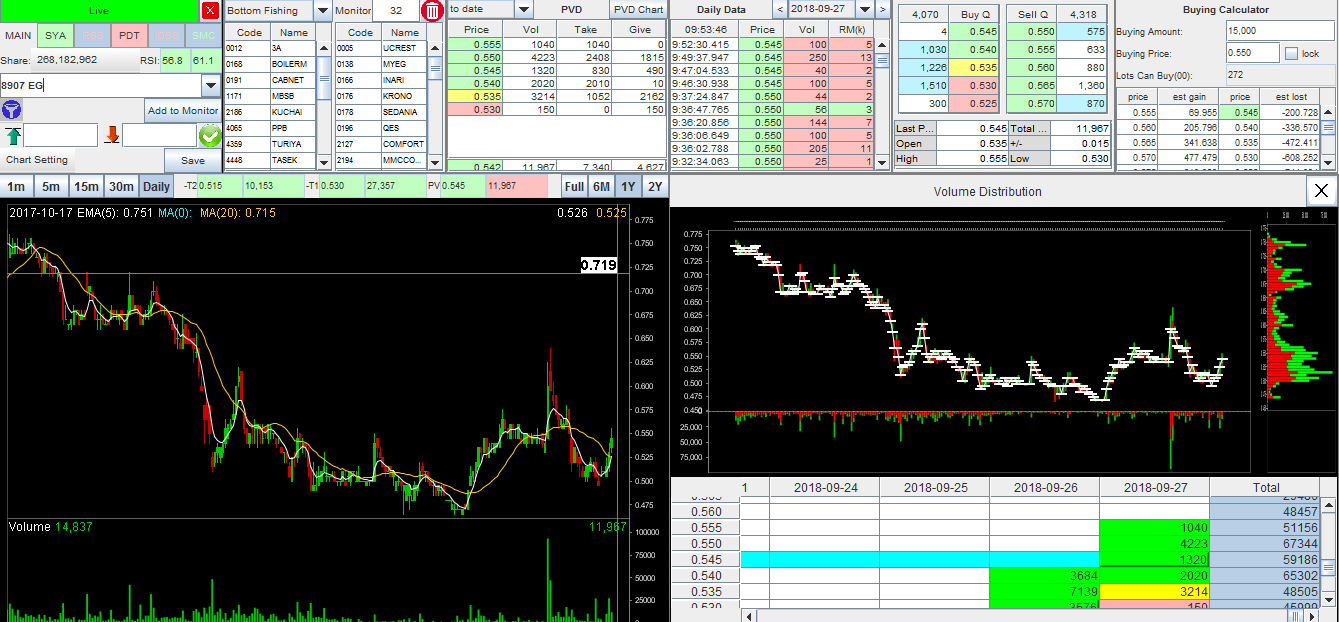

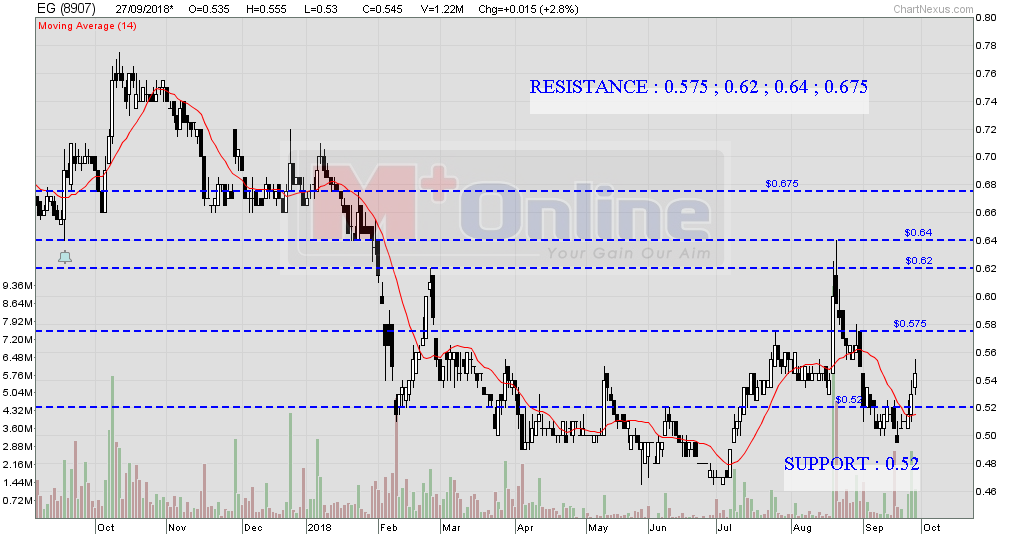

Let take a look at the chart.

Recent 4 years low peg at 0.465

26 Dec 2018 closing price peg at 0.53

Recent 4 years high peg at 0.998

From the Price Volume Distribution chart, it is showing there is heavy accumulation activity at the bottom.

