JL's Stock Picks and Coverages

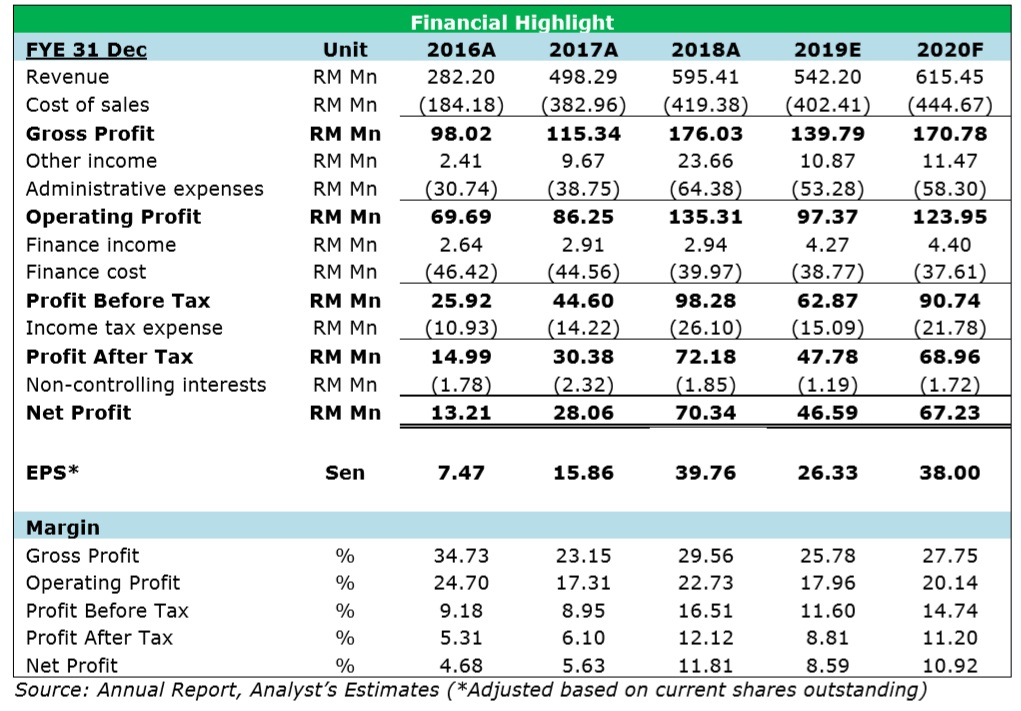

Crest Builder's Stellar Performance Unnoticed.

Callmejholow

Publish date: Thu, 08 Aug 2019, 01:34 PM

Circulating an article from SJ Securities on Crest Builder.

Corporate Profile

Crest Builder Holdings Berhad (CBHB) is a Malaysia-based company that has strong footholds in the construction and property development sectors. The group’s operation can generally be categorised under 4 different segments namely (i) Construction, (ii) Property Development, (iii) Concession, as well as (iv) Investment Holdings. The group is also a registered Class A Contractor with the Ministry of Entrepreneurial Development and a Category G7 with the Construction Industry Development Board (CIDB).

Investment Highlights

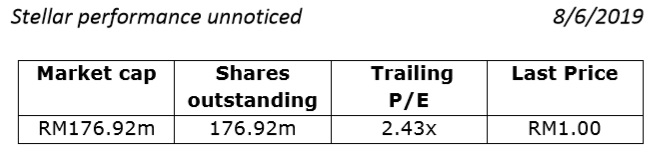

Abundant orderbook to sustain till 2021

CBHB’s outstanding construction order book stands at around RM1.0 bil, which is expected to last until mid FY21. It has bagged RM100 mil worth of construction jobs in 1HFY19, and is targeting to replenish its order book by another RM500 mil worth of projects in 2HFY19. We are also expecting faster recognition in progressive billing as most of its existing projects have completed the initial stage and on track to the higher stage with higher job claims. Another silver lining will be the possible jobs winning from East Coast Rail Link (ECRL); the group had submitted application to pre-qualify for ECRL’s civil work packages earlier this year and we are guided by its management that it is targeting to bid for station, depot, and building works.

