No looking back for NATGATE from the get-go

zaclim

Publish date: Fri, 15 Dec 2023, 03:21 PM

Electronics manufacturing services (EMS) provider NationGate Holdings Bhd has not looked back since its listing on Jan 12. The counter made its debut on the ACE Market at 81 sen a share, surging a whopping 113% from its initial public offering (IPO) price of 38 sen a share. It has moved beyond 81 sen to reach a high of RM1.77 sometime in July but succumbed to profit taking activities to trade at RM1.38 on Dec 12.

With a market cap of almost RM3 billion, the ACE-Market listed counter is a lot bigger than even those on the Main Market. It is fast catching up with its peers such as Main Market-listed V.S. Industry Bhd, which has a market cap of RM3.2 billion. Other listed EMS players such as ATA IMS Bhd, EG Industries Bhd, P.I.E. Industrial Bhd and JHM Consolidation Bhd are much smaller in terms of market cap.

Despite its good run, NationGate still has much room to trend higher. Technical analysts are calling the counter a ‘buy’ with target price of RM1.99 and stop-loss at RM1.105.

Investors are also banking on NationGate to continue its good financial performance. The company posted better earnings in 3Q23. Net profit rose 20.6% quarter-on-quarter to RM17.3 million on the back of 15.2% increase in revenue to RM165.6 million.

This was supported by the bottoming out of customer orders whereby customers who were cautious with inventory levels in Q2 should be gradually increasing orders coming in Q4.

NationGate may also benefit from US-China geopolitical tension as MNCs may be looking to relocate production to alternate countries, especially with the China +1 strategy.

A key customer has relocated its base to Penang from China. This customer currently outsources 30% of its contract manufacturing to NationGate and the closer proximity may foster stronger working relationship moving forward.

According to analysts, this temporary transition presents significant opportunities for NationGate to benefit from higher volume allocation.

The current 30% outsourcing to NationGate by the customer is expected to increase to 70% over the next 18-24 months. The increased adoption of AI, cloud computing and machine learning will boost the need for new data centres and GPU servers.

Therefore, NationGate’s Penang factory to house xFusion’s global supply centre will bode well for the group. xFusion, an AI-based data centre customer, is currently underway, primarily focusing on final assembly works.

Managing the intricate procedure of sourcing AI-related components from the USA, the group is sanguine on initiating a gradual ramp-up in the 2QFY24, which will then involve the PCBA process on top of the final assembly works.

More importantly, success in securing necessary supplies is expected to attract interest from two additional customers in the same sector to award jobs to NationGate.