Fundamental Perspective

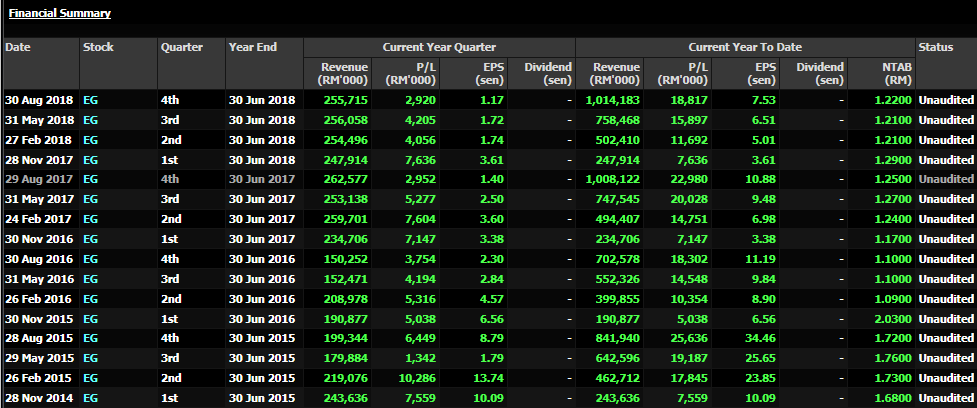

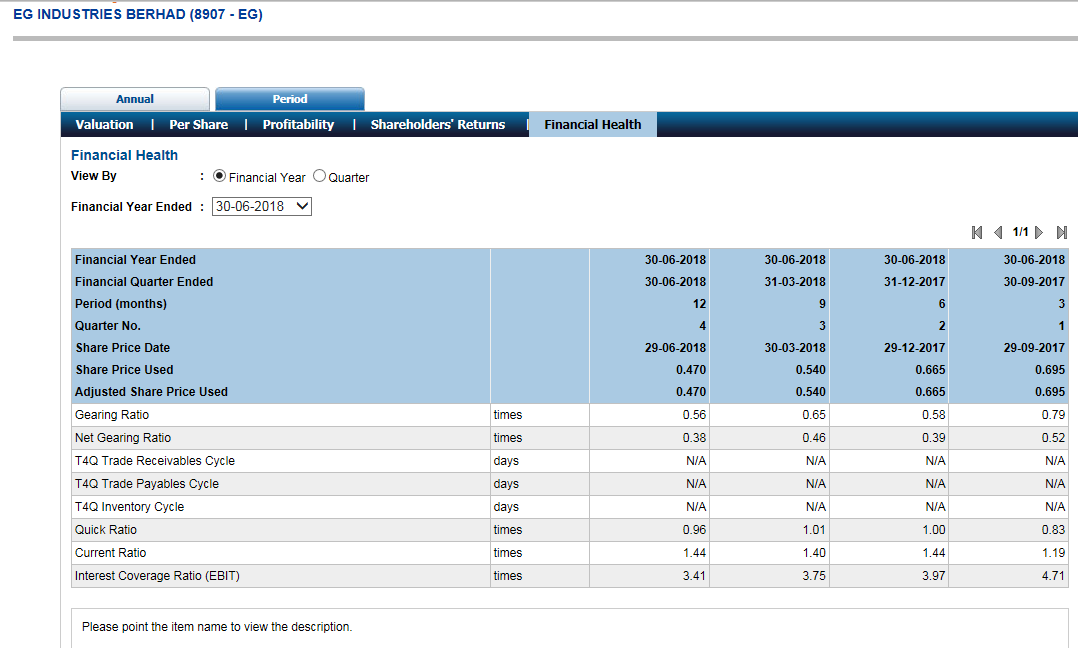

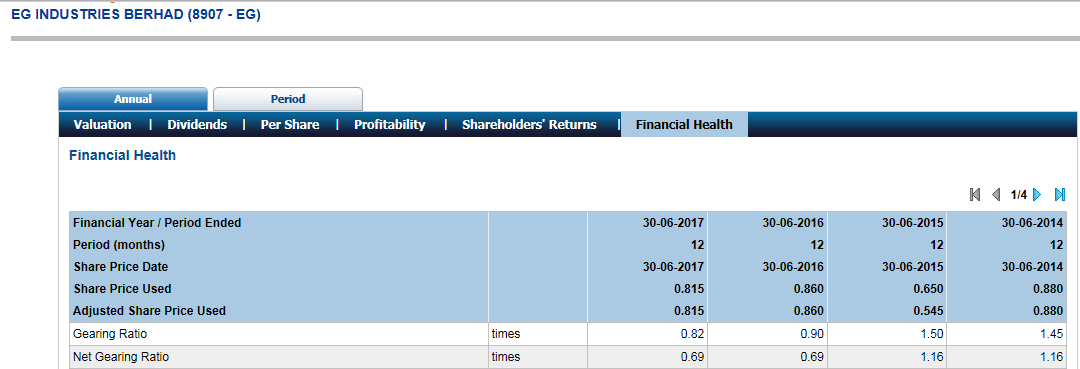

Company is aiming reducing the debt and believe profit generated from the business use to repay the loan. This can be seen from financial information obtain from Insage.

From year to year, quarter to quarter, there is significant reduction of the loan which translate to lower gearing ratio. It appear company is managing well of their financial performance.

