MY E.G. Services Berhad – A Cryptographic Accounting

Salaryman130

Publish date: Fri, 12 Jul 2024, 08:33 AM

- In line with the guidance published by the IFRS Interpretations Committee, MYEG accounted for its holdings of cryptocurrencies – likely received from selling $ZTX tokens – as inventories.

- Intriguingly, the absence of disclosure on the amount of cryptocurrencies recognised as cost of sales, as required in paragraph 36(d) of IAS 2/MFRS 102, implies that MYEG did not resell any cryptocurrency, at least in 2023.

- Applying the guidance in IAS 7/MFRS 107, MYEG’s 2023 operating cash flows would be less than half of the reported amount if the company report changes in the inventory level of its cryptocurrencies in operating cash flows rather than in investing cash flows.

While rational investors do not necessarily subscribe to the principle of “investing only in what you know,” they require higher risk premia for investments with greater informational asymmetry. Since all investors have equal access to material information (see Section 9.02(1) of Bursa Malaysia’s Main Market Listing Requirements), informational asymmetry is chiefly an issue between investors and company owners/managers. Transparent financial reporting, therefore, plays a critical role in narrowing the informational gap between the two parties. Depressed securities valuation may arise if investors find difficulties in comprehending a company’s financial statements.

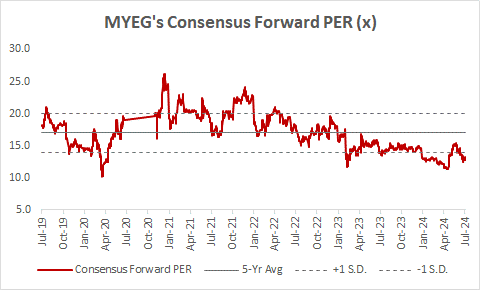

MY E.G. Services Berhad (MYEG), a constituent of FTSE Bursa Malaysia Top 100 Index, might have suffered from the complexity of reporting its cryptocurrency/blockchain venture. The stock’s forward price-to-earnings ratio has trended downwards since late 2020 to the current level of 13.2x, which is 1.3 standard deviations below the five-year mean of 17.0x (implying that there is only a 10.6% chance that the stock will trade cheaper than its current valuation, ceteris paribus). This de-rating happened even as the Malaysian market valuation has reverted close to its mean, while earnings growth expectations for the company have remained largely unchanged at the mid-teen level. One plausible explanation is that investors fail to appreciate MYEG’s lucrative sales of $ZTX tokens created from the company’s Zetrix blockchain platform, for which there is no specific accounting standard that applies, and MYEG’s obscure reporting of the venture does not help the situation.

The Wild West? Not really…

Despite the boom in cryptocurrencies, there is currently no specific IFRS/MFRS that applies to transactions involving the new asset class. The International Accounting Standards Board (IASB) has twice – first in 2018[1] and subsequently in 2022[2] – considered proposals to set new accounting standards for cryptocurrencies, but decided on utilising existing IFRSs while monitoring developments of the asset class.

Tasked by IASB, the IFRS Interpretations Committee, in June 2019, published guidance[3] on applying existing IFRSs to holdings of cryptocurrencies. The committee concluded that cryptocurrencies that do not give rise to contractual rights or obligations are not financial assets and should be accounted for as inventories when held for sale in the ordinary course of business, and as intangible assets in other cases. No official guidance has been provided for issuers’ accounting of cryptocurrencies.

The absence of a specific accounting standard or guidance, however, does not mean that issuers do not need to follow accounting principles when accounting for cryptocurrencies. Paragraph 11 of IAS 8/MFRS 108 prescribes that requirements in IFRSs/MFRSs dealing with similar issues should be considered first. EFRAG, the advisory body to the European Commission on matters related to IFRSs, has identified possible IFRSs that could apply to cryptocurrency issuers in its 2020 discussion paper[4], while Luo & Yu (2024)[5] provides an overview of accounting standards that have been chosen and applied by cryptocurrency holders and issuers.

Accounting for $ZTX

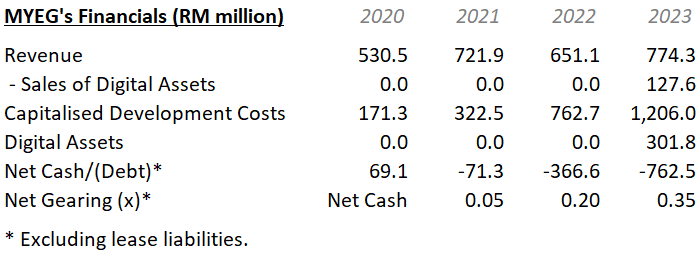

Considering the absence of contract liabilities, provisions, and contingent liabilities related to MYEG’s sales of $ZTX tokens in the company’s 2023 financial statements, MYEG likely has no obligation to holders of $ZTX. This is a norm for issuers of many other cryptocurrencies. Therefore, the company could rightfully recognise sales of those tokens as revenue. Revenue from selling “digital assets” rose from zero in 2022 to RM 127.6 million in 2023, which tallies with MYEG’s initial exchange offering of $ZTX in October last year.