Billion-dollar property projects in the pipeline

Among its ongoing property projects, we note that Alam Sanjung and The Greens @ Subang West are fully taken up. With almost all projects being fully taken up, we expect property division’s earnings to dip in FY19. However, it has another two new developments namely Latitud8 (GDV: RM1.1 bil) and Elevat8 (GDV: RM1.33 bil) in the pipeline and on track to be launched in FY20. We expect the two billion-dollar projects to be the next earnings driver for property development from FY20 onwards.

Recurring income

Moreover, it has property investments in 2 corporate towers namely The Crest and Tierra Crest that could collect rental incomes of about RM16 mil per annum. It also owns a 23-year BuildLease-Maintain-Transfer concession agreement with the Ministry of Higher Education and Universiti Teknologi Mara (UiTM) to build and maintain a campus in Tapah, Perak, enabling it to derive recurring income of around RM43.5 mil annually until Jan 2034.

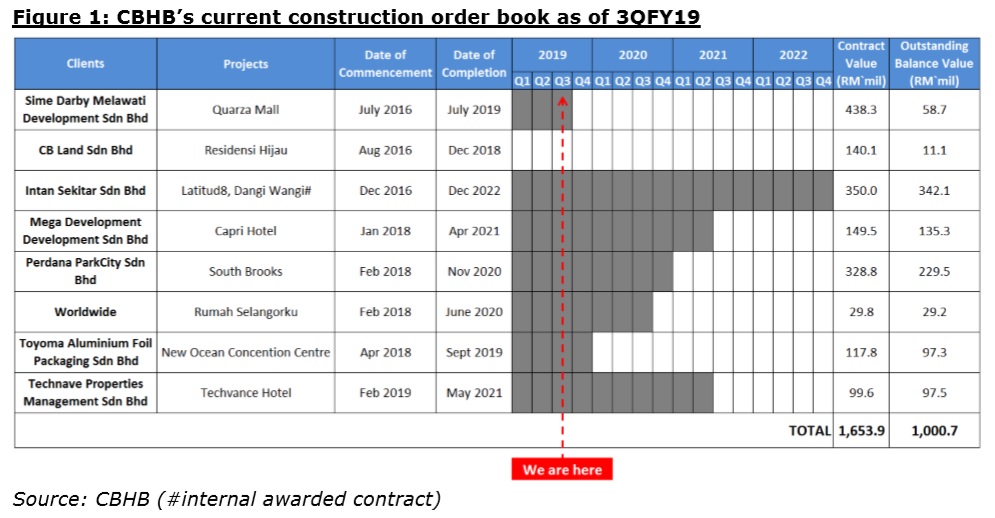

Financial Overview

CBHB’s 1QFY19 was resilience, with both revenue and net profit grew to RM163.82 mil (+31.80% Y-o-Y) and (+31.33% Y-o-Y) on higher contribution from both construction and property segments. Nevertheless, with lower contribution from property development segment, we expect CBHB’s revenue to slow down in FY19. Subsequently, we also anticipate lower net earnings as we forecast a higher revenue contribution from the construction segment which typically commands lower margins of around 7%-12%.

Meanwhile, CBHB is somewhat heavily leveraged with a net gearing ratio of 0.72x. Dividend wise, despite not having a dividend policy, it has been distributing at least 4.0 sen dividend during FY1518. It paid out 4.5 sen dividend for FY18, translating to a 4.37% dividend yield.

Valuations

Moving forward, we expect CBHB to continue its growth momentum supported by abundant orderbook and exciting launches of property projects. Despite recorded stellar performance over the years, CBHB remains undervalued and unnoticed by investors as market’s interests hava been diverted into construction companies with relatively greater involvement in mega-projects (ECRL, LRT, etc.). On the other hand, prolonged deferment of property projects could be another factor causing investors’ avoidance. In light of the earnings visibility, we value CBHB at RM1.62, based on SoP (Sum of Parts) valuation.

More articles on JL's Stock Picks and Coverages

Hidden Construction Counter Gems - INTA.

Created by Callmejholow | Jul 22, 2024

construction, INTA, CRESBLD, GAMUDA, IJM, KERJAYA, SUNCON

Protasco wins 10-year contract for road management services in Sarawak!

Created by Callmejholow | Dec 09, 2019

Crest Builder receives RM155.1mil contract for Plaza@Kelana Jaya!

Created by Callmejholow | Oct 15, 2019

HoselGoh

undiscovered gem.

2019-08-08 21:44