Using TA to maximize your Public Mutual Investment Profit

Edwin Toh

Publish date: Sat, 24 Nov 2012, 10:46 AM

Investment Switching from Equity to Bond

Overall Investment Profit

Total Saving of RM 1K or 3.8 % if i did not change it on that day. But bare in mind there was a surcharge of RM 25 but it is worth it..

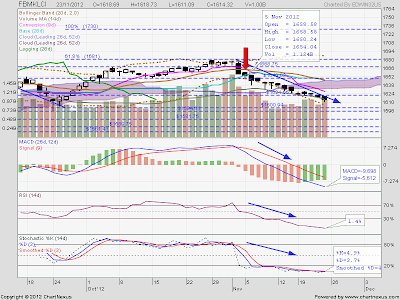

Let observe the graph of the performance between the Unit Trust Vs KLSE index

PUBLIC SELECT BOND FUND : Total Returns from 05-Nov-12 To 23-Nov-12=00.18%

PUBLIC SELECT BOND FUND : Total Returns from 05-Nov-12 To 23-Nov-12=00.18% 12M FD for Bond Funds : Total Returns from 05-Nov-12 To 23-Nov-12=00.15%

12M FD for Bond Funds : Total Returns from 05-Nov-12 To 23-Nov-12=00.15% PUBLIC SAVINGS FUND : Total Returns from 05-Nov-12 To 22-Nov-12=-01.71%

PUBLIC SAVINGS FUND : Total Returns from 05-Nov-12 To 22-Nov-12=-01.71% FBM KLCI : Total Returns from 05-Nov-12 To 22-Nov-12=-02.15%

FBM KLCI : Total Returns from 05-Nov-12 To 22-Nov-12=-02.15% PUBLIC SECTOR SELECT FUND : Total Returns from 05-Nov-12 To 23-Nov-12=-02.01%

PUBLIC SECTOR SELECT FUND : Total Returns from 05-Nov-12 To 23-Nov-12=-02.01% PFBM 100 : Total Returns from 05-Nov-12 To 23-Nov-12=-02.35%

PFBM 100 : Total Returns from 05-Nov-12 To 23-Nov-12=-02.35%More articles on The Stock Library

Discussions

As long as investment.. need to view out.. Since this is my epf investment and hope to get more than 10% interest annually compare to meager 6% from EPF.. Hope to get above 1 million after i retired from my EPF :)

2012-11-24 13:14

To get 10% return from the stock market is achievable no doubt as that is the historical long-range return of most developed markets. But to get that return from Malaysian unit trusts? I highly doubt so because management expenses, transaction costs etc easily eats up 3% of the return. That 3% per year is huge. I haven't heard of anybody who could get 10% long-term return from investing in unit trusts yet, I mean those people who really care and know how to count this long term return of their investment. So if you can't utilize your epf money to invest in small and mid cap stocks with growth potential but reasonably priced, I can safely say you can forget about getting 10% long-term return from unit trusts. Hack my return from my BHLB, then later became CIMB equity fund yielded me about 1-2% per year for 10 years. I didn't even know that I was shortchanged! Seriously, how many investors who listened to and trusted their unit trust "con"sultants know about this.

2012-11-24 13:58

Better to buy unit trusts/mutual funds @ fundsupermart, never TRUST unit trust/mutual funds agents

2012-11-24 14:33

yeah agree @ooi tecik bee..unit trust go down alot too..that is why lock in profits is important..

2012-11-25 10:31

Yes that is why when downtrend convert to bond fund which will go up slowly eventhough there is a recession and once recovery and hope on the equities fund. During 2009 18%, 2010 12% , 2011 9% and 2012 7%,

2012-11-25 11:01

Bond price depends on interest rate, the lower the interest rate, the higher the bond price. The lower the interest rate, the higher the present value of a bond. This is finance 101. That was why bond prices rose in 2008, 2009. 2010 when the Bank Negara lowered interest rate in tandem with interest rates around the world. Not too sure of 2011 and 2012 though as I though cash rate was creeping up. With this already low interest rate environment now, do you think the interest rate will go down further? If not how can bond price give you good return in the near future?