Despite recognising substantial revenue from selling $ZTX, MYEG saw a tighter cash flow position last year. Besides a RM 468.4 million cash outflow for development costs mainly for its Zetrix platform, the company intriguingly recorded a RM 301.7 million “net investments in digital assets” as an investing cash outflow. Knowing the nature of these digital assets is crucial for understanding the dynamics of MYEG’s cryptocurrency venture. Unfortunately, the lack of disclosures makes any such attempt a tall order.

Interpreting MYEG’s digital assets

At first glance, one might believe that MYEG’s digital assets are the company’s inventories of $ZTX. This is understandable since the accompanying note to the financial statements reveals that they are cryptocurrencies accounted for as inventories, albeit at fair value (less costs to sell) rather than net realisable value. IAS 2/MFRS 102, which guides the accounting of inventories, allows commodity broker-traders to adopt such an unusual measurement method where periodic changes in fair value are recognised in profit or loss, implying that MYEG is applying the broker-trader exception.

Yet, there are a few pieces of evidences that could debunk the conjecture. Firstly, MYEG recorded negligible fair-value gains on digital assets of RM 39,000 in 2023 and none in the first quarter of 2024 (1Q24), when the price of $ZTX spiked from USD 5 to nearly USD 17. Secondly, the marginal cost of issuing proof-of-stake cryptocurrencies such as $ZTX should be low as mining is not required, therefore spending a few hundred million solely on creating those tokens would likely be an overkill.

More importantly, MYEG did not sell any digital-asset inventory, at least in 2023, since the accompanying recognition as cost of sales is required to be disclosed, yet it is absent in the company’s 2023 financial statements. IAS 2/MFRS 102 exempts broker-traders only from its measurement requirement, as stated in paragraph 3 and emphasised in paragraph 5 of the standard, therefore MYEG should[6] still be bound to disclose “the amount of inventories recognised as an expense…” as per paragraph 36(d). However, a complete disclosure is not required for quarterly reports, as per IAS 34/MFRS 134.

Given the above, it is likely that MYEG’s digital assets are not $ZTX but rather cryptocurrencies received from selling $ZTX. This is plausible since cryptocurrencies traded on exchanges are commonly paid for in other cryptocurrencies, especially stablecoins such as Tether USDt. $ZTX, for example, is quoted in USDt on Coinstore and MEXC. If most cryptocurrencies received by MYEG were stablecoins, it explains the negligible fair-value gain recorded for 2023.

Still, two questions linger with the latter interpretation. Firstly, the amount of RM 301.7 million “invested” in digital assets was larger than the revenue of RM 127.6 million from selling digital assets in 2023, although a possible explanation is that MYEG was actively acquiring other cryptocurrencies for trading purposes. Secondly, the absence of disclosure on the amount of digital-asset inventory expensed now implies that MYEG did not resell any cryptocurrency received or bought, at least in 2023, which is unusual considering the company’s large capex needs, and even more so if the company is really venturing into cryptocurrency trading.

Inflated operating cash flows?

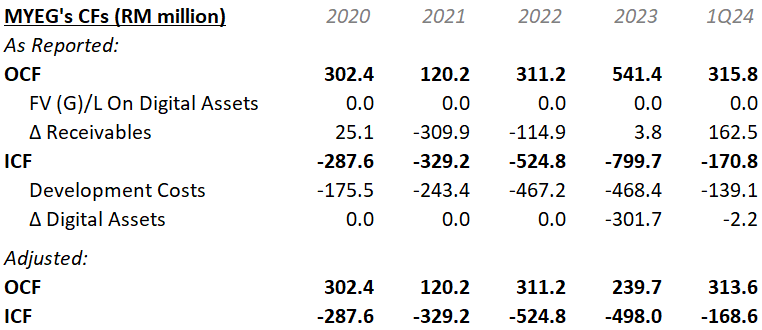

In either case of the interpretation of MYEG’s digital assets, investors’ main concern likely lies with the company’s cash flows. Yet, MYEG’s presentation of “net investments in digital assets” in investing cash flows conflicts with its accounting policy choice of treating those digital assets as inventories and with its presentation of “fair value (gain)/loss on digital assets” in operating cash flows.

