MSM Malaysia Holdings Bhd - It will be a lot ‘Sweeter’ from Now (TP RM3.04)

dollardollarbill

Publish date: Thu, 30 Nov 2023, 09:54 AM

The following are from BIMB Securities Research report which can be downloaded from my telegram channel at https://t.me/worthystocks.

Target Price RM3.04

Some Sweet Relief

The wholesale segment, constituting 40% of company’s total sales, faces challenges stemming from unchanged ceiling price set by the government over the past decade. MSM has been footing an additional cost of 88sen/kg, given the wholesale price at RM2.69 (retail price at RM2.85). Despite Malaysia's sugar-controlled price being the cheapest in the region and globally, local sugar producers are obligated to meet a minimum monthly quota of 24,000MT. To address this challenge, MSM has received RM1,000/MT for 24,000MT/month of a special incentive for November and December 2023 for Coarse Grain Sugar (CGS) of 1kg/2kg and Fine Grain Sugar (FGS) of 1kg, translating to an additional of RM24mn revenue for the month or RM48mn for 4QFY23. Note that the incentive will be backdated to 1st November until December at RM1k per metric tonne, equivalent to RM24mn incentive per month based 24k tonne quota (per month). This incentive will be reflected in the company's, topline and expected to remain in effect until the final decision is reached on the revised price mechanism, which we anticipate will be in the 2H2024 (note: incentive or hybrid mechanism). The latter option may potentially temper with demand however due to higher ASP if the government opts for price increase or hybrid. In sum, we prefer incentive option for MSM.

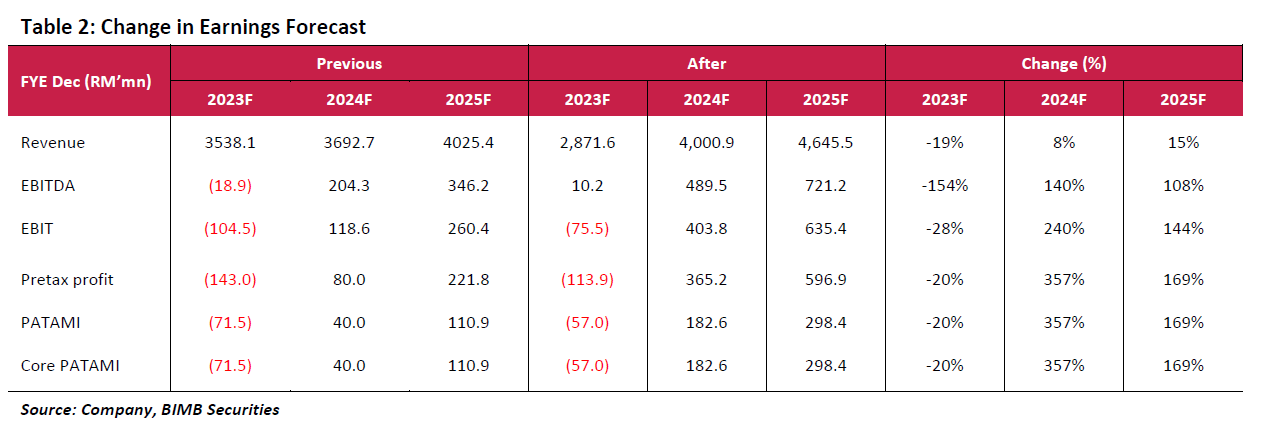

Earnings Revision

In the light of the special incentive and improved margins, we tweaked our FY23 earnings forecast higher to LAT of RM57mn from RM71.5mn and consequently PAT of RM182mn/RM298.4mn for FY24F-25F (Table 2), in view of incentive mechanism for 1H24 and hybrid mechanism for 2H24 onwards.

Maintain BUY call with higher TP of RM3.04

MSM is now valued at TP of RM3.04 based on FY24F EPS of 26sen that is pegged at global average PER of 11.7x. MSM remains a BUY.

BIMB Securities Research report can be downloaded from my telegram channel at https://t.me/worthystocks

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Worthy Stocks

Created by dollardollarbill | Apr 11, 2023

.png)