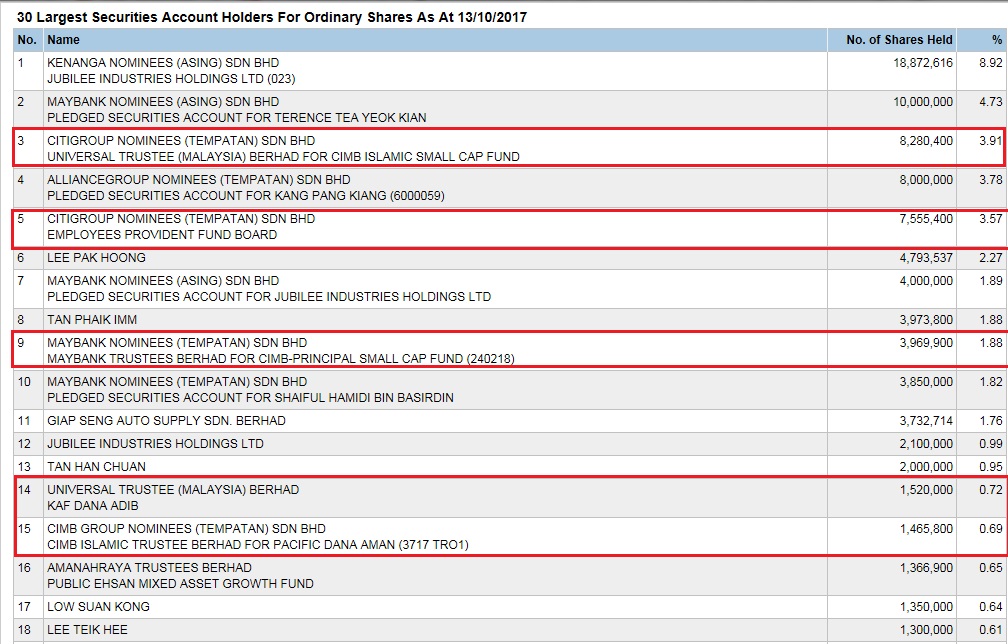

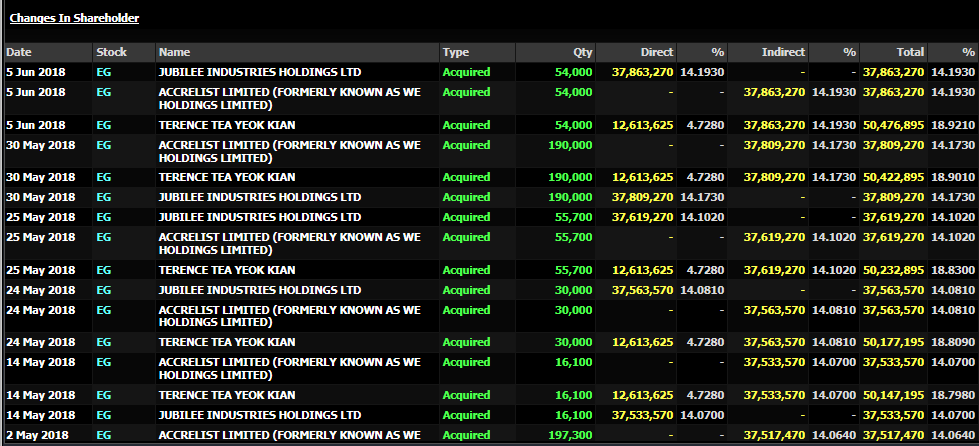

Now, let check who is their top 20 major shareholder. Is there any fund houses holding their shares.

On top of that, company and major shareholder is actively buying back their shares when the price appear to be attractive.

Disclaimer : Trade at your own risk. This is merely for educational purpose. Please consult your dealer/remisier for any investment/trading decision.

FB : https://www.facebook.com/Steventheeinvestment/

Telegram : https://t.me/steventhee628

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stevent Hee

Discussions

The telegram is for broadcast purpose. You may reach me at 0164993828

2018-09-27 18:19

Allow me to add some spice,i shared before in EG thread :

When shall EG turn to a net cash EMS ?

'Retained profit' : $109mil. as on 31/3/18

Average 3 years 'Anual Net profit' : $21mil

'Long Term Borrowing' : = $196mil as on 31/3/18

*** Its normal to have Short term borrowings eg. BA/TR are for daily trades need.

2018-09-30 14:06

[ EG - Futuristic Capital Funds Layout ]

As u may notice, EMS sector are Blossoming in Malaysia region .

Thus, the continuing of capital is crucially to ensure a better position and steadily growth in order to be able to ramp up to higher level of the value chain .

IN EG'S CASE,

FUNDS#1 (R.I.Nov'15) : 100% of $57mil utilised on 31/3/18

FUNDS#2 (R.I.Oct'17) : 38% of $40mil utilised on 31/3/18

*** Excl.$10mil from funds#2, bcoz not contributing as 'growth capital'.

FUNDS#3 (70mil. shares Eg-wc exp. Nov'20) : $30mil. expected by Nov,2020

FUNDS#4 (67mil. shares Eg-Pa exp. Oct'22) : $60mil. expected by Oct,2022

*** Dont forget if the Thai Unit IPO through, another capital unlocked then.

2018-09-30 14:08

VenFx

Hi ! Steven ,

I'm your regular telegram readers...

I saw your reply after my comments of your EG article sharing.

Just , I'm not able to reply u through your telegram channel.

Is it about your setting ?

2018-09-27 15:30