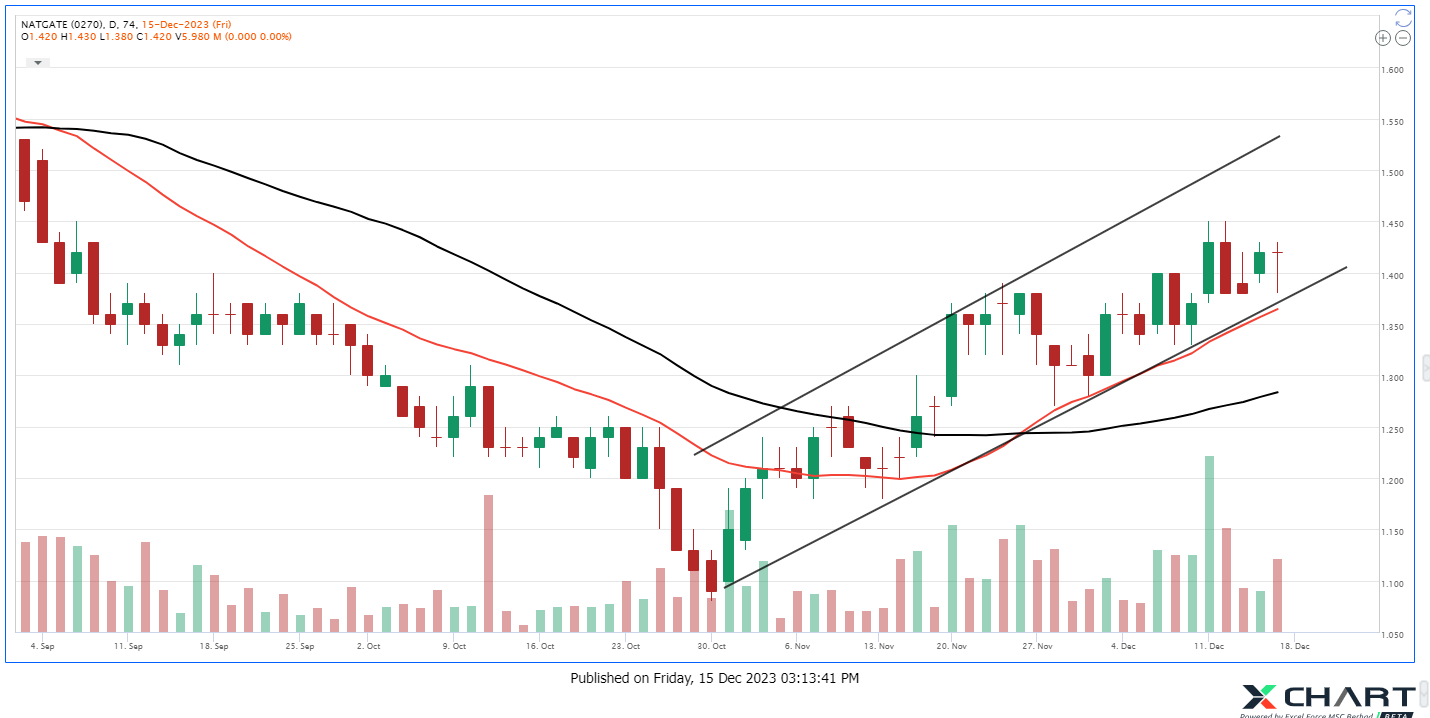

Extracting insights from the NATGATE Daily chart reveals the following:

- A promising reversal setup with high volume, accompanied by prices trading above both the 20 and 40 Moving Averages.

- Successful retesting of prices at the 20MA, indicating a successful Pullback setup

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | May 02, 2024

Oppstar Bhd touched an intraday high of RM1.55 on Apr 30 following news of tie up with Samsung Electronics. With more jobs coming its way, there are ample room for the counter to trend higher.

Created by zaclim | Apr 30, 2024

CENSOF’s stock price rebounded from last week higher low at RM0.265 with increasing volume. The stock price is riding above all EMA lines which are arranged in uptrend order.

Created by zaclim | Apr 30, 2024

Ranhill Utilities Bhd was a let-down after announcing its FY23 results about two months ago. What is driving its share price higher?

Created by zaclim | Apr 29, 2024

The stock price is riding above all EMA lines which are arranged in rosing order and also riding above rounding bottom SMA200 line

Created by zaclim | Apr 29, 2024

Spring Art Holdings Bhd has jumped to a year high of 27 sen recently and succumbed to profit taking. However, it is looking to rise again.

Created by zaclim | Apr 29, 2024

Radiant Globaltech Bhd has been moving higher in recent days, pushing it closer to its year high of 40 sen. Can the counter surpass this level?

Created by zaclim | Apr 25, 2024

The stock price is riding above all EMA lines. This indicates that the stock price is in transiting from accumulation phase into the initial stage of markup phase

Created by zaclim | Apr 25, 2024

RGB International Bhd share price is on an upward movement as investors take note of its latest deal involving product leasing. Can the good run last?

Created by zaclim | Apr 24, 2024

GDB’s stock price has been in an expanding wedge at the last count of 5-wave-pattern rebounded from last week low at RM0.255 where it was supported at EMA30 line

Created by zaclim | Apr 24, 2024

Kimlun Corp Bhd has been trending higher after it bagged projects, pushing its total outstanding orderbook to RM2.4 bil. With more projects in the pipeline, will the counter be able to rise further?