2012-11-25 11:19

Unit trust fund does not cut loss, hence how to use TA to trade ? Convert to bond during a bear market is not using TA to trade.

Thank you.

Ooi

2012-11-25 12:46

I am new to this site! Can someone kindly tell me is Public Mutual good or not?

2012-11-25 13:47

All unit trust are very dependant on the agents knowledge. Some agent i observe follow the "crowd" like thier up line.. thier up line say buy they ask us to buy and sell then sell lor. Better get one who try to understand your needs and see how he can tailor it for you.

All funds can make money, just how fast you want to reach your goals, like buy car la... if you want safe, easy and light on the pocket saga can do... but if you want to sport sport one then ferari. I personally will go for agent that have knowledges about market, economy and financials

2012-11-25 14:28

Public Mutual unit trust investment gave me 84% profit in 7 yrs.

Invested in 2005, gained almost close to 60% (before market crashed in 2008/2009), did not take profit. Unit trust price went down during the 'crash period'. After the crash, the price started to appreciate again.

Took profit in Sept 2012 cos KLCI reached all time high. Overall still gained 84% for 7yrs investement.

Judge for yourself.

2012-11-25 14:29

Posted by Ooi Teik Bee > Nov 25, 2012 12:46 PM | Report Abuse

Unit trust fund does not cut loss, hence how to use TA to trade ? Convert to bond during a bear market is not using TA to trade.

Thank you.

Ooi

Finally, a voice of sanity! :)

2012-11-25 14:33

[Posted by ongtkong > Nov 25, 2012 02:29 PM | Report Abuse

Public Mutual unit trust investment gave me 84% profit in 7 yrs.]

This is an excellent example of the return of unit trust equity fund. Now you earn 84% in 7 years. That is equivalent to 8.8% compounded annual return. This is not bad if you compared with putting your money in bank, about twice the amount. You are rewarded with the risk you have taken in investing in the equity market. You probably are very happy about it. In my opinion, most people should be happy about it. Of course some people may not be happy. They want to earn the 84% return in one year, not in 7 years. For me I am not that happy about it because if you compare with the rise of KLSE of 9% plus dividend yield of 3% per year, a total of 12% of the same period which is also the long-range return of equity, you earn less for about 3% a year. If I just invest in the Bursa equity index fund, I would have earn at least 11% a year, about 2% more. My RM10,000 investment 7 years ago would have compounded to RM20760 compared to your RM18,000. Why the difference? That is exactly the costs involved in the unit trust fund compared to an index fund; upfront fees, 2-3% total management expenses etc.

2012-11-25 15:34

Well I believe TA is a good strategy to know when klse going down to bearish for example this year 2012 during April where klse was at 1600 and drop to 1500, the equity fund started to drop by 6% but I changed it to bond and manage to get 0.5% profit instead of losing 6% and when the market rebound during June , I hope on when klse went above 1550 and up 1660 where I gain about 6%.. TA is always a good ways to know the market sentiment and know when to go away to other profitable funds instead of waiting in abyss for miracle for the market to rebound again. Sometimes some people are able to use TA to benefit but some does not but does not mean TA are not useful.

2012-11-25 17:56

Public Mutual used to be good & others are much better now compared to Public Mutual

2012-11-25 21:19

Making money from unit trust investment also depends on the fund you pick. For eg. Public Mutual has so many funds. Some funds will perform better than the others. If you pick the wrong fund to invest in, then your returns will be lower. Luck factor plays a part, I believe.

2012-11-25 21:58

Hi Jas...

I wanna buy unit trust. Hope to buy some good unit trust from you. Mind to share more about unit trust?

thank you

newbie

2014-08-01 16:59

DaveSingh

all those how have mutual funds.. should read this blog and learn how to make money in funds because long term holding like many claim to be best does not work anymore.. always take profits.. to ensure maximum returns..

2012-11-24 11:26