Avoiding Overvalued Company

yuanwei92

Publish date: Thu, 01 Oct 2015, 10:22 PM

Good company comes with premium price. When come to stock investment, the basic is simple - buy low, sell high. Albeit important, a good investment is not just about finding a great company, but finding one which selling at a discounted price!

“Investment success doesn’t come from buying good things, but rather from buying things well.”

– Howard Marks

To me, the most convincing way to do it is by performing DCF analysis on the company and value it together with other indicators such as PE, ROE and gearing ratio. Here's my quick and dirty way to check if the company is overvalued and how I interpret the result. Bear in mind this not an extensive method but I used it to have a rough idea of what is the price and value difference of the company.

Let’s do a simple DCF analysis on KAREX Sdn. Bhd. to estimate its value. The downside of DCF as most people know, its credibility depends on the assumptions made. Rubbish in, rubbish out. There are a few criteria here that we have to estimate which are 1) Cash flow; 2) Discount rate; and 3) Growth rate. In this analysis I will try to make these assumptions as optimistic as possible and later we’ll see the reason behind it.

1) Cash flow

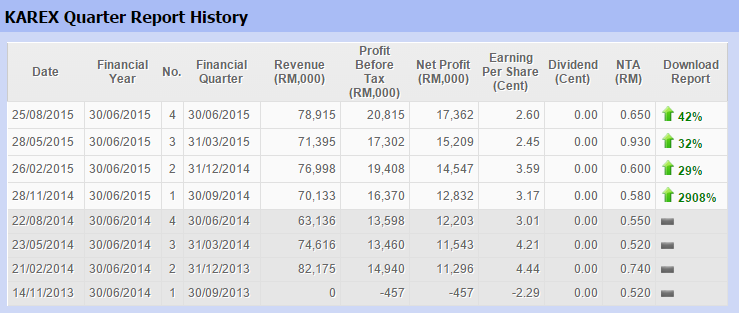

First let’s look into the cash flow which forms the main basis of our estimation. I’ll use KAREX’s FY2015 latest quarterly result as my basis of estimation. The net cash from operating activities of KAREX for 12 cumulative months is RM 45.8 million. This value could be obtained from KAREX’s annual report. Simple enough.

2) Discount rate

Estimating discount rate is one of the trickiest part as there’s no good model for it. Usually I’ll use capital asset pricing model (CAPM) to estimate a discount rate but for this case, I’ll just assume the only discount to operating cash is the inflation rate. This is as optimistic as it can get. Averaging 5 years of inflation rate we get a value of 2.4%.

Source: http://data.worldbank.org/indicator/FP.CPI.TOTL.ZG

3) Growth rate

Refer to figure below, for this case I estimate the growth rate based on quarterly EPS of KAREX. Since we only have its record for two years, omitting the first QoQ growth and averaging the rest we would get a value of 34%. We would assume the operating cash flow growth is somewhat similar.

Source: http://www.malaysiastock.biz/Corporate-Infomation.aspx?type=A&value=K&securityCode=5247

Interpretation of DCF analysis

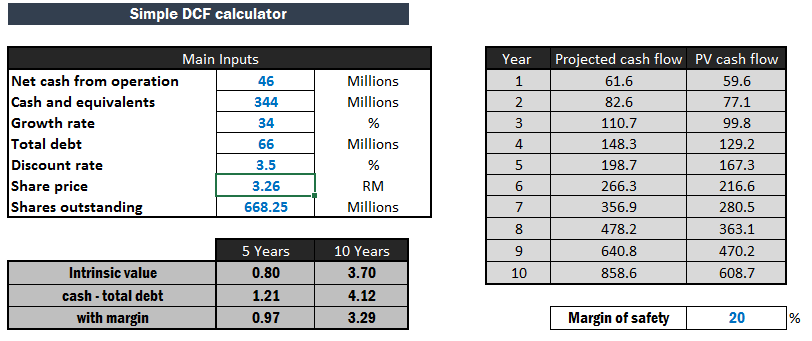

Now what I’ll do is to perform DCF analysis based on the values above to obtain the NPV for 5 and 10 years and dividing them with the number of shares. Also, I’ll take up all cash and cash equivalent subtracting total liabilities of company and again divide by number of shares then factor into the NPV to get a value of RM 4.12 per share. Next, I would apply a moderate 20% margin of safety to compensate for estimation error and finally I have a value of RM 3.29 per share. As of today (1/10/2015), KAREX is selling at RM 3.26. Here you can see the excel sheet I created for simple valuation:

Looking at this result I would imagine I’m buying the company as a whole with RM 3.26, then take its cash to pay off all the debt, wait for 10 years, and you eventually get RM 3.29. In other words, after 10 years my ROI would be only mere 1%. Let’s not forget, I’m being unreasonably optimistic in our valuation. I assuming the company with achieve 34% growth back to back for 10 years and the discount rate exclude cost of debt, cost of capital, GDP growth and etc. Again, this estimation is as rough as it can get, but still, with such optimistic assumptions I see no great difference between the company’s price and value. Even though I do not factor in macroeconomic trends and outlook of the company, I believe it is overvalued.

Would you invest in this company? I would like to hear of different opinions, leave your comments below.

