What You Should Know Before Buying Into G3 (Ex-Green Packet Boss Company)

Angelramirez683

Publish date: Sat, 16 Apr 2022, 11:09 AM

What You Should Know Before Buying Into G3 (Ex-Green Packet Boss Company)

G3 GLOBAL had been in my watchlist of stocks for the longest time, and now that Mr. CC Puan had left the company for good, G3 is off to a fresh start.

If you are just like me, here are some of the things you must know before investing into this company.

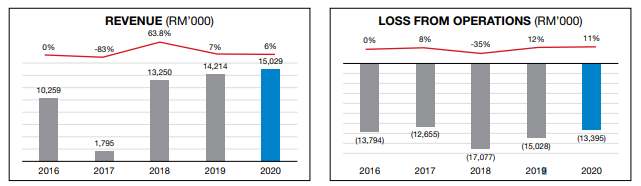

1.G3 had been making losses for the past few financial years

By any chance, if you are a value investor who focuses primarily on the earnings of a company then you may skip the article now. I fully understand that value investors focus on company that could create positive bottom line and cash flow, but G3 is not your typical value stock.

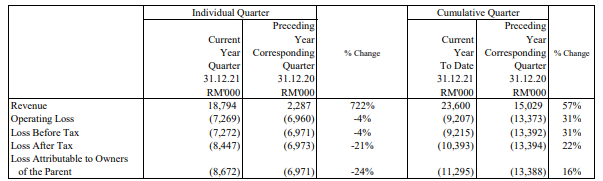

In G3’s latest financial report, the company had a net loss of RM8.67 million despite a significant increase in revenue.

Although the numbers are not looking good, we would need to factor in i.) Provision for amount due from trade debtors of RM2.9 million, ii.) Impairment of smart mobility and IoT inventories of RM2.2 million. This is very likely a kitchen sinking exercise executed by the new management. Based on my calculation, the net loss attributed to shareholders should be RM3.57 million ex all one-off items.

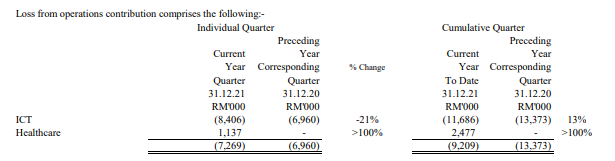

What’s more interesting is the ability of the company to create profit in their new healthcare related business.

The company had passed multiple resolutions in the EGM last week, and it seems like the management had more space in turning around their ICT business moving forward.

2.G3 Acquired Bestinet Healthcare Sdn Bhd Last Year

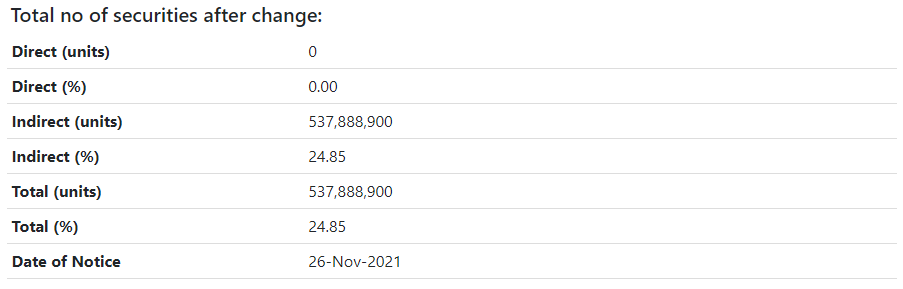

For the benefit of those who do not know, G3’s shares are being collected by Dato Sri Aminul Islam, whom is the founder for Bestinet.

And based on my research on Bestinet, the company is generating $24.2 million in revenue, which is equivalent to RM102.4 million in MYR based on the exchange rate of 4.23. To date, Dato Sri Aminul Islam is holding close to 25% of G3.

The role of investor is often connecting dots. By connecting all the dots or information gathered as shown above, it is very likely that the new IT tycoon to the company would turnaround G3.

But very often, turning around a business may take time and its not a simple as waving a magic wand. If you are keen on investing in G3, you must have the patience to wait it out.

3.The Company Secured Sizeable Healthcare Contract from the Government

If you are an employer, chances are you had already noticed the increase in price of test kits. Now, test kits are retailing at a price of RM10 each and the retail ceiling is approximately RM19. Those who are selling test kits are very likely to benefit from the price increase.

As for G3, the company secured a RM32.0 million contract to supply up to 2 million units of test kits.

An investor in the forum had rightly pointed out where unlike masks, the demand of the test kits are more likely to persist as compared to face masks.

Based on a 6% profit margin generated by G3 in their latest financial quarter, this could generate up to RM1.94 million in net profit for the group in base case scenario excluding the fact that test kit prices are going up.

On a group level however, we would need to wait for the ICT business to smoothen out the turnaround process.

That being said, most investors had missed out that Bestinet Healthcare will be focusing on tech-driven healthcare support services instead of involving in healthcare businesses directly, such as selling test kits. This could very well be another good pointer for G3.

4.The Share Price is Low…

This is obviously-obvious, but I wanted to point out that the risk and reward ratio for investing in G3 is high now. I mean, what more can you lose?

However, please take note that this article does not serves as any buy or selling recommendation. I’m just sharing whatever I see and interpret from the market. Please consult sifu-sifus before you do any investment decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on VoiceAbove

Created by Angelramirez683 | May 19, 2022