Genetec - A baby step

GENETEC - CLSA Target Price RM4.50. What have and have not been priced in?

Genetec A baby step

Publish date: Fri, 15 Apr 2022, 06:38 PM

What have been priced in to TP RM4.50?

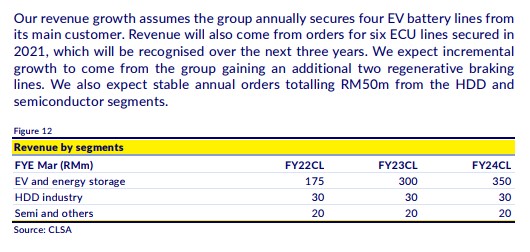

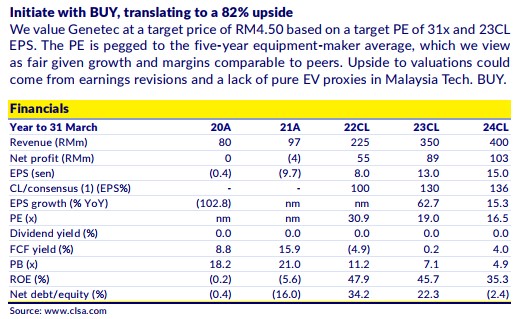

CLSA estimate 350M Revenue, 89M net profit & 13 cent EPS for FY 31-Mar-23.

The estimated revenue breakdown as above figure.

CLSA assumes HDD & Semi segment is stagnant. 300M Revenue from EV & ES from these contribution:-

- 4 Battery formation line from Customer T

- 6 ECU lines from Customer Z which will be recognized over next 3 years

- 2 additional regenerative braking line

What have not been priced in?

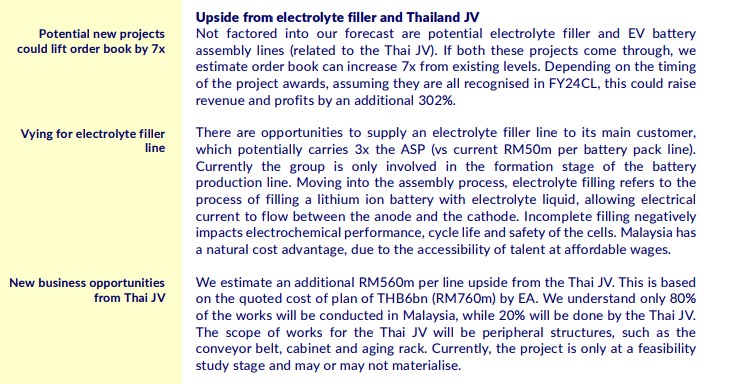

- JV with APCS Thailand -- Energy Absolute -- Electrolyte filler and EV battery assembly lines. CLSA estimate an additional RM560m per line upside from the Thai JV.

- Supply electrolyte filler line to Customer T, which potentially carries 3x the ASP (vs current RM50m per battery pack line). Electrolyte filling refers to the process of filling a lithium ion battery with electrolyte liquid, allowing electrical current to flow between the anode and the cathode.

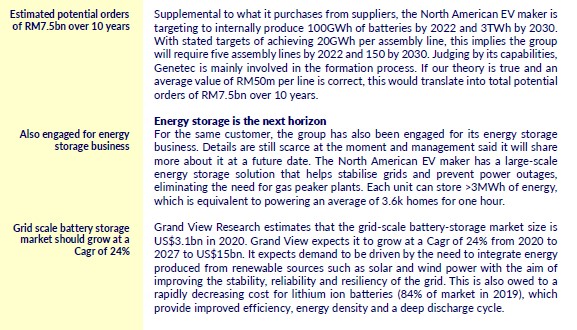

- More than 4 battery formation line to Customer T and its Battery Supplier (P / L / C). Customer T might ramp up its production to produce more car to met its order.

- Energy Storage project from Customer T. PxxxxPack & MxxxPack. The group has also been engaged for its energy storage business. Details are still scarce at the moment and management said it will share more about it at a future date. The North American EV maker has a large-scale energy storage solution that helps stabilise grids and prevent power outages, eliminating the need for gas peaker plants. Each unit can store >3MWh of energy, which is equivalent to powering an average of 3.6k homes for one hour.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Genetec - A baby step

Tesla to launch new models ahead of planned timeline, shares jump

Created by Genetec A baby step | Apr 24, 2024

CIMB Analysis: Genetec Maintains Growth Trajectory - Strong Buy Recommendation at RM3.60

Created by Genetec A baby step | Feb 29, 2024

Why Thixomolded Magnesium is better than Gigacast Aluminum [The Limiting Factor]

Created by Genetec A baby step | Jan 18, 2024

Tesla's PDO Patent // One-Upping the 'Million Mile Battery'? [The Limiting Factor]

Created by Genetec A baby step | Jan 04, 2024

Genetec Powers Ahead: CIMB's Top Pick for 2024 in the Green Energy Revolution!

Created by Genetec A baby step | Dec 12, 2023

Genetec A baby step

What's regenerative braking? To increases range of electric vehicles https://klse1.i3investor.com/blogs/genetec_rm400/2022-04-18-story-h1621490115-ZF_Regenerative_braking_increases_range_of_electric_vehicles.jsp

2022-04-18 08:58