Pantech on a high despite poorer results

zaclim

Publish date: Fri, 16 Feb 2024, 08:42 AM

Pantech Group Holdings Bhd’s share price is currently hovering at an all-time high, after touching 98 sen on Jan 30. It uptrend doesn’t appear to be stopping anytime soon.

Based on technical charts, the counter is expected to continue its upward movement after closing at 97 sen on Feb 14. The counter, riding on the positive trend, could challenge resistance targets of RM1.06 and RM1.13.

It is certainly a long way since it fell to a 52-week low of 71 sen in June last year. The recent positive run is seen despite it posting a weaker results.

9MFY24 core net profit of RM69.8 million fell 15.2% year-on-year, came in below consensus’ expectations at 68% of consensus’ full-year forecasts. This was on the back of lower 9MFY24 revenue and PBT slipped 14.8% YoY and 19.2% YoY respectively.

Its 3QFY24 revenue declined 26.2% YoY dragged by slower sales demand from local oil and gas projects for the trading segment while quarterly PBT dropped 41.8% YoY.

The company also experienced lower average selling prices and lower demand for stainless steel products for the manufacturing division. Tenders for major oil and gas projects such as the Pengerang Integrated Petroleum Complex (PIPC) have been delayed. As such, 4QFY24 results are expected to be flattish or only improve slightly due to less major O&G projects locally.

Nevertheless, Investors are probably positive as the company should post better performance in FY25 as the tenders for major projects such as PIPC are likely to start in the middle of the year.

