Rebound Trades - Over Sold names

fifalaw

Publish date: Thu, 23 Oct 2014, 03:11 PM

The recent sell off on Wall Street have touched a pain threshold point of the Fed which increases the odds of a year end rally. At least two of the many regional Fed heads have spoken in recent days giving hints that the Fed is not adverse to the idea of another kick the can exercise as far as raising interest rate is concern.

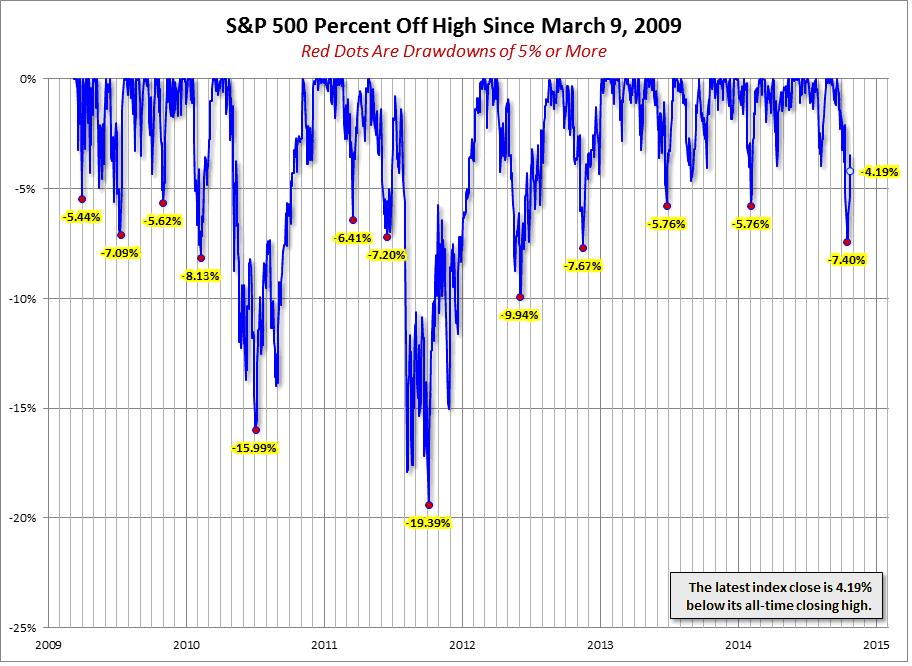

An analysis of the above chart is clear in terms of the buy on dips post each pull back in the S&P. This strategy works better whenever the Fed blinks or 'intervenes'. It is also apparent that once the market reached an inflection point following a mass sell off, the subsequent recovery have not only erased the losses but the rally have been typically extended for a period longer than the compressed time it took sellers to take the market lower. Will this time be different?

Honestly, there is no clear cut answers. For me, based on probability and on this above trend analysis - just a casual observation - instincts tell me that the prospects of a recovery in market sentiment in the US as being high. Pretty much the same old same old

So against the in-tandem sell off in domestic equities, I think heavily oversold stocks - even some of the penny stocks - will outperform and are worth jumping into. Some of my favourites oversold names but still well rated by broking houses are names like KNM, Bonia, Dsonic, MKH and Pelikan.

tjhldog

Lol

2014-10-23 16:40