Engtex buoyed by water and construction projects but challenges remain

zaclim

Publish date: Fri, 05 Jan 2024, 09:26 AM

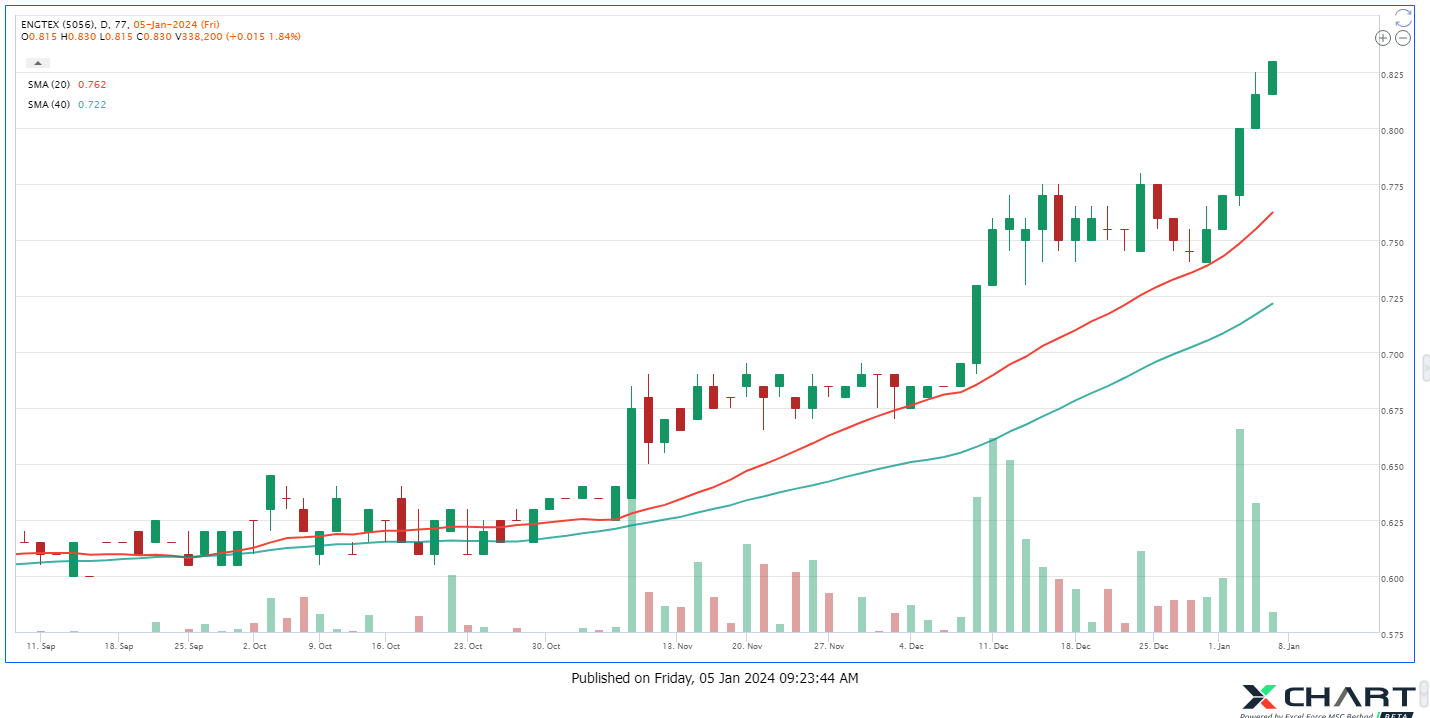

In the last 6 months, Engtex Group Bhd has gained 31.5% to close at its 52-week high 82 sen on Jan 4. The counter is expected to continue its upward momentum to a near term resistance level of 92 sen. However, if you are a value investor, you may find Engtex to be overpriced given its current PE ratio of 157.6 times.

In addition, investors could be wary of its returns on capital employed (ROCE) with is at a low 3.4%, based on the trailing twelve months to September 2023 compared with the industry average of 5.6%. If you looking at its ROCE 5 years ago, it was at 9.3% and now it is just 3.4%.

The company has been putting in the more or less the same capital employed in the business over the years but returns have been declining. This indicates that it is operating in a mature industry with intense pressure on its margins due to the competitive industry despite it holding a competitive advantage in large diameter pipe manufacturing.

Engtex is a steel products manufacturer, mainly making steel and ductile iron pipes and fittings, valves, hydrants, industrial casting products catering to the water sector. It also has property development business and hospitality involving the company's hotel business.

Steel products are however Engtex’s main stay and analysts favour the counter compared with steel players.

Analysts see a bright spot in local steel product makers which prospects are buoyed by several factors. Firstly, is the revitalisation of the local construction sector and the impending roll-out of mega public infrastructure projects (including water projects). There is also the reduced volatility in the cost of steel input which brings about better margin and earnings stability.

One of the key catalysts for the water sector is the proposed water tariff hike. The proposed water tariff increase awaits Cabinet approval for implementation this year.

This paves the way for larger and more structured capex allocations for pipe replacements beyond the annual RM1 billionn from Pengurusan Aset Air Berhad. If the tariff hikes materialise, it would speed up water infrastructure upgrade projects.

Engtex, as one of the few domestic players capable of producing larger diameter ductile iron and mild steel pipes, as well as a supplier of other construction materials (e.g. wire mesh, steel bars), should be a key beneficiary.

On the other hand, there could be further delays in water tariff hikes as the government does not want to cause unnecessary burden to the people. Due to uncertainties in the economy, there could be slower rollout of construction projects while significant volatility in metal prices, could negatively impact Engtex’s earnings growth.

Here are the setup based on Daily Chart:

1. Strong uptrend with several healthy pullback

2. No weakness so far, may have any round of pullback to 20MA

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jul 01, 2024

Sunview Group Bhd has been moving uptrend in recent month, having surged about 15% to close at 74 sen on June 28. How much room can it manoeurve upwards?

Created by zaclim | Jun 28, 2024

Ancom Nylex Bhd is on the uptrend as it is expected to benefit from a slew of positive developments. This will probably help propel the counter to continued uptrend.

Created by zaclim | Jun 25, 2024

THPLANT is among the first oil palm planter to go into renewable energy. Although it will take a while before it turns into fruition, investors are not missing a beat and join the renewable ride.

Created by zaclim | Jun 24, 2024

With booming prospects in the construction sector in Malaysia and Singapore, the company is set to grow further.

Created by zaclim | Jun 21, 2024

Sports Toto Bhd has been quietly inching up to reach a high of RM1.68. With heightened interest in the counter, is there opportunity to trend higher?

Created by zaclim | Jun 19, 2024

Gadang Holdings Bhd appears to be heading new territory as its share price moved towards its new 52-week high of 52 sen recently. Can the upward momentum be sustained?

Created by zaclim | Jun 13, 2024

Censof Holdings Bhd is on a good run, gaining close to 20% in just over two days. Has investors missed the boat or can they still make some trading profits from this counter?

Created by zaclim | Jun 12, 2024

Edelteq Holdings Bhd has seen a surge in its share price to reach a 10-month high recently. Can the upswing continue

Created by zaclim | Jun 11, 2024

Pantech has made good ground in terms of share price, rising close to 50% in the past year. While it posted disappointing results recently, it will likely ride on the expected elevated crude oil price

Created by zaclim | Jun 10, 2024

Evergreen Fibreboard Bhd has shown signs of a bullish momentum and could see it move closer to its year high of 38 sen. Question is when it can move beyond that level.