IAS 7/MFRS 107, which provides guidance on the statement of cash flows, defines operating activities as “the principal revenue-producing activities of the entity and other activities that are not investing or financing activities” and investing activities as “the acquisition and disposal of long-term assets and other investments not included in cash equivalents.” Paragraph 14 of the standard further states that operating cash flows “generally result from the transactions and other events that enter into the determination of profit or loss,” while paragraph 20 shows that operating cash flows are affected by periodic changes in the level of inventories. Presenting changes in inventories as part of investing rather than operating cash flows, therefore, seemingly goes against IAS 7/MFRS 107.

Adjusting for its “investments” in digital assets, MYEG’s 2023 operating cash flows would be more than halved. While the company’s cash flows have improved in 1Q24 due to a lower level of non-trade receivables, an appropriate computation of operating cash flows is still important since the amount is “a key indicator of the extent to which the operations of the entity have generated sufficient cash flows to repay loans, … and make new investments without recourse to external sources of financing” (paragraph 13 of IAS 7/MFRS 107). This figure is especially informative when investors are keeping an eye on the cash-generating ability of MYEG’s cryptocurrency/blockchain venture.

Unfortunately, investors will have to wait to get clarification from the management, since MYEG has just held its annual general meeting. Nonetheless, sales of $ZTX should continue to be strong for the time being as MYEG is now offering a higher annual percentage yield of 80% to passive investors who wish to stake those tokens. The recent launch of ZTrade, which enables exporters to submit their data securely to Xinghuo Blockchain Infrastructure and Facility – one of the four major blockchains backed[7] by central government agencies in China – may help to boost demand for $ZTX should MYEG mandate payment in the token, even if such a move might be dreaded by accountants of those exporters.

References:

[1] International Accounting Standards Board. (2018). “Cryptocurrencies: Potential new research project.” IASB Staff Paper, November.

[2] International Accounting Standards Board. (2022). “Third Agenda Consultation: Projects to add to the work plan.” IASB Staff Paper, April.

[3] IFRS Interpretations Committee. (2019). “Holdings of Cryptocurrencies.” Agenda Decision, June.

[4] European Financial Reporting Advisory Group. (2020). “Accounting for Crypto-Assets (Liabilities): Holder and Issuer Perspective.” EFRAG Discussion Paper, July.

[5] Luo, Mei; and Yu, Shuangchen. (2024). "Financial reporting for cryptocurrency". Review of Accounting Studies, Vol. 29, pp. 1707-1740.

[6] This requirement has been emphasised in the 2019 guidance issued by the IFRS Interpretations Committee.

[7] 中央网信办数据与技术保障中心. (2024). 中国区块链创新应用发展报告(2023).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on consectetur adipiscing

Discussions

Digital assets part acquired part received from sale of Zetrix token?

2024-07-13 13:32

Digital assets stated cost less impairment

Appreciation in value should not be booked in

Inventories treatment

2024-07-13 13:39

Will the said report have any major negative or detrimental effect on MYEG's stock price? Or any circumstantial evidence of foul play here?

2024-07-13 15:26

@OrlandoWeb3AI (1) I, too, believe that the cost of issuing $ZTX is included in development costs, which supports my conjecture that digital assets are not MYEG's inventory of $ZTX; (2) Indeed, digital assets could be acquired, maybe even for the planned ETF; (3) IFRS Interpretations Committee has concluded that cryptocurrencies are not cash; (4) MYEG mentioned, in p.223 of its 2023 annual report, that it measures digital assets at "fair value less costs to sell, with any change in fair value less costs to sell being recognised in profit or loss in the period of the change." This inventory measurement method, while being less common, is allowed for agricultural producers and commodity broker-traders (see paragraph 3 of MFRS 102).

2024-07-13 16:52

@lawrencecwyen If you are referring to this write-up/blog post, then I am confident to say that it will not impact share prices. This write-up is based solely on publicly available information, which would have been considered by investors and factored into MYEG's share price the moment they were released.

2024-07-13 17:01

looks like the co. posted their AGM video on their website.

good bkgd info, especially on zetrix. seems like the digital asset in their balance sheet are stablecoins. can watch the video from their website https://www.myeg.com.my/investor-relations/general-meetings

2024-07-15 14:16

OrlandoWeb3AI

Cost of producing the token is part of the development cost

This cost is very very small that is why not in cost of sales?

Development cost is amortised

2024-07-13 13:26