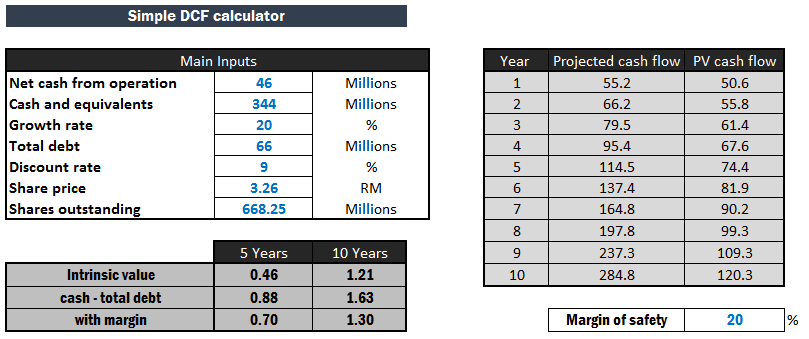

Estimation using more realistic assumptions. =)

With eager to learn,

Yuan Wei

“The more you know, the more you don’t know”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Yes is overvalued with current PE 36

But there is competitive advantages of this company also

Just how we see it...subjective

2015-10-01 23:34

Thanks for the comments, I didn't not have any other blog at this moment, will be writing here if I came across any useful thoughts/ideas.

Feel free to modify and use the worksheet I created and let me know if you have better idea of using it =) (link to download: https://dl.dropboxusercontent.com/u/86103942/Simple%20DCF%20Calculator.xlsx)

2015-10-02 07:46

Discount rate appears to be too low (Try using the weighted average of cost of debt and cost of equity)

2015-10-02 08:54

34% growth rate is unrealistic..At current price, ppl are actually buying it for future earnings. risky and not under valued.

btw, good article *thumbs up*

2015-10-02 09:32

Discount rate using published Bank Negara interest rate is too low. Try compare a plate of chicken rice now compared to one year ago. 3% increase? Immpossible

2015-10-02 12:04

Exactly. Through this example, I wanted to point out that even with such unrealistically optimistic discount rate and company growth rate, the company still seem overvalued, hence the actual value would be much much lower. On top of that I'm not aware of any other factors that could elevate it's estimate value to that extend.

2015-10-02 12:49

overvalued? Bintai, BTM are.........avoid them if can. Good luck if still holding. HIGH RISK HIGH RETURN mah.

2015-10-02 13:56

Not forgetting those gloves companies...sheer madness they are trading at huge premium to its larger global comparables...

2015-10-02 14:02

The DCF Calculation is wrong. You should also include terminal value in the model. In your case, you are assuming the company stop operating at the end of Year-10. You can read about how to caluclate DC on this: http://www.investopedia.com/university/dcf/dcf4.asp

2015-10-02 14:48

My humble opinion as a Karex shareholder. You need to understand the purpose of growth stock against traditional stable stocks. Growth for the stock is exponential and if you personally look at the output, eventually you will realize that most shareholders are investing on the future growth of the stock. KAREX is a growth stock. Besides it being a growth stock, I am currently getting 2.5 cents yearly. (not counting bonus issues and the growth of the share price)

2015-10-05 10:05

Thanks for the comment lulhunter. I might be wrong, my concern would be that when it is trading at a price so high leveled up due to optimism on its business nature, I afraid that it might approach/exceed its future value. Anyway it is just my opinion as I have no correct estimation on its future growth and insights in this industry.

2015-10-05 20:08

once Karek got a karat-quarter, the price will drop like waterfall... I believe yuawei didn't mean to tell Karek was bad, just that to invest Karek at current price might be a bad idea.(which i share exact the same idea though i didn't understand very well your calculation)

if with regard to "cold eyes" formation, PE more than 20 is not something he will pursue, a fair PE for growth will be <<20. Personally, when i do stock screening, PE >20 will definitely out from my selection...

for those who think that "growth stocks reserve higher PE(in this case, i meant to say >>20), please try to look at https://sg.finance.yahoo.com/q?s=AAPL

2015-10-05 20:25

Thanks hissyu2 for your comment, you just summed up my points! =) I didnt realise Apple is trading at such P/E as well.

2015-10-05 21:29

hissyu2 is right about karat-quarter. That's why no one can time the market (or they are billionaires) At such high P/E ratio, Karex is definitely not the best stock to invest in NOW, but it is a good stock to keep when you bought it low, let's say during IPO price.

Mind you if you bought 1000 shares at RM 1850 during IPO: RM 1.85, the share you have now is 2250 after 2 rounds of bonus issue at the price of RM 3.30 which is worth RM 7425 adding RM 37.50 dividend making it worth RM 7462.50 as of today within 2 short years. Another thing to note is that their production capacity is increasing as they continue to setup their factories and acquisition.

Is it overvalued? Yes. Is it not worth investing? Definitely not.

2015-10-06 13:48

Just accept the truth laa.. all the glove counters now are very overpriced.. will drop hard when the roof is finally hit and when the main players decided to take profit. You dare to hop into the boats now.. just to make a few lucky bucks? Wish you best of luck..

2015-10-06 13:59

lulhunter, yes.. karex is worth to invest if you entered this counter few years ago :)

For a company which continues to grow and does have the prospective(good future), we should hold for long(continuous growing, dividend ++, good cash flow, manageable debt, clean account)

but if you were to ask me to buy karex at current price for "investment"? i rest my case...:)

and your last sentence is definitely correct

2015-10-08 21:02

yuanwei, i am looking forward to seeing your next post :) thanks for the great heart to share your hardwork/effort:)

2015-10-08 21:04

The-One, if top glove could hit the estimated PE(current PE), we don't call it overpriced, we call it GROW :)

2015-10-08 21:05

You are using a faulty valuation method. Don't copy and paste from textbook, it simply won't work.

2015-10-21 16:48

AyamTua

there are karek...

there are sumatek ..

there are glotec...

tetetekkkkkk kikikiiii

2015-10-01 22:33