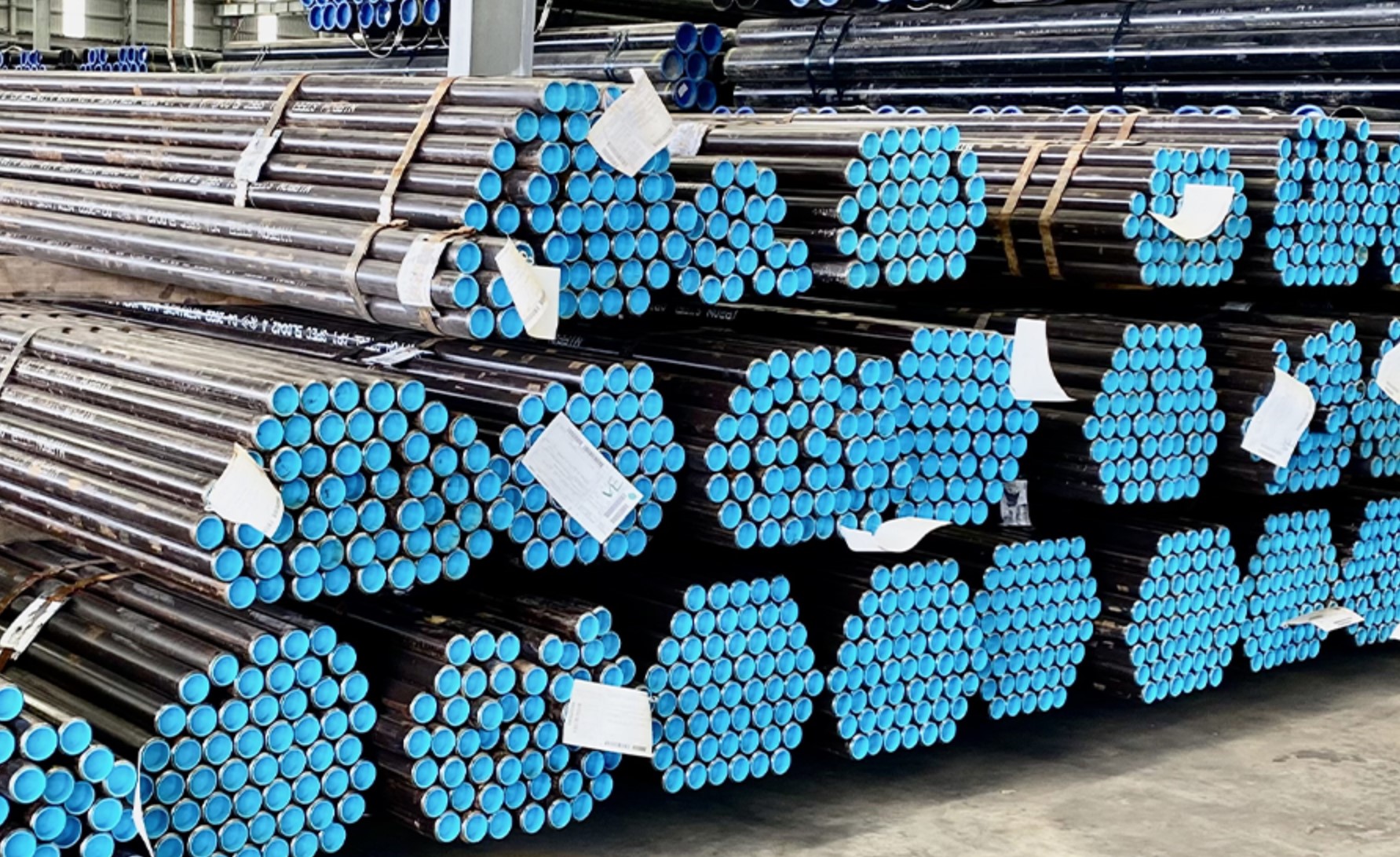

In addition, Pantech is aiming to move up the value chain from basic to specialty chemical under the National Industrial Master Plan 2030. It is certainly in a good position, being one of the largest one-stop providers for pipes, valves and fittings (PVF) in Malaysia, providing solutions for gas and fluid transmission.

The O&G sector is feeling increasing pressure to decarbonise their operations, increasing the demand for carbon capture, utilisation and storage, potentially benefitting Pantech.

In addition, the potential of hydrogen as an energy carrier that can store, move and deliver energy will increase the demand for the production, delivery, and end-use of the gas in the future.

In particular, the delivery of hydrogen may require the installation of new pipeline beside the existing transmission pipeline for natural gas.

On another positive note is Pantech being an attractive dividend play, potentially offering 6.7% dividend yield for FY24-FY26. Investors are unlikely to go wrong with this counter over the longer term once all pieces come together for the company.

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Nov 21, 2024

Moving forward, investors are excited on prospects of retailers such as Aeon as it stands to gain from renewed sentiment following the announcement of Budget 2025.

Created by zaclim | Nov 19, 2024

Analysts are also optimistic on Kelington’s margin improvement bolstered by a significant increase in higher-margin UHP projects

Created by zaclim | Nov 18, 2024

PGF Capital Bhd is starting to show a sustained upside after closing at RM2.24 recently. Will the counter be able to surpass its 52-week high of RM2.24?

Created by zaclim | Nov 18, 2024

Unique Fire Holdings Bhd appears to be moving upwards on the back of strong buying signals. How high can it go?

Created by zaclim | Nov 18, 2024

Dufu has seen challenging times especially when the revenue strengthened against the USD. But the situation has somewhat stabilised and the counter could head for some gains.

Created by zaclim | Nov 15, 2024

Clean energy specialist Solarvest Holdings Bhd is back on investors’ radar to close at RM1.66 on Nov 14. Can the counter repeat or even surpass its high of RM1.83?

Created by zaclim | Nov 13, 2024

KJTS Group Bhd Is having a positive upturn with its share price likely to surpass its high of 85 sen.

Created by zaclim | Nov 11, 2024

Moving forward, the healthcare operator plans to expand regionally once the local market reaches saturation.

Created by zaclim | Nov 11, 2024

AGX Group Bhd has gone to new highs since making its debut on the ACE Market in February this year. How high can it go?

Created by zaclim | Nov 07, 2024

PMB Technology Bhd seemed to be rebounding from its recent low in October. What are the factors that will catalyse its share price further?